US Housing Market House Prices Bull Market Trend Current State

Housing-Market / US Housing May 01, 2019 - 03:45 PM GMTBy: Nadeem_Walayat

It's been a while since my last analysis of the US housing market, in fact a full 3 years, preceded by my original 3 year trend forecast covering November 2012 to early 2016 that forecast a strong a bull market against expectations at the time (and for many subsequent years), for it's forgotten today that in the aftermath of the financial crisis the prevailing view was that the US housing market was dead for a generation, and this not just from the usual perma doom merchants (I don't like to name names but you know who they are!) but was consensus view at the time.

It's been a while since my last analysis of the US housing market, in fact a full 3 years, preceded by my original 3 year trend forecast covering November 2012 to early 2016 that forecast a strong a bull market against expectations at the time (and for many subsequent years), for it's forgotten today that in the aftermath of the financial crisis the prevailing view was that the US housing market was dead for a generation, and this not just from the usual perma doom merchants (I don't like to name names but you know who they are!) but was consensus view at the time.

So before we plunge into the analysis deep towards concluding in a trend forecast, it's good to understand the reasons why the consensus led by academics usually tend to find themselves on the WRONG side of major market trends.

The Times - 4th June 2015 - US homeowners 'should expect fall in property prices'

American homeowners who are struggling to make up for value lost during the financial crisis can expect recent gains in property prices to reverse...

Where even the king of the US housing market data, Prof. Robert Shiller continued to warn not just against high housing market valuations but also for stocks, a bull market which he neither saw coming and has remained on the wrong side of for a good 5 years!

Rate hike needed to pop bubbles: Robert Shiller - 1st June 2015

The U.S. Federal Reserve should consider lifting interest rates sooner rather than later to tackle speculative bubbles in the housing and stock markets, Nobel Prize-winning economist Robert Shiller told CNBC on Monday.

"I'm thinking they (Fed policy makers) ought to be considering that, because that is the mistake they made in the past," the Yale University professor told CNBC Europe's "Squawk Box" when asked whether he believed the Fed should raise interest rates soon or later on.

"They didn't deal with the housing bubble that led to the present crisis. There's a suggestion in my mind that they should be raising rates now, (but) unfortunately the latest news looks a little weak on the demand side," Shiller added.

“How can it be that people think we can’t get a risk less return in real terms for 30 years? There’s something bizarre. That looks a little bit like a bubble as well. So the whole thing might correct—both bonds and stocks,” Shiller said.

Shiller said he’s also been “kind of surprised” by the housing market, which is up around 25% since the 2009 low (and even more in some cities). “We’re seeing a sort of boom in the housing market,” he said. “We’ve got stocks and bonds highly priced and now we’re starting to see maybe housing going in the same direction. It’s like everything is pricey.” Shiller looped back to his weekend article, which laid some but not all of the blame on the idea that anxiety can actually spur investors to grab on to any available asset, pushing up prices. “Worries about the future can actually cause asset markets to be priced highly … When the Titanic was going down, people would pay a fortune for anything that floats. I’m exaggerating, of course, but that might be the situation we’re in now,” he said.

So what do academics such as Robert Shiller repeatedly miss ? They missed the significance of MOMENTUM and SENTIMENT on TREND which is ACCUMULATIVE as I have covered many times over many years.

19 Aug 2013 - UK House Prices Bull Market Soaring Momentum

What Academics and Journalists Will Never Understand About Markets

In having immersed by myself in the markets for 30 years now, I know that what many academics tend to take for granted rarely matches reality. Whilst I covered many aspects of trading markets in my last ebook (Stocks Stealth Bull Market 2013 and Beyond - Free Download). However in terms of economic trends what academics will always fail to grasp is that markets are NOT driven by fundamentals but by SENTIMENT and it is SENTIMENT that CREATES the fundamentals! Which is why the academic economists rarely have any real clue as to what is going in the markets because they are nearly always looking in the WRONG direction i.e. they are looking at the CAUSE rather than the EFFECT, as in reality it is the EFFECT that makes itself manifest in the price charts long before the CAUSE appears in the economic data that academics focus upon, which is why the SAME economic data can and is used by economists and pseudo-economist (journalists) such as that which we see on TV news shows to explain EITHER price rises OR falls.

You can only know the markets IF you TRADE the markets! The pseudo and academics economists will never get you on the right side of trends years ahead of the herd, in fact most press media commentators will be some of the LAST people to jump onboard trends, usually just before they end!

Momentum Drives Housing Market Sentiment and Economic Growth

As house price rises continue to accelerate, many people sat on the sidelines waiting for prices to fall or even crash will realise that it is just not going to happen, and in their despair at the relentless accelerating trend of rising prices, in increasing numbers will feel no choice but to jump onboard the housing bull market as a they see the houses they have been viewing sold and asking prices trending ever higher.

As house prices rise, home owners see the value of their houses rise £x thousands per month, in many cases by more than their salaries, this will encourage many to borrow and spend more, and save less which will meet the governments primary objective for inflating the economy by means of the housing market. Everyone will be playing the game of how much has my house value increased by, a quick analysis of my own housing portfolio (based in Zoopla estimates) shows a 5.5% increase in housing wealth over just the past 6 months! Does this make me feel richer, more willing to spend? Well, being only human, YES it does!

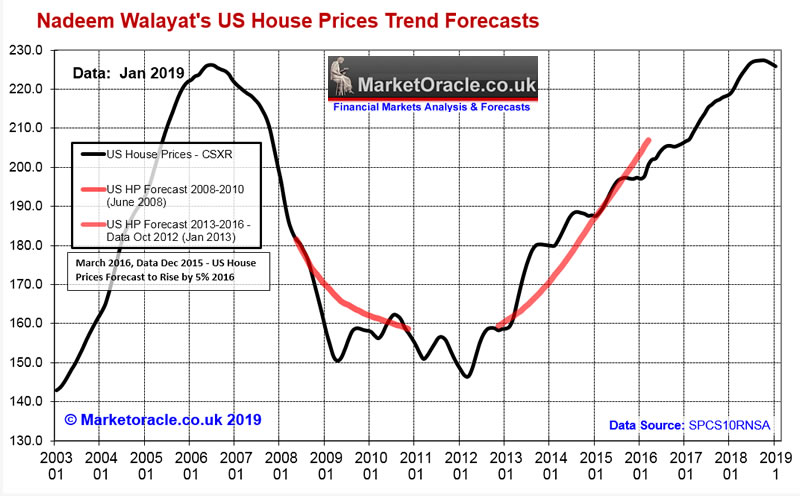

So momentum and sentiment plays an important part in determining a trend forecast for US house prices. First a recap of my original forecast for US house prices covering the period November 2012 to early 2016:

U.S. House Prices Trend Forecast 2013-2016

12 Jan 2013 - U.S. Housing Real Estate Market House Prices Trend Forecast 2013 to 2016)

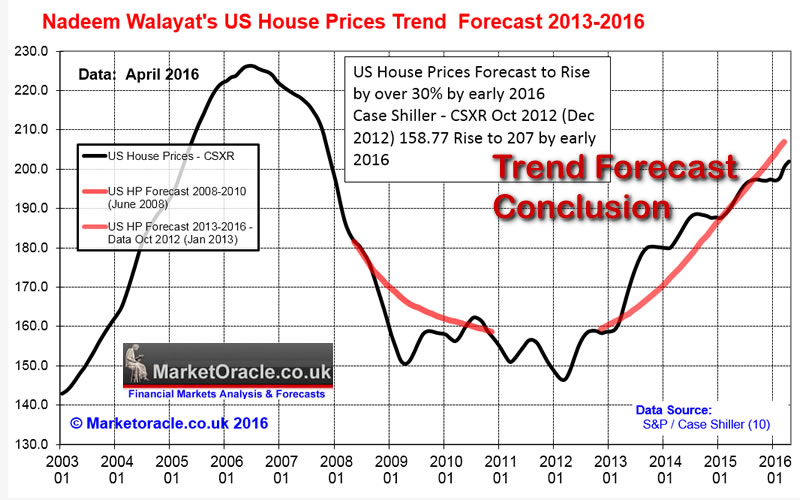

US House Prices Forecast Conclusion - As you read this, the embryonic nominal bull market of 2012 is morphing into a real terms bull market of 2013, with each subsequent year expected to result in an accelerating multi-year trend that will likely see average prices rise by over 30% by early 2016, which translates into a precise house prices forecast based on the most recent Case-Shiller House Price Index (CSXR) of 158.8 (Oct 2012 - released 26th Dec 2012) targeting a rise to 207 by early 2016 (+30.4%).

As a reminder, that at the time of the publication of my forecast highly vocal commentators such as Peter Schiff where strongly bearish on the outlook for U.S. Housing market as illustrated by his video of January 2013 -

"Prices have to fall, they are still much too high, and I think any body who is clinging to the hope that the real estate market has bottomed really should rethink those assumptions"

"You don't want to buy anything related to real estate...., a lot of shorting opportunities there...., housing is not going to recover its going to fall for years" - Peter Schiff - Jan 2013

And as far I can see remained consistently bearish for the duration of the subsequent bull market.

18th May 2015 - Peter Schiff: Monetary Death is Coming!Kitco News

CK: You are notorious for making bold predictions. Of course, we can go back and look at those famous predictions you made leading up to that housing crisis in market crash in ’07. Is 2015 shaping up to be a disaster year or is it too soon to know at this point?

PS: Well, 2015, we are not quite half over yet. My guess is that and this is not going to be the year when it hits the fan. I do believe though that when the Fed does not raise interest rates the dollar will start to decline. But since it had such a big rally it has got a long way to drop, I think, before it would get into a situation that would cause a potential currency crisis which is where I think the end game is. But we could have something like that in 2016 or 2017. But I do think the end is near as far as when this crisis is going to occur.

But it is certainly possible that something happens in 2015. It is just hard to handicap it because you have got so many people that have no idea what is going on, and it is just a question of when are they going to open their eyes? When are they going to figure it out? In the housing market I was criticizing, pointing out the bubble, warning up the implication for years before the thing finally blew up. You just do not know how long it is going to take. Sometimes the bigger the bubbles are the longer they can last before people recognize them. Eventually, when they top, of course, the bigger they get the bigger the pop.

My in-depth analysis and concluding trend forecast was also published as one of my first Market Oracle videos during Jan 2013.

And here's how the US house prices trend forecast concluded early 2016, resulting in only a -2.5% deviation against the forecast so proving remarkably accurate, as had my preceding forecast during the bear market.

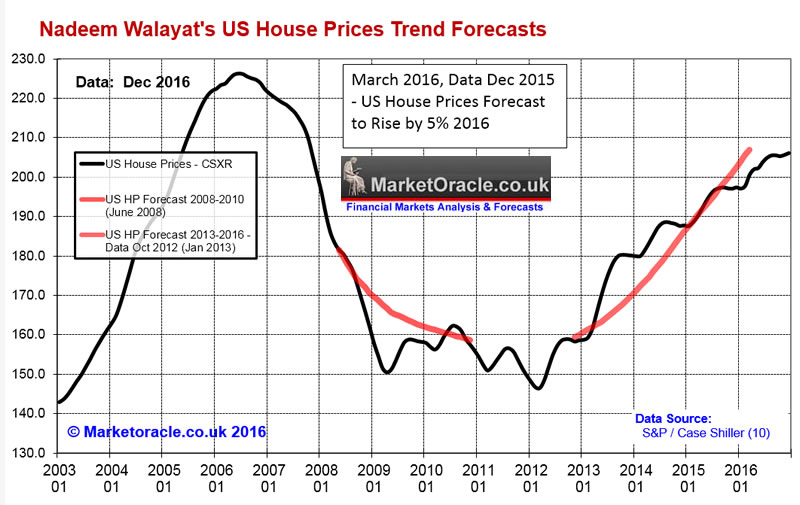

Whilst my last interim analysis of the US housing market in March 2016 ahead of planned for in-depth analysis that remained pending, concluded in expectations for a continuation of the bull market for a 5% gain for the year.

And despite the prevailing doom at the time in expectations for Fed starting to hike interest rate concluded in a +4.4% gain in US house prices.

That was my last forecast for the US housing market which brings is to the present. Where despite all of the mainstream media noise and the usual perma doom mantra, the US housing bull market has continued to rage on upwards all the way to NEW ALL TIME HIGHS!

The last bull market peaked at 226.3 for June 2006 data, which is set against the most recent peak of 227.5 for October 2018 data. TAKE NOTE OF THIS FOLKS! All of those highly vocal fools who have bet AGAINST this bull market for its duration, who even today continue to do so! I don't like naming names, but do check before you buy into their highly polished and convincing perma doom sales mantra. The US housing BULL MARKET is now into its EIGHTH YEAR!

Now whilst it has been a while since I last looked at the US housing market. However that does not mean I'm starting from a blank slate for my extensive ongoing UK housing market analysis equally applies to the US housing market, albeit with differing numbers and skewed outcomes, so the conclusion of this outlook should continue to prove reliable for at least 2 years forward.

U.S. House Prices Analysis and Trend Forecast 2019 to 2021

The rest of this analysis has first been made available to Patrons who support my work: https://www.patreon.com/posts/us-house-prices-26484438

- Momentum Analysis

- US ECONOMY - GDP

- Unemployment

- Inflation

- Producer Prices Index

- Yield Curve

- US Debt

- QE4EVER!

- DEMOGRAPHICS

- US Home Builders Index (XHB)

- US Housing Market Real Terms BUY / SELL Indicator

- US House Prices 2019 to 2021 Trend Forecast Conclusion

- Peering into the Mists of Time

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Recent analysis includes:

- Bitcoin Price Trend Forecast 2019 Update

- Stock Market Dow Trend Forecast - April Update

- Top 10 AI Stocks for Investing to Profit from the Machine Intelligence Mega-trend

With planned analysis for May 2019 to include :

- Stock Market Trend Forecast Update

- Machine Intelligence Investing stocks sub sector analysis

- UK Housing market ongoing analysis.

- Gold / SIlver trend forecast update.

- China Stock Market SSEC

So again for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.