Low New Zealand Inflation Rate Increases Chance of a Rate Cut

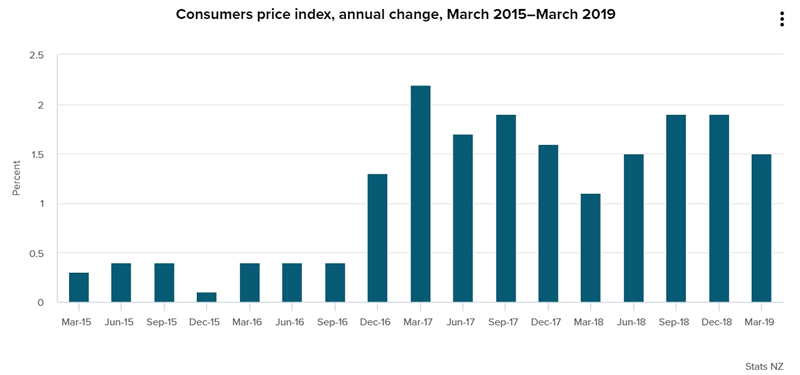

Interest-Rates / Global Financial System Apr 18, 2019 - 10:52 AM GMT New Zealand CPI (Consumer Price Index) only grew by 0.1% in the three months to March with annual increase of 1.5%. This is well below the 0.3% rate expected by the market. The RBNZ (Reserve Bank of New Zealand) annual inflation target is between 1%-3%. The latest result falls at the lower end of the range. This has raised speculation that the RBNZ may cut official interest rate as early as next month.

New Zealand CPI (Consumer Price Index) only grew by 0.1% in the three months to March with annual increase of 1.5%. This is well below the 0.3% rate expected by the market. The RBNZ (Reserve Bank of New Zealand) annual inflation target is between 1%-3%. The latest result falls at the lower end of the range. This has raised speculation that the RBNZ may cut official interest rate as early as next month.

Last month, the RBNZ gave an explicit easing bias to suggest that it’s likely to cut overnight cash rate (OCR) again. The central bank said: “Given the weaker global economic outlook and reduced momentum in domestic spending, the more likely direction of our next OCR move is down.” Today’s data further supports the view that the central bank could cut the COR as early as May. The New Zealand Dollar fell by one full US cent immediately before the release.

The combination of strong Chinese data beating expectations and weak New Zealand CPI also gave AUDNZD a strong push higher.

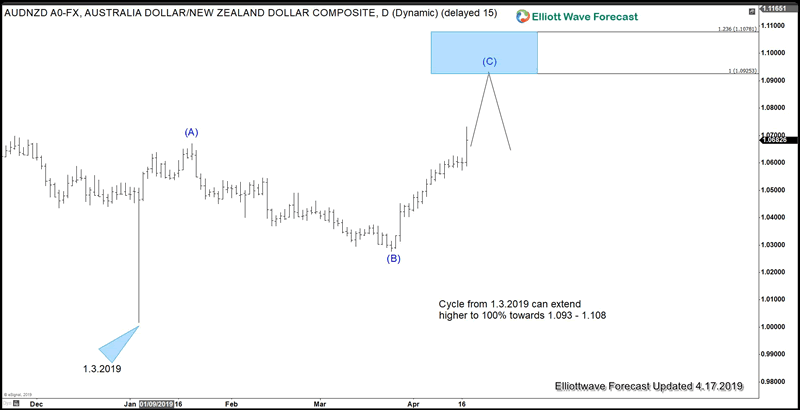

AUDNZD Daily Elliott Wave Chart

Low New Zealand Inflation Rate Increases Chance of a Rate Cut

AUDNZD shows an incomplete bullish sequence from 1.3.2019 low favoring more upside. The rally looks to be unfolding as a zigzag Elliott Wave structure. Pair can continue to extend higher within wave (C) towards 1.092 – 1.108 which is 100% – 123.6% Fibonacci extension of wave (A). Pullback should now hold above wave (B) at 1.0276 in 3, 7, or 11 swing for further upside. Technical outlook of AUDNZD therefore also supports a weak New Zealand Dollar.

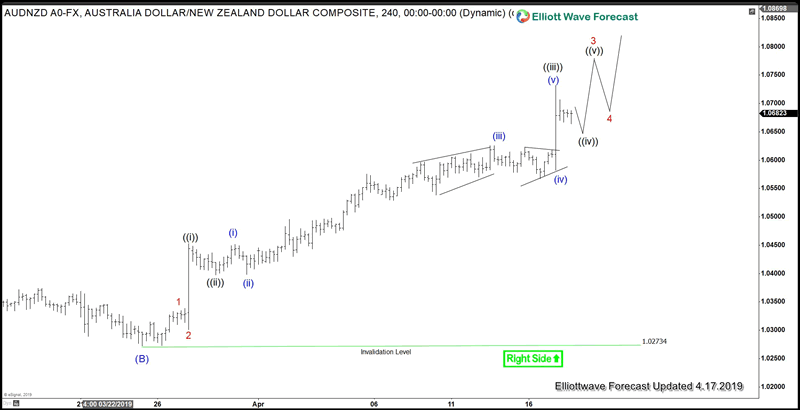

AUDNZD 4 Hour Elliott Wave Chart

The 4 hour chart above shows the internal of wave (C) of the zigzag from 1.3.2019 low. The internal subdivides as a 5 waves impulse Elliott Wave structure. Up from wave (B) low at 1.0273, wave 1 ended at 1.0338 and wave 2 ended at 1.03. Wave 3 rally is in progress and also subdivides in 5 waves of lesser degree. Expect pair to continue to find support in the dips in 3, 7, or 11 swing as far as pullback stays above 1.027 low.

Conclusion

A soft CPI data increases the chance of a rate cut by RBNZ next month. The central bank has given the hint of further easing last month and today’s data may seal the deal. From technical side, Elliott Wave view in AUDNZD supports further upside in the pair while above 1.027. This technical outlook aligns with the fundamental view that New Zealand may weaken due to expected OCR cut.

Keep in mind that market is dynamic and the view may have changed since the writing time of the article. For the latest technical update in AUDNZD and other instrument, feel free to take the 14 days FREE trial.

By EWFHendra

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2019 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.