A Recession is Coming… But Not Just Yet

Economics / Recession 2019 Apr 09, 2019 - 08:36 AM GMTBy: Harry_Dent

In the last week, there have been a slew of articles warning that we’re on the verge of a recession.

In the last week, there have been a slew of articles warning that we’re on the verge of a recession.

The most prominent is talk about the yield curve – the 10-year versus the three-month Treasurys – finally inverting. That has led every recession since 1955, and only gave one false signal in the 1960s.

I agree. This is something to worry about. But, this signal typically appears about a year before any recession hits. That means stocks could run up another six to nine months before they react. That’s all we need for my Dark Window blow-off rally scenario.

Then there was what was called “The Vicious Trifecta”…

- German 10-year bonds went back into negative yields adjusted for inflation when European manufacturing data came in weak. This follows other slowing indicators, including Italy falling into a recession in the last two quarters of 2018.

- S. manufacturing data also came in at the lowest rate in two years and 10-year Treasurys have fallen to 2.36% since, near negative yields just above the inflation rate.

- Fund managers pulled capital out of equities to the tune of $20.7 billion in the week ending March 21.

So much for those tax cuts creating sustainable 3% to 4% growth as we warned they would not.

Gary Shilling, known for his deflationary leanings, issued a warning because we can’t seem to break above the Fed’s 2% inflation target, even though unemployment has fallen from 10% in 2009 to a recent low of 3.5% (it’s currently at 3.8%). That’s a sign of deflation and recession.

Then both Morgan Stanley and RBC Markets warned that the correction into late December looked like ones that have preceded previous recessions and larger corrections.

Well, that’s where I most disagree…

It might be true for normal stock crashes and corrections. But this is the peak of the largest and most global bubble of our lifetimes. My research and analysis prove without a shadow of a doubt that stock bubbles go out with a bang, not a whimper. And like I said recently, the late September/early October top in the markets was a whimper. That was the first sign to me.

The second was that you only know a major bubble has finally topped when you see a first violent correction, with losses ranging from 30% to 50% in the first two or three months (the average loss is 42% in 2.6 months).

Halfway into the last correction in mid-November, I could tell we weren’t on that trajectory and declared this just another correction, not a top and the start of a major crash yet.

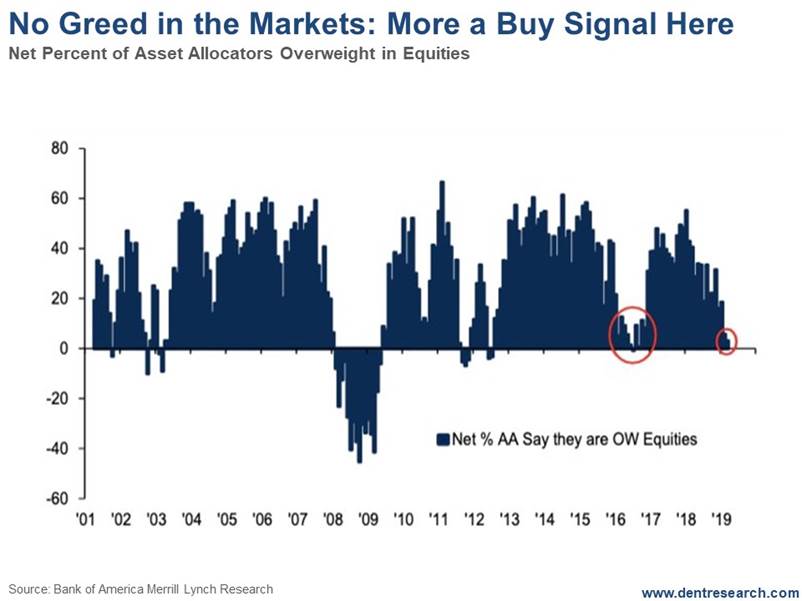

In light of this, here’s a chart I just came across that argues we’re nearing a final buying opportunity into this Dark Window blow-off top scenario I’ve forecast…

The percentage of asset allocations that claim they’re over-weighted to equities is near zero. Outside of being at the bottom of the major stock crash/recession in late 2008/early 2009, where the reading was -40% to -45%, near zero is where you want to buy!

If we were near a top and major turning point down, we should have seen investors pouring into equities, not being this conservative.

In short, all the pieces fit perfectly into my favored Dark Window scenario, in which we could see a final blow-off rally that takes the Dow to 33,000-plus and the Nasdaq to 10,000 by early 2020. After that, it’s tickets.

Yes, things are slowing.

Yes, there is reason to worry.

But not yet.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.