The Economics of Happiness

Politics / Demographics Mar 19, 2019 - 11:00 AM GMTBy: Harry_Dent

It always strikes me as odd that the happiest countries tend to be in cold-as-hell places like Scandinavia and Canada. It’s kind of similar stateside, too.

It always strikes me as odd that the happiest countries tend to be in cold-as-hell places like Scandinavia and Canada. It’s kind of similar stateside, too.

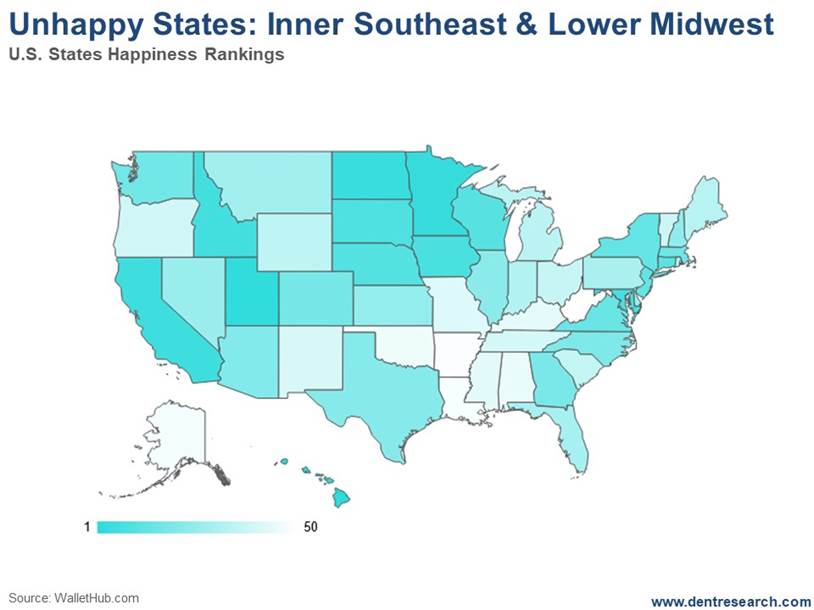

This weekend I saw a recent study by WalletHub that shows that the happiest states in the U.S. tend to be in the upper Midwest region – you know, where the Arctic vortex comes on through! In order of happiness, we have Minnesota, North Dakota, Iowa, South Dakota, Nebraska, and Wisconsin.

Those in the less-frigid-but-still-cold Northeast are also generally happier. We’re also talking just south of there: Virginia, North Carolina, and Georgia. And of course, the west coast is largely happy, except Oregon. The Rockies also, except Wyoming. And then there is the Southwest… Well, except for New Mexico.

The unhappiest states mostly fall in the inland Southeast and lower Midwest. West Virginia is ranked as the least happy state in the nation. Note the whitish and very light blue shadings.

So, what’s going on here and what economic significance does the data seem to carry?

Common denominators…

Well, two of the tangible common denominators from the individual categories are, not surprisingly, rising incomes and low crime/safety. The upper Midwest states have steadily growing shale jobs, which makes for a happier population. The Southeast and lower Midwest have been the hardest hit from our steady loss of manufacturing jobs.

There is also the fact that upper Midwest states have much more ethnic/cultural homogeneity, while the inland Southeast is very high on ethnic diversity. As a general rule, birds of a feather tend to get along better, a reality that became all-too-stark since my Geopolitical Cycle turned negative in 2001, with 9/11 sparking a tense 16 years filled with terrorist events, civil wars, mass shootings, protests, Brexit, Trump, and a resurgence of isolationist and nationalistic views…

Besides the cycle involved in this phenomenon, there’s a demographic element as well…

Who Are the Sad Sacks?

Recently I was watching Dr. Sanjay Gupta on Fareed Zakaria’s CNN show “GPS.” If you watch one show on geopolitics, his is definitely the most objective and factual…

Gupta noticed that the rising unhappiness is largely found in one particular sect of our economy: white, working-class males, especially between the ages of 45 and 54.

Gen Exers.

They’re faring worse in a declining economy brought on by their own declining numbers. Immigration, automation, and foreign competition, especially in manufacturing jobs, has made their experiences so much worse.

The U.S. has 5% of the world population and 80% of the opioid prescription abuse. Guess which generation dominates that epidemic! And guess where these people are concentrated: in the Southeast and Midwest… surprise, surprise.

These are the voters who went overwhelmingly for Trump and helped elect him, against all expectations and odds. These are the voters who are the most anti-immigrant, anti-foreign workers, and anti-Muslim.

All of this is to show you that my Geopolitical cycle has been dead on.

It All Comes Back to the Cycle

Like I said earlier, this cycle turned negative around the time of 9/11, with radical Islamic terrorist attacks in the U.S. and Europe.

But in recent years, 70% of such terrorist attacks have been from white supremacists. The devastating mass murder in New Zealand last Friday is just the latest example… and that’s in a country that’s peaceful and pro-immigration/diversity.

New Zealand’s Prime Minister immediately declared that they would change their gun laws. (The U.S. has only succeeded in theorizing on such change, like a broken record, after each of our mass slayings.) That is a sign of progress and that this cycle is coming to an end soon, as originally forecast around 2020.

But there is much more to come from this populist backlash against globalization.

The simple truth is that it’s the global and domestic people that have fallen behind in the massive job and technological revolution of the past decades that are the most unhappy and fighting back. In Zero Hour, I warn of a broader political revolution on a 250-year and 84-year cycle that is just coming to a head and from which we’ll see more changes in the years ahead.

The disenfranchised in the West have reacted against the radical Muslim and foreign worker threats. Now more of us are reacting against the white supremacists who are reacting with terror against that. Most of us are sick of both sides.

My view has always been that we will have to realign our political structures around more common cultures within countries and within global regions. Countries like Iraq and Syria, with strong Sunni and Shia populations. just can’t get along. That’s increasingly true of the blue versus red states in this country and in the northern versus southern regions of Europe. Unhappy people cause political and social revolutions… it’s that simple. And there are plenty of them to be found around the world today. And my proven cycles saw it coming well ahead.

Harry

Follow me on Twitter @HarryDentjr

P.S. Another way to stay ahead is by reading the 27 simple stock secrets that our Seven-Figure Trader says are worth $588,221. You’ll find the details here.

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2019 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.