The Average American Can’t Save Enough to Retire

Politics / Pensions & Retirement Mar 19, 2019 - 10:46 AM GMTBy: John_Mauldin

How much money do you need to retire?

How much money do you need to retire?

Answering this question is one reason a good financial advisor is worth every penny you pay them. But let’s talk about some generalities.

Say you want to stop working at 65. You’re in good health and your family tends toward long lives. You expect to reach 90, having been retired for 25 years.

Will Social Security alone be enough? Probably not.

Let’s do the math…

Not Much Security

If you spent most of your life paying as much as legally possible into the system, and you retire in 2019 at age 65, your monthly benefit will be $2,757. It jumps to $3,770 if you delay retirement until age 70.

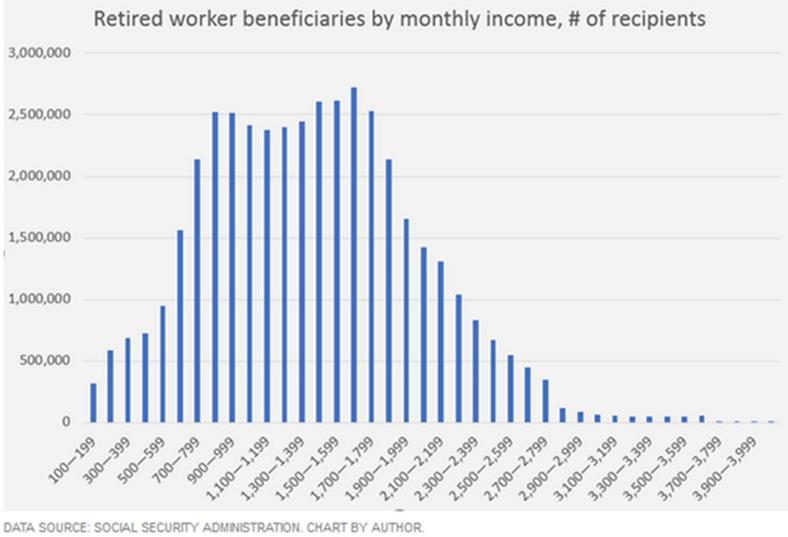

Here’s the distribution.

A solid majority of Social Security recipients receive $2,000 a month or less, and many less than $1,000. The average benefit is $1,413, according to Social Security’s latest fact sheet.

If that’s all you have, your retirement lifestyle is not going to include many cruises and golf tournaments.

Of course, it shouldn’t be all you have. Social Security was never supposed to be a complete multi-decade retirement plan. It was designed to keep retired workers out of poverty at a time when lower life expectancies kept retirement much shorter for most—if they lived to 65 at all.

Now we live longer, and we have higher expectations, which political leaders have done little to dampen. Often they’ve done the opposite.

Bottom line: Social Security probably won’t give you much security. You need more.

Is That All There Is?

Ideally, people should avoid relying on Social Security and accumulate other savings as well. Many, perhaps most, do not. The reasons vary.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.