Bernanke's Confidence Trick Game

Companies / Credit Crisis Bailouts Sep 24, 2008 - 12:47 PM GMTBy: Mike_Shedlock

MSN Money is reporting Buffett takes a stake in Goldman

MSN Money is reporting Buffett takes a stake in Goldman

The world's most famous investor is betting that it's time to buy into one of the battered financials. Berkshire Hathaway's (BRK.A) Oracle of Omaha Warren Buffett said late Tuesday that he is buying a $5 billion interest in Goldman Sachs (GS), one of the two investment banks left standing amid the fallout of the mortgage crisis. Berkshire Hathaway gets a perpetual preferred stock that pays a 10% annual dividend, which takes precedence over other payments to common shareholders in Goldman.

Berkshire will also have warrants to buy an additional $5 billion in Goldman common stock any time over the next five years at $115 a share, about $10 below Tuesday's closing price.

Confidence Boost or Confidence Game?

Minyanville professor Kevin Depew is asking "Confidence Boost or Confidence Game?"

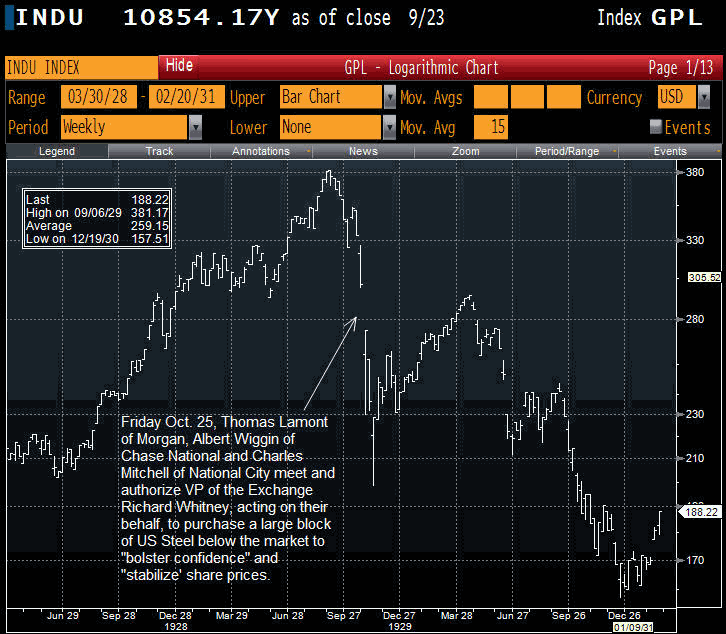

It's being called an "endorsement" and a "show of confidence" designed to "bolster the market." No, I'm not talking about Warren Buffett's deal struck yesterday to shore up the capital base of Goldman Sachs (GS) to "restore confidence".

I'm talking about Morgan Bank, Chase National Bank and National City Bank's agreement to pitch in and buy shares of US Steel (X) at below market prices to thwart the share price panic on Wall Street on October 25, 1929. Here's how that worked out:

Bernanke's Confidence Game

In Ben Bernanke's testimony yesterday, it seems that in his view "the plan" essentially boils down to this: if the government can start buying this toxic stuff at a "hold-to-maturity price", it will establish a price that everyone else in the markets can then use.

The government plan is to tell the market what price to value these things at, and then everything will work out fine after that.

The whole thing is so absurd. The market will continue to price these assets on their own accord, regardless of what some bureaucrat pays for them.

Buying assets below or above what they are worth cannot inspire confidence any more than a game of three card monte can.

Addendum:

I gave an incorrect fax number for Sanders in Senator Sanders' Petition Against Paulson

Please click on the above link and fax Sanders

Every fax helps.

Thanks

Mish

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2008 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.