Britain's Demographic Time Bomb Has Gone Off!

Economics / Demographics Mar 14, 2019 - 07:57 AM GMTBy: Nadeem_Walayat

Britain's Demographic Time Bomb Has Gone Off!

This is the next analysis in a series that aims to conclude in a new multi-year trend forecast for UK house prices, this analysis takes a look at the impact of Demographics on the probable house prices trend over the next few years. But first a recap of my analysis to date that so far suggests to ignore mainstream press hysteria that warns of impending doom for Britains housing market, encouraged no less than the Government and Bank of England which warn to expect a 30% CRASH in UK house prices should the UK LEAVE the EU without a deal.

- Current State and Momentum Analysis

- UK House Prices, Immigration, and Population Growth Trend Forecast

Instead my analysis so far paints a picture for UK house prices to remain on an overall upward trend trajectory which this analysis focused on the impact of an Ageing population on house prices.

Britain's Demographic Time Bomb Has Gone Off!

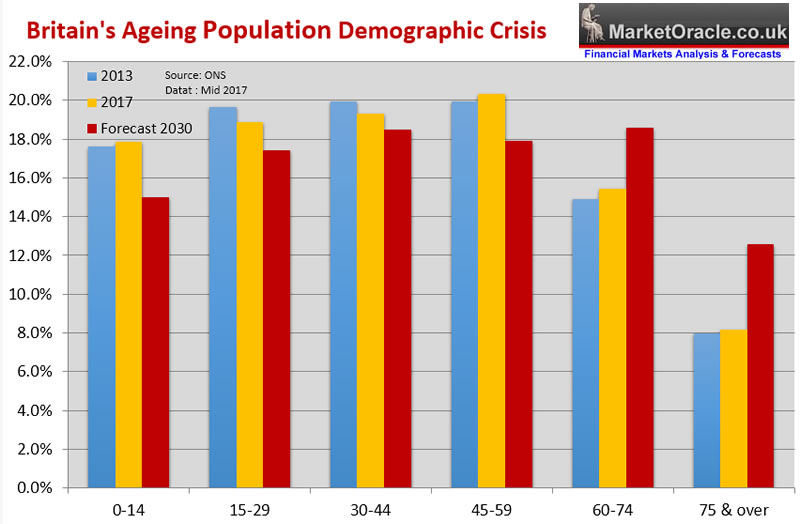

Britain's demographic crisis as illustrated by an ever growing ageing population that despite an increasing number of workers due to immigration cannot maintain worker to retiree ratios of the past, where 25 years ago there were 8.9 million pensioners against 28 million workers or a ratio of 3.15 workers to every retiree (15.5% of the total population), today there are over 12.5 million pensioners to 33.4 million workers, a ratio of 2.67 to every retiree (18.9% of the total population) which is already having an economic impact in terms of productivity and a drain on resources as Britain's growing elderly population demands an ever greater share of the economic pie, putting an ever increasing burden on the welfare state, services such as the NHS that will continue to severely impact on the economy consuming an ever increasing proportion of national resources.

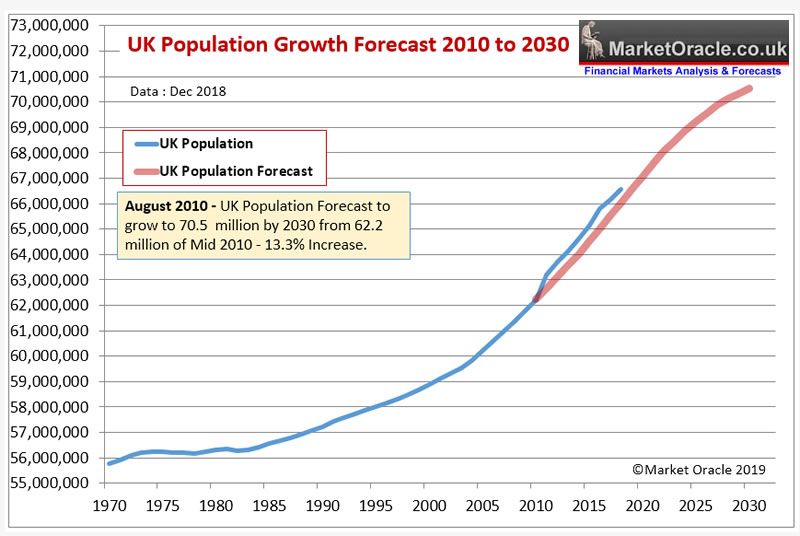

As my forecast graph illustrates there is no end in sight to Britain's demographics crisis as the UK looks set to see the number of retirees increase from approx 12.5 million today to 15 million by the end of 2030 the impact of which will partially be offset by Britains rising population from 62 million (2010) to at least 70 million by the end of 2030.

Which whilst putting Britain in a far better state than many other countries who's total population and worker base is already shrinking as well as experiencing increasing ageing populations such as Japan, Russia, Spain and Italy. Whilst it looks like Germanys open door immigration policy could save Germany from a similar fate to other European nations with falling populations. In fact I could do a whole separate analysis on how bad the demographic picture is for many if not MOST European nations. Which ironically makes a mockery of the recent anti-immigration rhetoric, which perhaps only ahead of the curve Germany recognised. Anyway most European nations are DIEING! For that is what it means when their populations are on a downwards trend trajectory as a consequence of poor fertility rates coupled with an ageing population. Which also suggests that one should AVOID investing in most European countries, especially eastern europe because most lack one of the fundamental drivers for rising house prices, a RISING population.

Back to the UK, a 6% increase in total population against a 20% increase in retirees is only going to partially offset the economic impact of the increasing number of retirees as the ratio of workers to retirees continues to fall, especially as this trend looks set to continue well beyond 2030 by which time the number of over 75's looks set to nearly double in number, rising from 8% of the population today to more nearly 13% and in total approx 25% of Britain's population will be over 65 which suggests a ratio of 2.4 workers per retiree 1, that implies a further 10% loss of purchasing power of workers earnings over the next 15 years to pay for the growing retiree burden.

The consequences of Britain's demographics are as I pointed out 9 years ago in the Inflation Mega-trend ebook of Jan 2010 (FREE DOWNLOAD), that governments have only ever have had one solution which is to PRINT MONEY be it called debt that will never be repaid or QE or a multitude of other examples such as Funding for Lending, and the consequences of the perpetual exponential money printing is as I have often written about is for continuous exponential inflation. This is why whenever I hear warnings of deflation I consider the proponents to be delusional because there has not been nor will there ever be persistent DEFLATION!

This article will continue in Part 2. However the whole of this analysis has first been made available to Patrons who support my work.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst counting down to BrExit Chaos.

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.