Is Recession Near?

Economics / Recession 2019 Mar 08, 2019 - 12:50 PM GMTBy: John_Mauldin

I trust Dave Rosenberg of Gluskin Sheff. He’s been a perpetual speaker at my SIC conference for at least 10 years.

I trust Dave Rosenberg of Gluskin Sheff. He’s been a perpetual speaker at my SIC conference for at least 10 years.

Dave is screaming recession every chance he gets, but he is not a perma-bear by any means.

He’s been bullish at the right times in the past. Dave turned uber-bullish 9 or 10 years ago. It was way outside the consensus at the time, but he has never cared much about being part of the consensus.

So while I don’t entirely agree with him this time, I pay attention.

Dave summed up his bearish argument in his famous Breakfast with Dave letter last month. It was weeks before the retail sales report knocked the legs out of more bullish outlooks.

This article will be more like a back-and-forth between Rosie and me when we are together. I hope you enjoy our conversation.

Rosenberg’s Bearish Argument

- “We are now in month #115 of the current expansion, double the post-WWII norm, and five months from becoming the longest ever.”

I guess I just shrug my shoulders and ask, “So what?” We have a dozen data points of recoveries after recessions. Maybe when we have 100, we can start talking about statistical probability. There is no statistical reason this recovery couldn’t last a lot longer. Ask Australia.

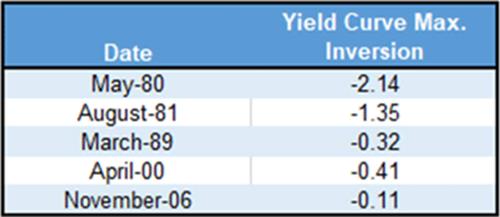

- “The yield curve doesn’t have to completely invert for a recession call. It barely did so the last two times.”

Agreed. The below table measures the size of the last five 2Y/10Y yield curve inversions. You see, they’ve been getting progressively smaller.

Source: Real Investment Advice

If that trend continues, we might not even need a yield curve inversion to signal recession. And much of the curve is already inverted at the short end.

- “Stocks appear to have peaked last fall. Average lead time from market peak to business-cycle peak is seven months.”

Maybe. Then again, a solution to the China trade war and a solution to Brexit coming at roughly the same time could cause a market melt-up and new highs. On the other hand, Doug Kass thinks the market is getting ready to roll over and is increasing his short exposure.

- “Fed policy changes are coming too late. It already overtightened, as it did so often in the past. Rosenberg thinks “neutral” Fed Funds rate is no more than 1.75%, so the last two hikes were missteps.”

Again, maybe. I agree the neutral rate is historically low, but it may be here. This is something we will only know for sure in hindsight. If 50 basis points can cause recession, then this economy is extremely weak and is likely to enter recession anyway.

- “Recessions historically begin when the unemployment rate climbs 0.4 percentage points above its cycle low, which this time seems to have been 3.7%. So 4.1% unemployment, when it happens, should ring an alarm bell.”

Completely agree. Small increases in unemployment tend to coincide with the onset of recessions.

- “The recession will probably be mild but there is no correlation between a recession’s severity and how far equity markets decline.”

Agreed.

- “This time, the bubble is on corporate balance sheets, as firms borrowed money at historically low rates. Instead of productive use, much of the borrowing went to share buybacks. This did nothing to cover future debt-servicing costs.”

I’ve written about this at length. I think corporate high-yield debt and leveraged loans will be the next recession’s subprime mortgage loans. This could create quite a severe liquidity crisis.

- “While many focus on high yield, the leveraged loan market is in a bubble of its own. A key risk for this year is a debt refinancing “tsunami” as trillions in debt has to be rolled over at higher rates.”

That “tsunami” could actually cause a recession.

Share buybacks and capital spending will be curtailed as cash flow falls, and wages and debt-servicing costs rise.

A 35% decline in stocks would be typical for this kind of recession, though Rosenberg thinks some non-cyclical and defensive names could outperform.

Has the Fed Overtightened?

The main question here is whether the Fed stayed hawkish too long, as Dave thinks, or is loosening up in time to keep the economy growing. We don’t know yet.

For that matter, we don’t know if they are turning dovish. We only know they’re talking about ending the rate hikes and/or ending the balance sheet reductions.

The FOMC meets again March 19–20, so whatever they do then should tell us more. And if the economy perks up? The Fed can talk about more tightening later in the year.

Get one of the world’s most widely read investment newsletters… free

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.