The Exponential Stocks Bull Market

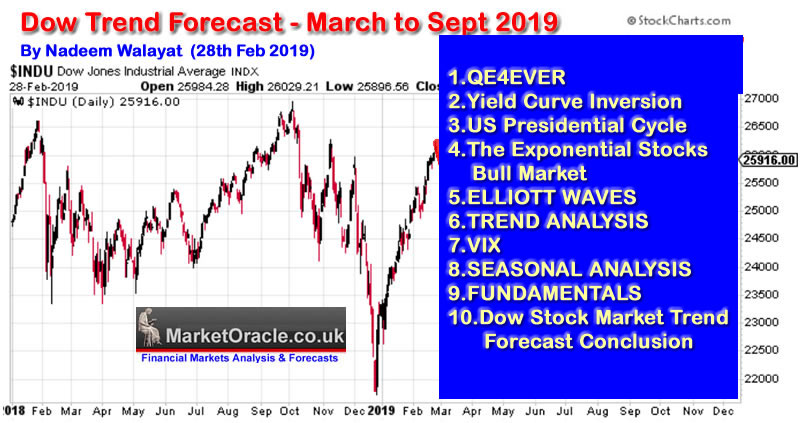

Stock-Markets / Stock Markets 2019 Mar 07, 2019 - 05:47 PM GMTBy: Nadeem_Walayat

Were now into the 11th year of this ageing stocks bull market for which my underlying message for its duration has been the same, one of "the greater the deviation from the bull market peak then the greater the buying opportunity presented".

Were now into the 11th year of this ageing stocks bull market for which my underlying message for its duration has been the same, one of "the greater the deviation from the bull market peak then the greater the buying opportunity presented".

Whilst all bull markets eventually come to an end. However, that end ALWAYS tends to prove temporary, soon appearing as inconsequential blips on the long-term trend chart as the overall inflationary stock market trend is exponential! Which is why the Great Stock Market crashes of the past such as 1929 and 1987 are barely visible blips today.

This is the fourth in a series of articles that concludes in a detailed trend forecast for the Stock Market Dow Stocks Index covering the period from March 2019 to September 2019.

- Fed Balance Sheey - QE4EVER

- Yield Curve Inversion

- US Presidential Cycle

- The Exponential Stocks Bull Market

- ELLIOTT WAVES

- TREND ANALYSIS

- VIX

- SEASONAL ANALYSIS

- FUNDAMENTALS

- Dow Stock Market Trend Forecast Conclusion

However, the whole of this analysis has first been made available to Patrons who support my work.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Similarly the likes of the dot com bubble bear market and financial crisis have already been diminished in significance in terms of the long-term trend i.e. it does not matter that much whether one bought stocks near the 2007 top at say Dow 13,000 or towards the bear market bottom say 800 in terms of the current value of ones stock market holdings at Dow 25,000. And definitely not when compared to what the perma bears would have experienced if they had actually shorted stocks at any point that their mantra proclaimed that THE FINAL TOP was IN! And then held those shorts as the Dow rallied to 25k!

So bear these two points in mind when investing in stocks -

1. The greater the deviation from the bull market peak then the greater the buying opportunity presented".

2. The long-term inflationary stock market trend is Exponential!

Thus the reality of ALL bear markets in the general stock market indices such as the Dow is to present investors with their latest stock buying opportunities in advance of the resumption of what is an inflationary exponential stock market trend, all whilst the bears perpetuate none existant deflationary scenarios.

Therefore the primary objective for stocks investors is not really to try and pick tops and bottoms but to identify the mega-trend sectors to invest in for the long-run. Today's mega-trend sector is Artificial Intelligence that I will continue to cover in a series of articles and videos.

Watch my video from 2016 for a primer of what's to come over the next 2 decades of why EVERYTHING is about to CHANGE, in fact now ALREADY changing!

The whole of this analysis has first been made available to Patrons who support my work.

So for immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your Analyst

Nadeem Walayat

Copyright © 2005-2019 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.