Industrial ETF XLI Set to Make New All-Time Highs

Companies / Company Chart Analysis Mar 04, 2019 - 11:02 AM GMTXLI Set to Make New Highs

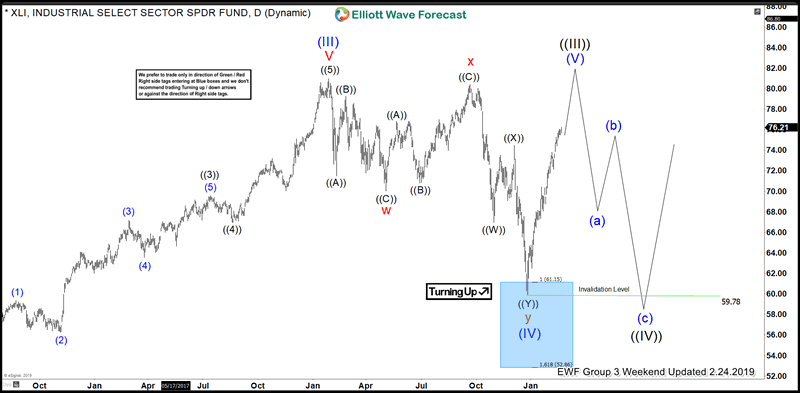

The Industrial Sector ETF, XLI, is set to make new all-time highs above the January 2018 high at 80.96. From 80.96 Elliott wave analysis suggests XLI corrected lower on the daily chart in 7 swings to the 12/26/2018 low of 59.92. Within the final 3 waves of y (red label) we see a near perfect measurement of equality amongst the subwaves. From the red x high of 80.41 on 9/20/2018 the ETF dropped lower in 3 swings into the blue box range producing a reaction higher. We are labeling the 59.92 low as wave (IV) suggesting wave (V) of ((III)) is now progressing above 80.96. The Blue Box highlighted below in the daily chart are measured areas with a high probability of reaction in the next projected direction. Learn about this proprietary system here.

XLI Impulsion Higher in Wave (V)

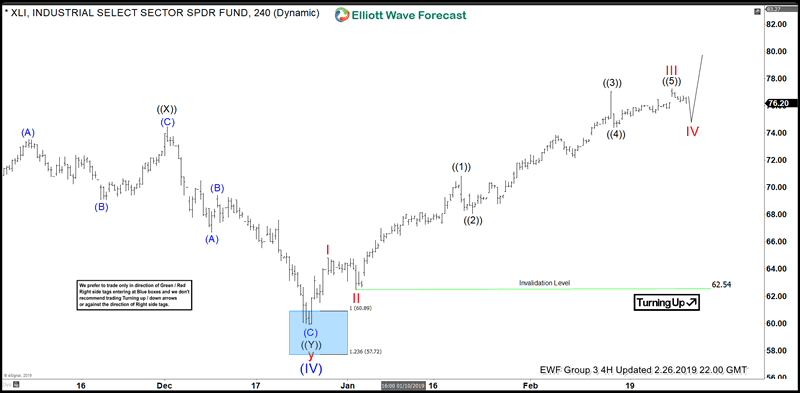

The 4 hour Chart Progression is Incomplete

From the December 2018 low we observe 7 swings in the chart. In our system of analysis we suspect XLI to be impulsive to the upside. Consequently this observation dictates that to be impulsive the ETF must complete a derivative of a 5 swing move from 59.92. So far we have 7 swings which is a derivative of a corrective 3 wave sequence. Corrections unfold in swings of 3,7,11,15, etc. Impulses unfold in derivatives of a 5 swing sequence. Hence the count from 59.92 in XLI should have a clear 5, 9, 13 and so on number of waves. Since we only have 7 the cycle from the low is incomplete thus calling for new highs.

XLI 4 Hour Chart Showing Incomplete Sequence

Learn more about the Elliott wave analysis we provide everyday for 78 different instruments. A Free Trial is always available to test drive our proprietary forecasting service. When you are ready to subscribe use this link to make your plan selection. We hope to see you around the services with our hundreds of active and successful subscribers!

James

EWF Analytical Team

https://elliottwave-forecast.com

ElliottWave-Forecast has built its reputation on accurate technical analysis and a winning attitude. By successfully incorporating the Elliott Wave Theory with Market Correlation, Cycles, Proprietary Pivot System, we provide precise forecasts with up-to-date analysis for 52 instruments including Forex majors & crosses, Commodities and a number of Equity Indices from around the World. Our clients also have immediate access to our proprietary Actionable Trade Setups, Market Overview, 1 Hour, 4 Hour, Daily & Weekly Wave Counts. Weekend Webinar, Live Screen Sharing Sessions, Daily Technical Videos, Elliott Wave Setup .

Copyright © 2019 ElliottWave-Forecast - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.