This Simple Investing Formula Is All That Most Investors Need

InvestorEducation / Learning to Invest Feb 22, 2019 - 10:13 AM GMTBy: John_Mauldin

“Buy and hold” is a great, time-tested investment strategy. It works on two conditions, though.

“Buy and hold” is a great, time-tested investment strategy. It works on two conditions, though.

You have to allow it sufficient time. And you have to stick with it. The problem is very few investors can stick with it.

They see their net worth shrinking, get scared, and bail out. And they do so at the wrong time. Then they re-enter at the wrong time. And the cycle repeats.

Asset diversification doesn’t help here. Because it still leaves you at risk of making a mistake on emotions.

Emotional decisions aren’t effective risk control. You need a quantifiable, non-emotional decision process.

Here’s what I do.

Escaping the Emotional Trap

One method I’ve been suggesting to my readers for some time is to diversify investment strategies—or advisors—instead of asset classes.

If you are running your own portfolio, another approach is to embrace your emotional human nature. Then counteract it with a disciplined risk-management process.

In other words, you have to remove emotions from the equation. But how?

There are all kinds of methods, but here’s one very simple one as an example.

The 200-day moving average identifies an asset’s long-term price trend. You can use it to stay on the right side of the trend.

Stay exposed when the current price is above the 200-day MA, get out when it drops below.

Is this perfect? No.

It will make you miss opportunities and occasionally keep you in the market through a quick-developing plunge. But it doesn’t have to be perfect to improve your results.

It just has to be better than what you would do on your own.

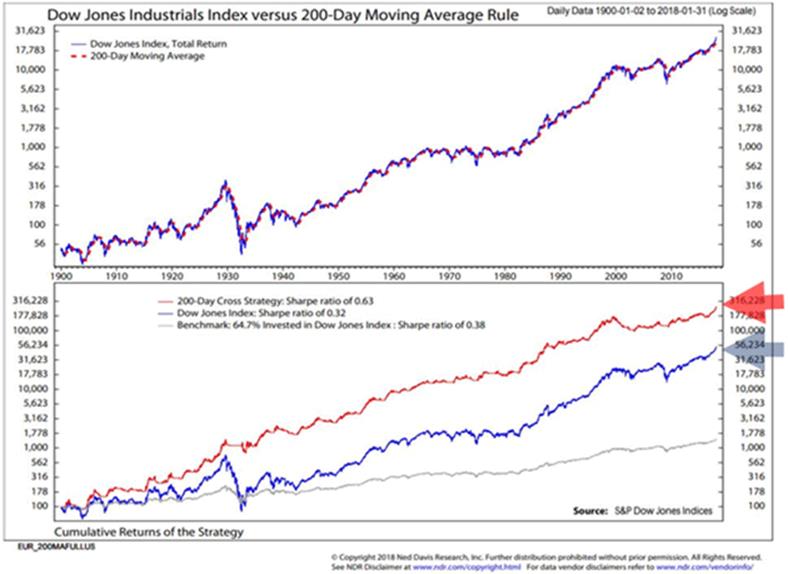

The lower part of this chart shows the Dow Jones Industrial Average total return going back to 1900 (blue line). The red line shows the same Dow if you had entered and exited using a 200-day MA rule.

Source: Ned Davis Research

Note this is a log scale so the difference in dollars is even greater than it appears.

Better yet, the difference in your mental state would have been incalculable. You would have missed the major bear markets and then got back in when the uptrend resumed.

Doing Something Is Better Than Doing Nothing

Now, there are much more sophisticated versions of this strategy. Some are better than others.

But again, I think even something this simplistic is much better than going it alone. This is especially true as we enter the 2020s. I suspect it will be a period of unprecedented, never-before-seen conditions.

The one thing we can be pretty sure about is the trends will change periodically. And every such change will be an opportunity for profit or loss.

Get one of the world’s most widely read investment newsletters… free

Sharp macroeconomic analysis, big market calls, and shrewd predictions are all in a week’s work for visionary thinker and acclaimed financial expert John Mauldin. Since 2001, investors have turned to his Thoughts from the Frontline to be informed about what’s really going on in the economy. Join hundreds of thousands of readers, and get it free in your inbox every week.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.