The U.S. Declares Economic War Against Venezuela

Economics / Venezuela Feb 02, 2019 - 06:04 PM GMTBy: Steve_H_Hanke

Since the election of Hugo Chavez in December of 1998, Venezuelans have embraced Chavismo. This peculiar form of socialism has allowed Venezuela to morph into what is in essence an organized crime syndicate and has pushed the country in an economic death spiral. For the stunning evidence of this death spiral, we need look no further than Venezuela’s inflation rate.

Since the election of Hugo Chavez in December of 1998, Venezuelans have embraced Chavismo. This peculiar form of socialism has allowed Venezuela to morph into what is in essence an organized crime syndicate and has pushed the country in an economic death spiral. For the stunning evidence of this death spiral, we need look no further than Venezuela’s inflation rate.

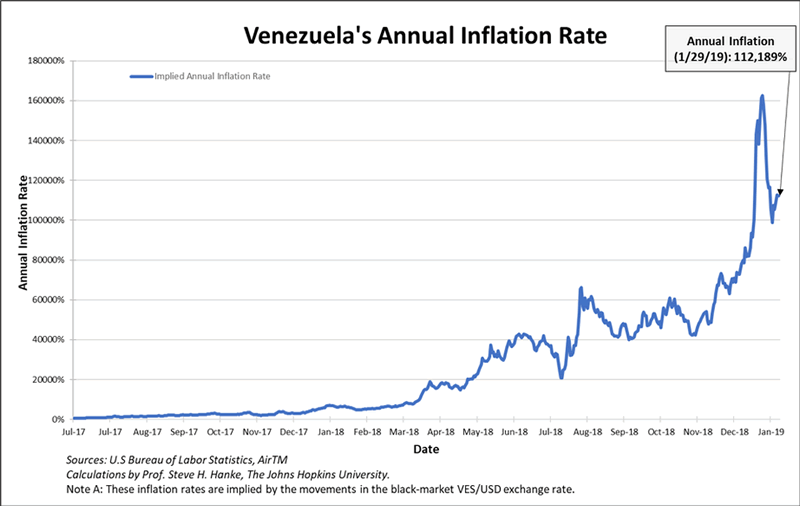

Today, Venezuela’s annual inflation rate is 112,189%/yr. The chart below tracks the daily measurements of this annual rate. Unlike the fantastic inflation forecasts thrown around by the International Monetary Fund (IMF), the data in the chart are real measurements—accurate measurements.

Today, Venezuela’s annual inflation rate was measured at 112,189%/yr.Prof. Steve H. Hanke

Venezuela is suffering from the ravages of hyperinflation—a rather rare phenomenon. Indeed, there have only been 58 episodes of hyperinflation recorded in history, but Venezuela’s episode is a special case. Although its rate of inflation is modest by hyperinflations standards, its longevity is extended. Venezuela’s episode has lasted a 27 months to date, and there have only been 4 other episodes recorded in history that have lasted longer.

Alas, the word “hyperinflation” is thrown around carelessly and misused frequently in the press. Indeed, the debasement of language in the popular press has gone to such lengths that the word “hyperinflation” has almost lost its meaning.

So, just what is the definition of this oft-misused word? The convention adopted in the scientific literature is to classify an inflation as a hyperinflation if the monthly inflation rate exceeds 50%. This definition was adopted in 1956, after Phillip Cagan published his seminal analysis of hyperinflation, which appeared in a book, edited by Milton Friedman, Studies in the Quantity Theory of Money.

Since I use high-frequency data to measure inflation in countries where inflation is elevated, I have been able to refine Cagan’s 50% per month hyperinflation hurdle. With improved measurement techniques, I now define a hyperinflation as an inflation in which the inflation rate exceeds 50% per month for at least thirty consecutive days.

***

For some time now, the United States has been using Venezuela’s vulnerabilities to engage in a low-grade economic war. Instead of military action, the U.S. has imposed selected economic sanctions against certain Venezuelans. These have amounted to slaps on the wrist, with threats of worse to come. But, as January 28, 2019, the U.S. has declared a full-scale economic assault. Indeed, it declared an embargo against Petróleos de Venezuela (PDVSA)—the country’s state-owned oil company that controls the world’s largest oil reserves and produces virtually all of Venezuela’s foreign exchange.

This move shouldn’t surprise us. In a fundamental sense, economic warfare is nothing more than protectionism, a doctrine that is near and dear to the heart of President Trump and his administration. The measures taken under the protections flag are often precisely the same as those employed under the economic warfare flag. Both, of course, fly in the face of free trade, which lies at the root of free-market capitalism.

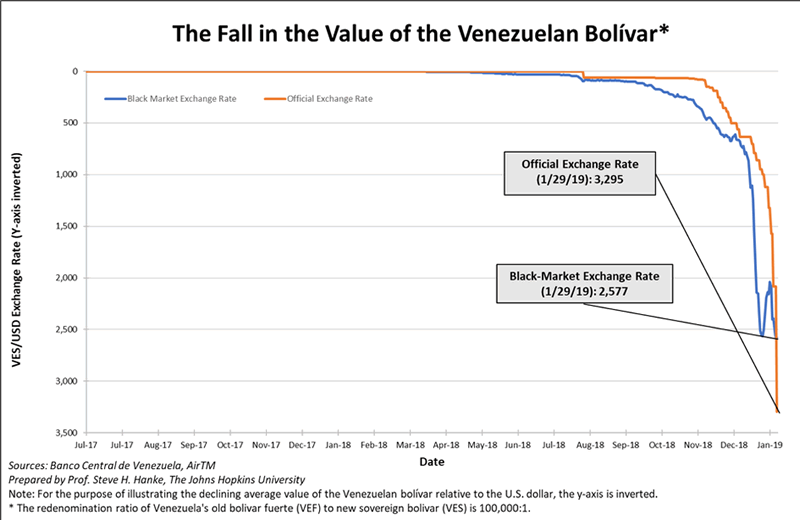

At the same time that Washington declared economic war, Caracas announced that it was going to devalue its currency, the bolivar, in an attempt to allow its value to align with that in the black-market (read: free market). As the accompanying chart shows, the official bolivar/U.S. dollar exchange rate plunged, and shot past the black-market rate. This realignment of the official and black-market exchange rates carries with it significant implications.

Prof. Steve H. Hanke

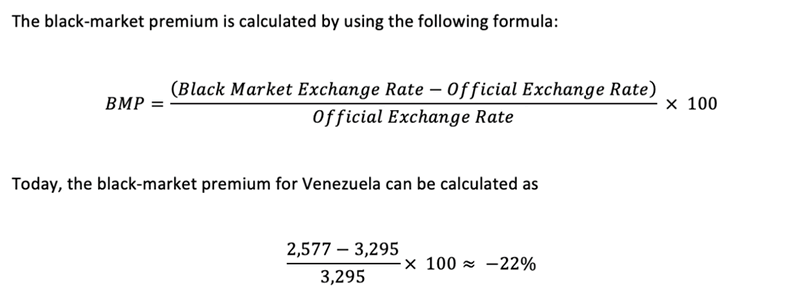

The black-market premium (BPM) is a convenient metric that allows us to understand the importance and relationship between the official and black-market exchange rates.

Prof. Steve H. Hanke

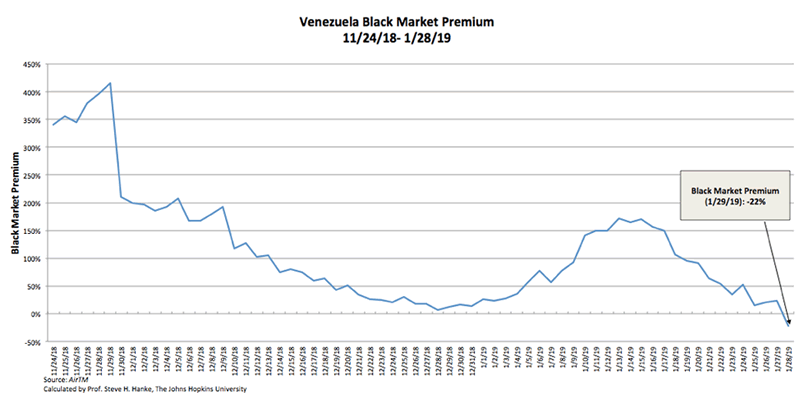

The following chart shows the course of the BMP since November 2018. For all of the dates, except today’s, the BMP has registered positive. This means that Venezuelans were willing to pay a premium for U.S. dollars on the black-market than if they were lucky enough (read: privileged enough) to obtain them at the official rate.

Prof. Steve H. Hanke

For the privileged, Maduro’s cronies and regime insiders, the premium meant that they could buy dollars “cheap” at the official rate and immediately sell their greenbacks “dear” on the black-market. In the process, they would pocket the black-market premiums. By keeping the official rate set so that the bolivar was artificially overvalued via controls, the Maduro regime could restrict access to the Venezuela’s foreign exchange reserves and doll them out to friends, guaranteeing massive profits at no risk.

But, the largess for loyalists has dramatically dried up. Indeed, the BMP has turned negative. What does this unusual negative BMP mean? Well, it implies that market participants expect the bolivar to appreciate relative to the greenback, and that individuals are willing to pay a premium to obtain bolivars on the black-market. This indicates that those in the market, at least for today, expect the Grim Reaper to put an end to Chavismo and Venezuela’s death spiral.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2019 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.