Fed Doves Take Flight (But We Are Not in Kansas Anymore)

Interest-Rates / US Interest Rates Jan 27, 2019 - 05:48 PM GMTBy: Gary_Tanashian

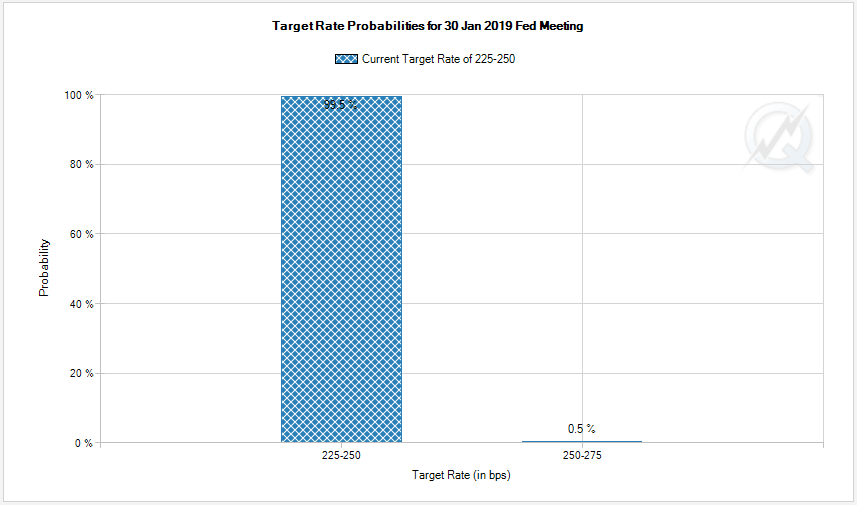

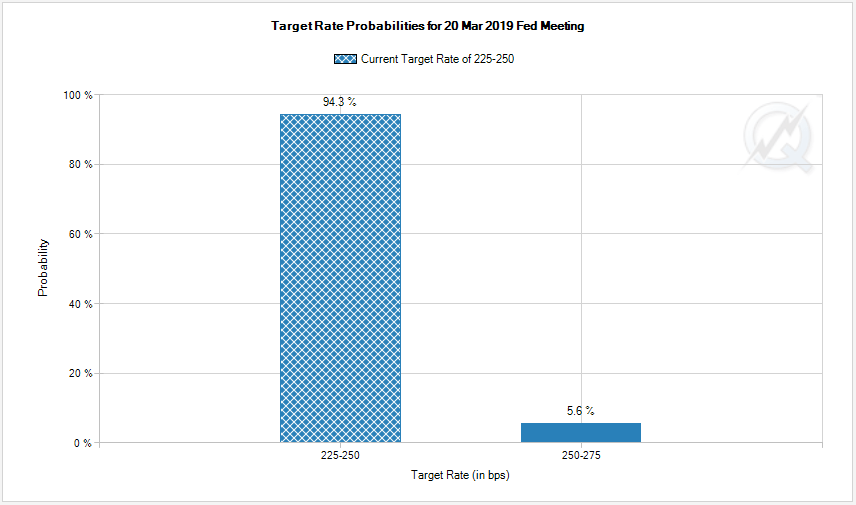

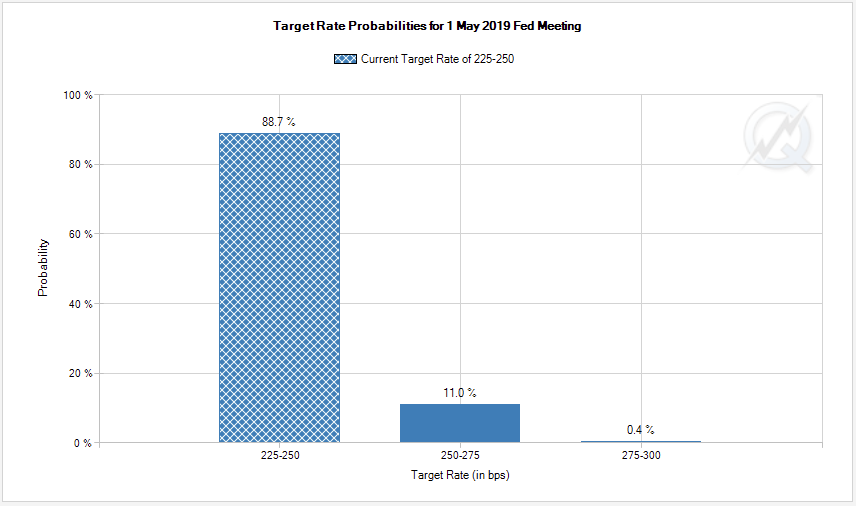

Wise guys trading Fed Funds futures see no more rate hikes in 2019, and a few even imagine a rate cut before year-end. Here are the projections for the next 3 meetings, showing an overwhelming view that the Fed will hold the current 225-250 target rate. Graphics: CME Group

Among other misconceptions promoted in the media about financial markets is the idea that it is bearish when the Fed is raising the funds rate. That is not the case. The Fed raises the funds rate against positive economic activity and/or inflationary activity. And in the age of Inflation onDemand, one is – in my opinion – not much different than the other.

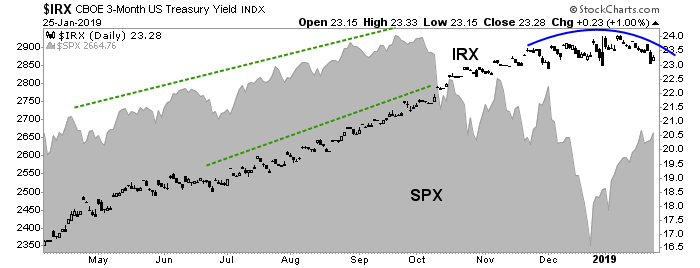

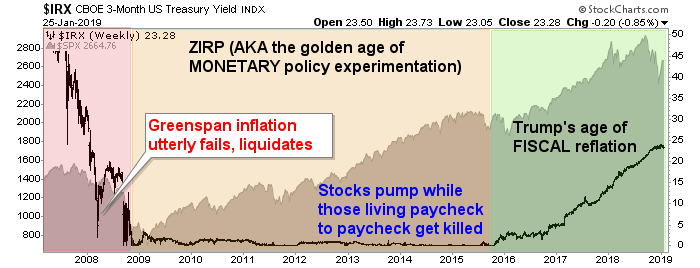

Okay, that’s just a daily chart showing that the funds rate (represented here by the 3 mo. T-Bill yield, IRX) and S&P 500 went in unison to the upside and that IRX began rolling with the market’s post-September problems. But what of the longer-term relationship?

It is very significant that projections of a dovish Fed are in play, if the post-2015 relationship between financial markets and Fed policy is to hold true. From 2008 to 2015 the Bernanke Fed (w/ one year of Yellen) blighted financial markets, inflicting the ZIRP abomination as asset owners (including owners of stock certificates) were enriched while the real economy was drained (real savings is a necessary component of a real economy). Before and after the ZIRP era, the Fed Funds rate was positively correlated to stocks.

It is no secret that I dislike, distrust and have little faith in the man named Donald Trump. But taken at face value, the type of policy he has overlaid on top of Bernanke’s blight has been more honest. That is because it is political, fought for and debated every step of the way. The Fed’s ZIRP era policy (incl. QEs 1-3) was veiled, hidden behind a curtain. It is logical that the Funds rate (and IRX) have resumed positive correlation with SPX.

Bernanke was regarded as a hero who saved the global economy…

But in reality he was a little more than a Wizard of Wall Street hiding behind a curtain, pulling levers, perhaps meaning well but ultimately bringing more tears to more people than the relative few that were enriched by his policy.

Had Trump not had the misfortune of following such balls out, seemingly interminable monetary policy, his fiscal efforts – assuming his pathology would not get in the way of those efforts – might one day be looked back upon as heroic.

Those Main Streeters that were punished relentlessly by the Bernanke Fed – in service to the enrichment of the elite (there’s a little populist lingo for ya) – finally had enough, clicking their Ruby Slippers and summoning Trump to bring them back home. The problem is, we have not yet resolved the distortions from the ZIRP years and if the Fed really is going dovish, that resolution may be dead ahead.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2019 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.