Half of Investment-Grade Bonds Are Just One Step from Junk Status

Interest-Rates / Corporate Bonds Jan 07, 2019 - 04:23 PM GMTBy: Submissions

BY ROBERT ROSS :

The S&P fell 10%. It was its worst December since 1931.

BY ROBERT ROSS :

The S&P fell 10%. It was its worst December since 1931.

When the market drops, conventional investing wisdom says buy bonds. And this is what investors did.

Many have shifted money out of stocks into bonds. Much of that money has flowed into investment-grade corporate bonds.

These bonds are seen as some of the safest bonds investors can buy. The problem is that investment grade doesn’t mean what it used to.

Corporate Bond Quality Is Plunging

The quality of investment-grade corporate bonds has crumbled over the last decade.

A bond is considered investment grade if it’s rated between AAA and BBB-. The closer to AAA, the safer the bond.

But according to Morgan Stanley, the US has been flooded with BBB-rated bonds. In the last 10 years, the triple-B bond market has exploded from $686 billion to $2.5 trillion. That’s an all-time high.

In other words, 50% of the investment-grade bond market now sits on the lowest rung of the investment-grade ladder.

And there’s a reason BBB-rated debt is so plentiful.

It All Comes Back to Incentives

Companies have binged on cheap credit for years.

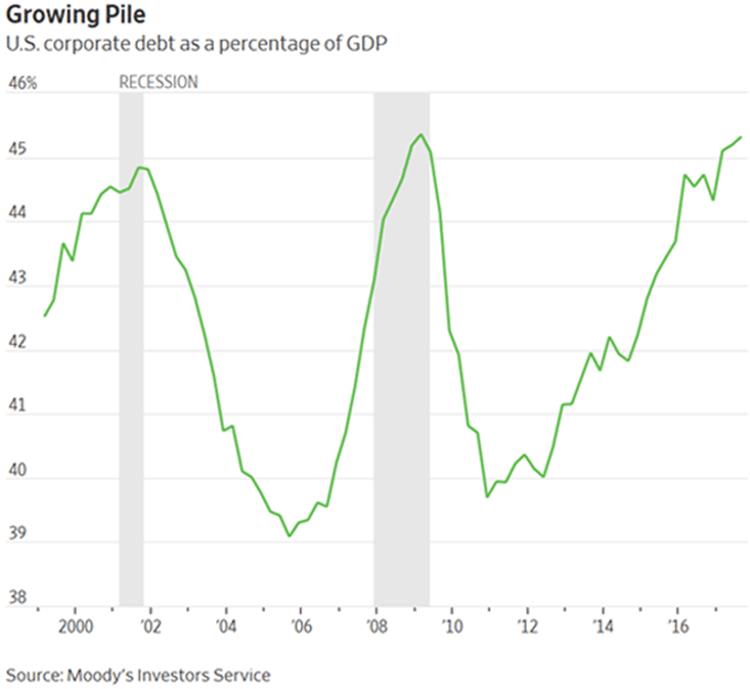

Ultra-low interest rates have seduced companies to pile into the bond market. Corporate debt has surged to heights not seen since the Global Financial Crisis:

Source: Wall Street Journal

But interest rates are on the rise. And as I’ve recently discussed in The Weekly Profit, this spells trouble for investors.

Higher interest rates make investment-grade corporate bonds less attractive. This is especially true for the lower tiers, such as BBB-rated bonds.

That’s how the bond market works. Bonds sold today with a higher interest rate make yesterday’s lower-rate bonds lose value. So, higher-rate bonds are a better deal for investors.

And that’s bad news for the companies issuing these bonds.

BBB-Rated Bonds Are a Ticking Bomb

In a recession, BBB-rated bonds are the most vulnerable of all investment-grade bonds.

According to Moody’s, 10% of BBB-rated corporate bonds are downgraded to “junk” status in a recession.

Since the number of BBB-rated bonds has exploded, we will see more such cases than ever before in the next recession.

And when that happens, investors that own a basket of bonds in an index fund will get hurt.

When Index Investing Goes Wrong

When a bond’s rating is slashed from investment-grade to junk, it automatically gets kicked out of any investment-grade indexes.

Then passively managed investment-grade bond funds are forced to sell these junk bonds at a huge loss. As a result, the fund’s price crater.

We are about to see this happen with General Electric (GE). The struggling company is rated BBB+ by S&P—just two notches above junk status.

The stock keeps hitting new lows. So, I expect General Electric will get downgraded to junk in 2019.

If we see a wave of corporate downgrades, corporate bond funds holding near-junk-level bonds will get crushed.

Hit “Sell” If These ETFs Are in Your Portfolio…

My goal is to find the safest yields for my readers. Whether it’s dividend-paying stocks, business development companies, or even gold stocks, I want my readers buying the safest investments possible.

Today, investment-grade corporate bond ETFs are anything but safe.

Of the major investment-grade corporate bond funds, the Vanguard Intermediate-Term Corporate Bond ETF (VCIT) is the riskiest to own.

This $18 billion fund yields 3.6% but has a dangerous mix of assets.

VCIT has 65% of its assets in bonds rated BBB or lower. If we see a big spike in downgrades to investment-grade bonds, this fund will get hit hard.

Next in line is the Invesco BulletShares 2022 Corporate Bond ETF (BSCM).

This $1 billion fund yields a low 2.8%, and 49% of its bonds are rated BBB.

Even worse, the fund holds three bonds of soon-to-be-junk General Electric.

Lastly, we have FlexShares Credit-Scored US Corporate Bond ETF (SKOR).

This small fund yields 2.9% and has $100 million in assets. But 64% of the ETF’s assets are in bonds rated BBB or lower.

As interest rates rise, I think we’ll see a wave of bond downgrades, and these funds will take the brunt of the downturn.

Now is the time to sell these funds before it’s too late.

BY ROBERT ROSS

© 2019 Copyright ROBERT ROSS - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.