China, Global Economy has Tipped over: The Surging Dollar and the Rallying Yen

Economics / Global Economy Jan 04, 2019 - 04:09 PM GMTBy: FXCOT

We had noted of the coming storm in equity markets worldwide in our research to clients. A part of that research can be found herE: The coming storm . Also here: We did say. We also had noted of the fall in USDJPY rom 113 to 110 levels. But the pair fell even more and wiping away billions in retail margins.

We had noted of the coming storm in equity markets worldwide in our research to clients. A part of that research can be found herE: The coming storm . Also here: We did say. We also had noted of the fall in USDJPY rom 113 to 110 levels. But the pair fell even more and wiping away billions in retail margins.

We do suggest to forex traders to keep us boookmarked and also follow us on twitter. You can also register to be updated of important research we send so you are not caught on the wrong side of the market.

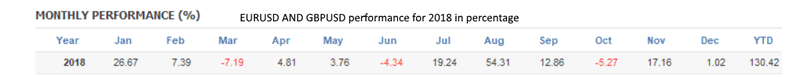

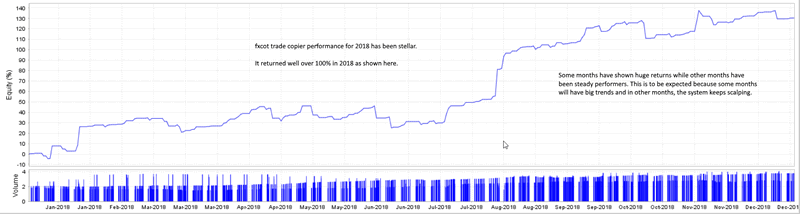

We run a highly successful forex trade copier. It is has made over +130% return in 2018. It has been running since 2010 and has made over 100% return every single year since 2010.

Apple issued a downgrade in sales guidance voicing concerns about Chinaese growth numbers. We take a look at the situation. Chinese Economy Slowdown

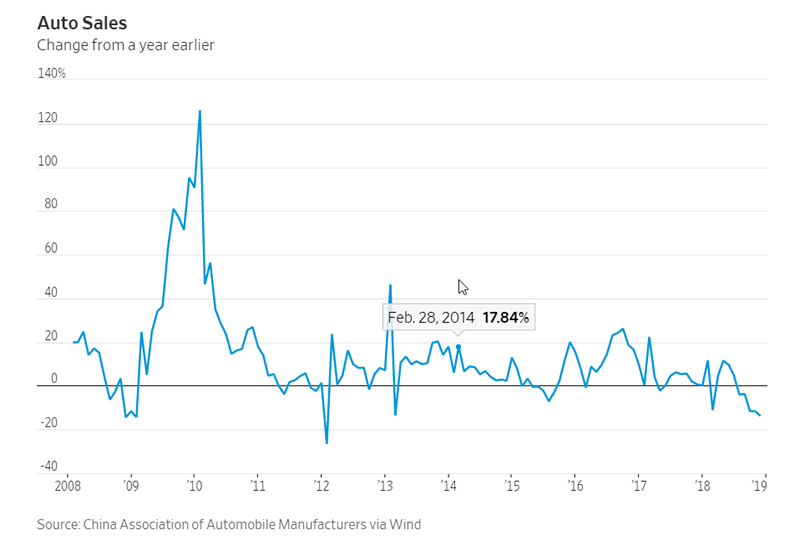

Auto sales saw their steepest drop in nearly seven years in November—the fifth straight monthly decline. The slump sets the world’s largest auto market on track for the first annual sales drop since 1990.

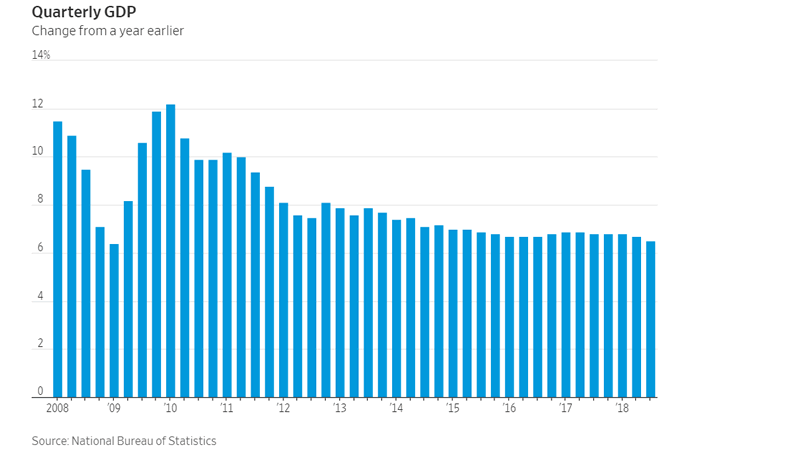

China’s economy slowed to the weakest pace in nearly a decade in the third quarter and is expected to slow further in the coming year. Economists expect gross domestic product to fall to 6.4% in the fourth quarter, down a tick from third-quarter growth of 6.5%.

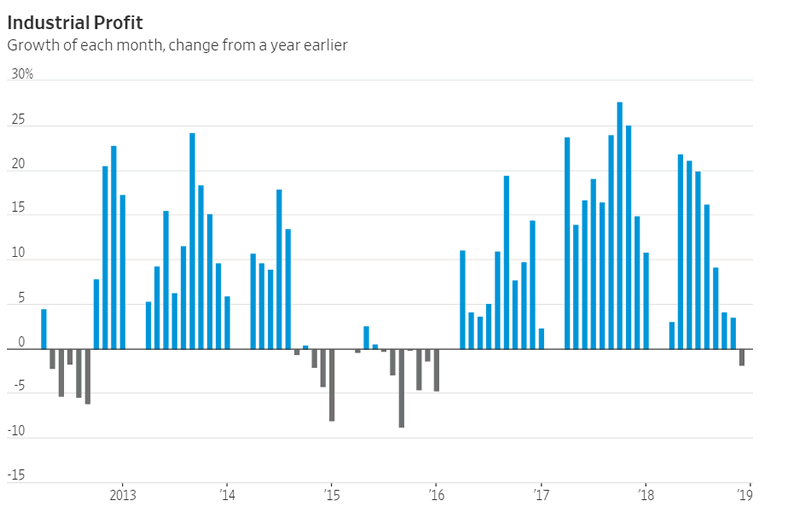

Earnings at Chinese industrial companies fell in November for the first time in nearly three years on the back of slackening demand. Industrial profits registered double-digit growth in 2017, but have been cooling since May last year, hit by subdued factory price gains and slower sales.

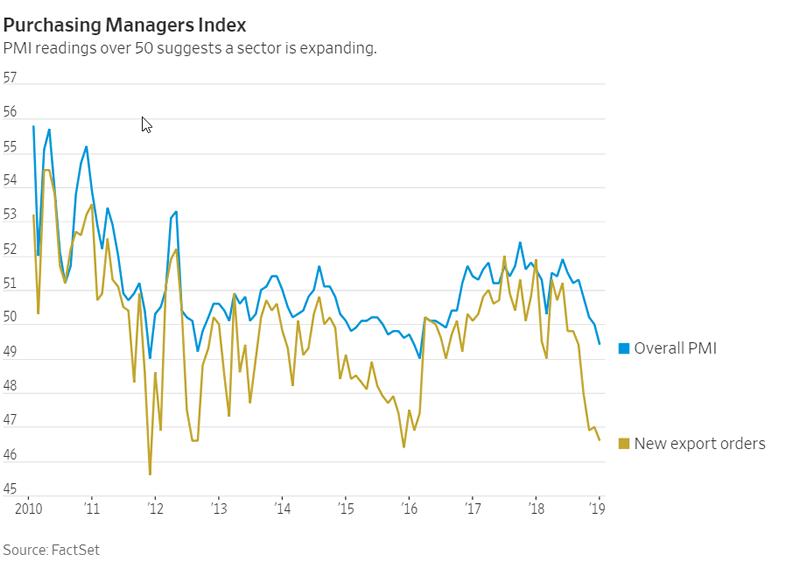

China’s key manufacturing sector contracted in December, ending about two years of expansion, with official and private gauges slipping amid sagging demand. The downbeat PMI readings suggest China’s economic growth likely decelerated further in the final quarter of 2018 and the slowdown is expected to continue this year.

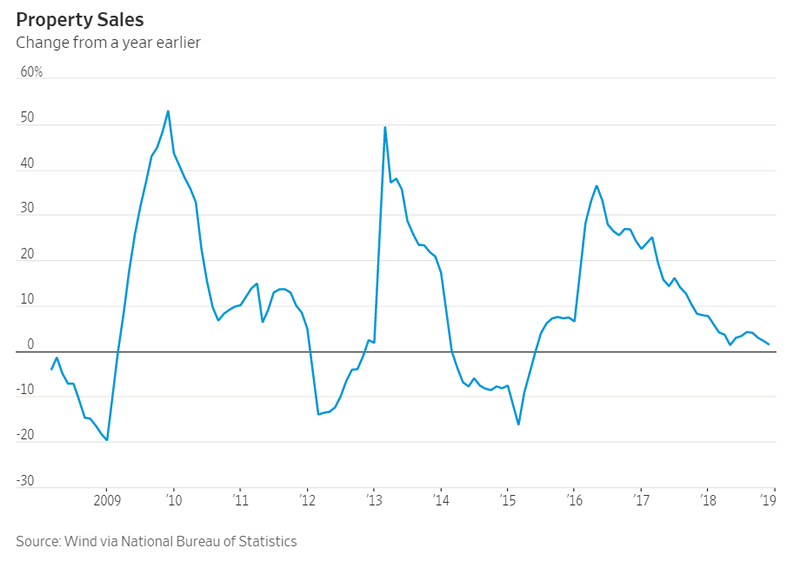

The chinese property sales have continuously plummeted. The govertnment is weighing easing measures however it could be a case of too little too late.

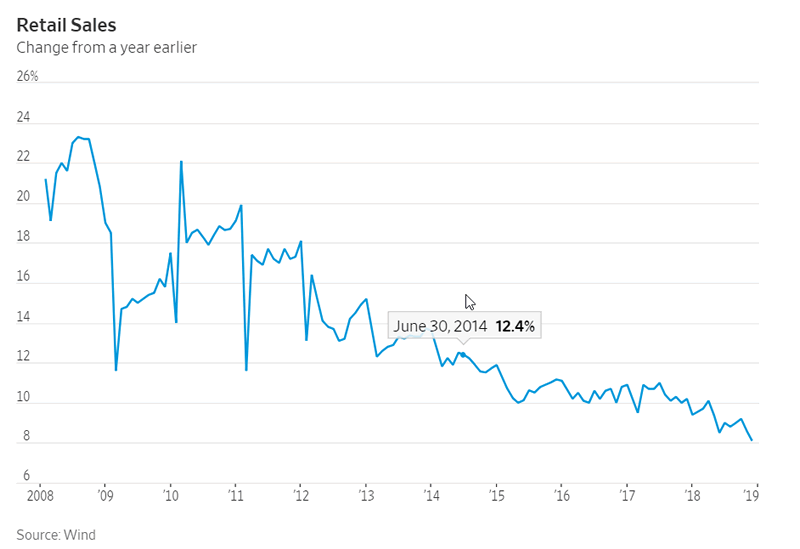

Retail-sales growth—which has been fairly resilient during previous slowdowns—dropped to its lowest level in more than 15 years in November. And the government’s efforts to cut personal income tax has failed to lift spending.

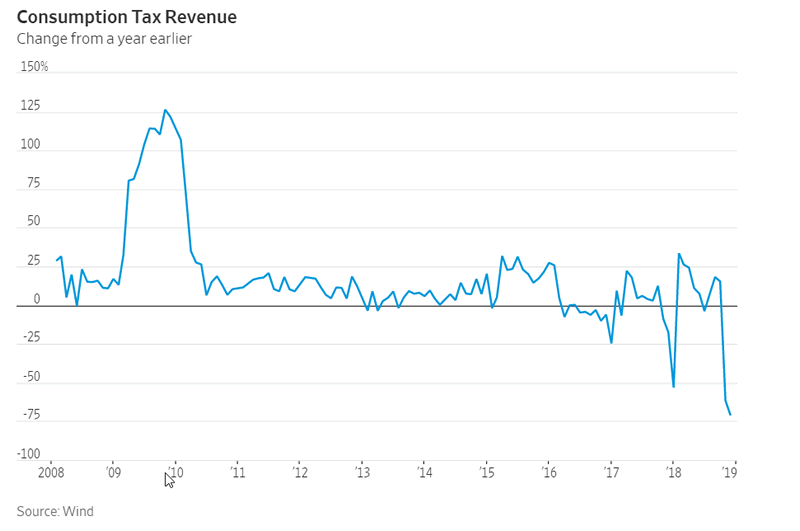

Consumption-tax revenue fell 61.6% from a year earlier and then dropped 71.2% in November. Consumption tax in China is imposed on luxury goods such as high-end cosmetics and jewelry, and items deemed environmentally unfriendly, like cars and gasoline. Rich consumers are backing away which is a terrible sign for the economy.

No matter which way data is sliced, the Chinese economy is imploding.

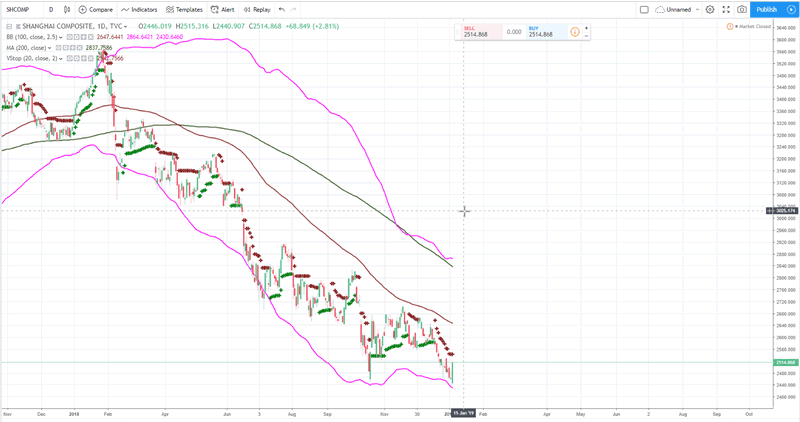

China: Painful fall

The Shanghai stock index has been falling since mid 2018. It has fallen more than 30% in less than 1 year.

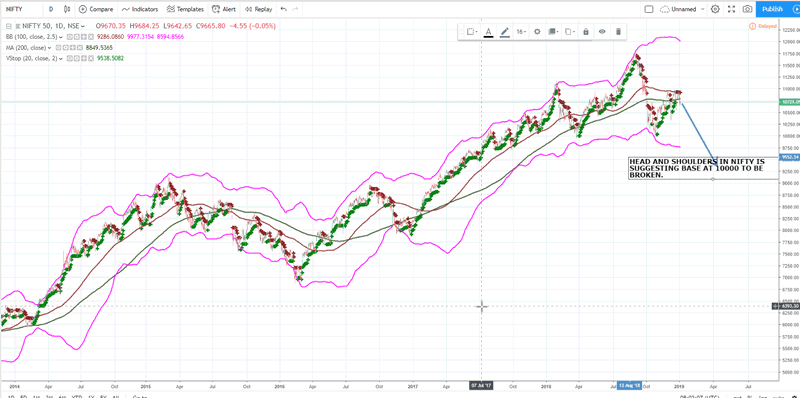

India: Waiting for the crash

We see the most rewarding shorts to be had in Indian markets. India is overpriced by magnitude of at least 20%. Much of the market is supported by public banks and institutions. But a forceful move under key support will see a crash of over 20%. We see the Nifty index to hit 8500 before May 2019. Earning data has been lagging. There is a drying of fund flow for new projects and the govt -RBI spat has not yet been priced in.

US Dollar

We see a forceful rally in US dollar in 2019. The move will propel the dollar above 100 possibly before June 2019. However, we also see the US dollar post the rally to fall to 80 as the FED WILL be forced to cut rates again and possibly into negative territory in a hurry. We do not see any rate hikes in 2019. The worsening global economy will have a debilitating impact on US economy and will see job losses and consumer spending falling. Things are about to get a lot worse for US markets and economy.

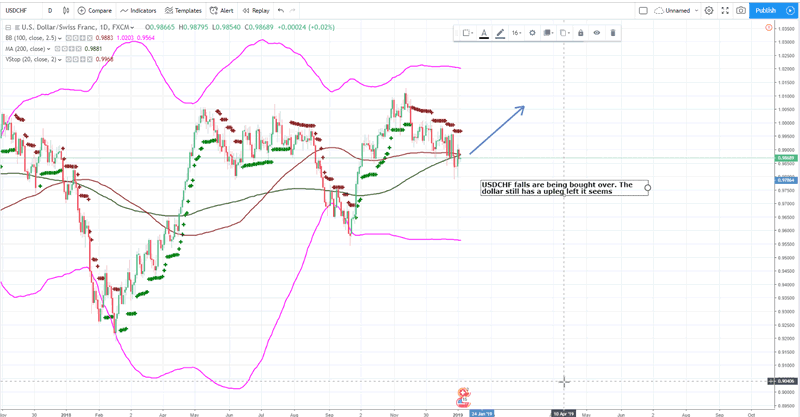

USDCHF

USDCHF has been consolidating at 9850 and the fall from 1.0050 has been arrested. It does seem there is a strong upleg left on USDCHF before it falls back to 9500.

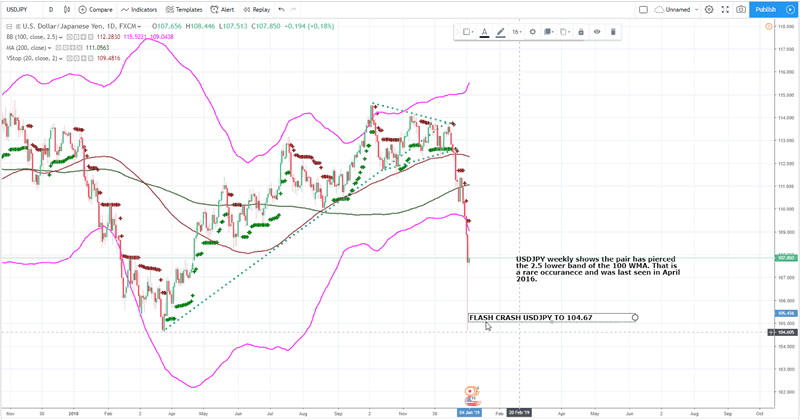

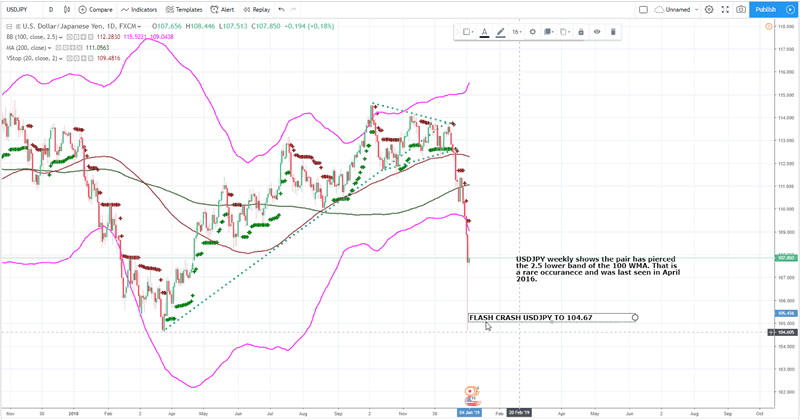

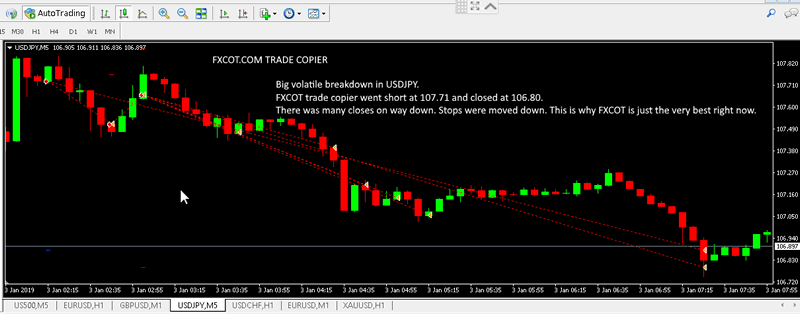

USDJPY

The bellweather of risk sentiment in the world has toppled over below 110.Many margin accounts has been wiped cleaned.

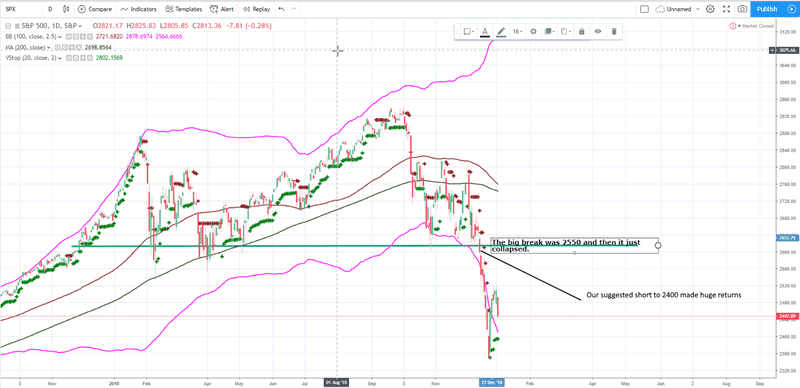

S&P500

We have had multiple reports been published about the impending move in S&P500 to 2400. It has now come to pass. We see more and severe pain to follow. Dollar to surge and yen to rally. Things are about to get painful until mid of 2019.

TRADE COPIER: 2019 STARTS STRONG

As you can see above the trade copier returned over 130% return. It made $14000 on an account of $10000. The above results are for EURUSD, GBPUSD. It also trades USDJPY and the returns of USDJPY will increase performance even more but majority clients have traded EURUSD and GBPUSD on fxcot in 2018.

The 2018 saw the copier making more than +130% return. If you started with 20,000 $, then your capital currently is near $44000. One of the most profitable trading systems in the world. It took a few trades even in 2018. Here they are.

Probably this is the only system that even took advantage of the flash crash on 2 Jan.

See as the USDJPY flash crash was happening, the fxcot trading system was making money having shorted USDJPY at 107.8 and closing at 106.89.

If you would like to connect your MT4 and copy our trades, please contact us or send us a email at teamcot@fxcot.com

Teamcot

FXCOT is Investment Management firm specializing in futures and forex trading. We run a high return trading system for our premier clients. The trading systems uses four different strategies to take advantage of various market conditions. We also send daily trade setups and economic commentary.

© 2018 Copyright FXCOT - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.