The Stock Market Plunge Protection Team, The Fed & The Investor Costs

Stock-Markets / Stock Markets 2018 Dec 31, 2018 - 02:16 PM GMTBy: Dan_Amerman

The "Plunge Protection Team" is the colloquial name for the Working Group on Financial Markets (WGFM). The Working Group was established by the executive order of President Reagan in 1988, in the aftermath of the stock market plunge of October, 1987.

The "Plunge Protection Team" is the colloquial name for the Working Group on Financial Markets (WGFM). The Working Group was established by the executive order of President Reagan in 1988, in the aftermath of the stock market plunge of October, 1987.

The group reports to the President, and the official members of the group include the Secretary of the Treasury, the chairman of the Federal Reserve, the chairman of the SEC, and the chairman of the CFTC. In other words, the group members are the four most powerful financial officials in the United States. In practice, the committee can be composed of senior aides and officials that have been designated by those top officials.

According to Treasury Secretary Mnuchin, the WGFM met by telephone on the afternoon of December 24th, to discuss the ongoing plunge in U.S. stock indexes. The very next trading day, the Dow Jones index experienced its largest ever single day point gain, closing up over 1,000 points. The following day, more than half of the 1,000+ points in gains were temporarily lost - until there was a late day reversal that came out of nowhere, and the Dow climbed by over 600 points to close with another gain.

Coincidence?

There is no doubt that the Plunge Protection Team does exist, and that it convened on Christmas Eve. The hotly debated question is whether the WGFM does more than just talk and persuade, and whether it can and does actually intervene in the markets on a more direct basis when needed.

While the popular view is one of the Working Group itself actually spending the money, that is not necessarily the issue in practice. If the Treasury, Fed, SEC and CFTC act in cooperation, with each using their fullest emergency powers by executive order but without full disclosure to the public - what can they actually do and what are the limits?

This analysis does not attempt a definitive answer, but rather examines the implications of two "what if" scenarios:

1) What if the WGFM can and does directly intervene in the markets?

2) Alternatively, what if the WGFM can accomplish something similar to the effects of such an intervention through the full utilization of the powers of its members?

As will be explored, the price of stopping plunges for the good of the financial system is borne by individual investors, with three forms of losses. There is also a fascinating degree of overlap with the individual actions of one of the group members - the Federal Reserve - which can create the same three types of investor losses as part of ongoing cycles of crisis and the containment of crisis.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

The WGFM & Wild Conspiracy Theories

The purpose of the Working Group on Financial Markets is to attempt to change market prices. It is the Treasury, Fed, SEC and CFTC working together to change prices from what they would otherwise would be, in order to maintain stability and keep plunges from happening.

We don't know what of the many open powers of the member organizations are being used. Keeping in mind that executive orders have frequently been used in recent decades to exert broad new powers in areas that used to require legislation, and that many executive orders relating to national security are indeed kept secret from the public - we simply don't know what executive orders may have been issued over the years with regard to the WGFM, or what its emergency powers actually are.

The greatest misconception about the Plunge Protection Team is that it is some sort of conspiracy theory, with mysterious individuals secretly meeting and wielding great power. The truth is that the Working Group on Financial Markets is the open collaboration of the most powerful group of financial entities in the United States.

As it happens, their meetings often are secret, they do not release their minutes, we don't know their full mandate, we don't know their full powers - but we do know by definition that their job of maintaining stability and preventing market plunges means intervening - in some form or combination of forms - to keep prices substantially higher than they otherwise would be.

I personally don't know whether the intervention of the Working Group on Financial Markets created or contributed to the 1,000 point surge in the Dow on December 26th, 2018, or the 600 point recovery the following day. If they did intervene - I further can't say that I know the specifics of how they did it.

That said, if the WGFM did intervene - it wouldn't be conspiracy theory in action. It would the Treasury, Fed, SEC and CFTC successfully doing exactly what they are supposed to be doing - by executive order of the President of the United States. At least temporarily interrupting the momentum of a major breakout to the downside that threatened financial stability is exactly what the WGFM is supposed to do, it is why the group was created in the first place.

So, where things get really interesting is when we consider not conspiracy theorists, but those who are the opposite of conspiracy theorists, and who dismiss out of hand the idea that a "Plunge Protection Team" could actually exist, or that it could reverse the trend lines for the major indexes by some form of market intervention.

This may seem the most reasonable perspective on the surface. But, as a start, to take that perspective is to deny the unquestionable fact of the existence of the Working Group on Financial Markets, while calling the Secretary of the Treasury a bald-faced liar with regard to the Christmas Eve phone meeting. To deny that the WGFM could actually do anything, is to assert that Treasury, Fed, SEC and CFTC acting in combination and with the full powers of the presidency behind them - are helpless to intervene in markets.

On the other hand, for an individual who is aware of what the WGFM actually is, accepting that this extraordinarily powerful group may sometimes do exactly what it is supposed to do - could also mean accepting the possibility that interventions of some sort helping to create 1,000 point and 600 point index moves is much less of a fanciful or absurd idea than many investors might think.

How A Plunge Protection Team Could Cheat Investors

The idea of a "Plunge Protection Team" sounds pretty good from some levels. Once a market plunge gets going, then it can become difficult to stop - and this can be exacerbated by automated trading programs. The results can be extremely painful for individual investors.

So the Plunge Protection Team becomes a form of circuit breaker. It keeps the markets from going to where they would naturally fall absent the interventions.

Most people don't want plunging markets, but rather they want high asset prices and stability. Therefore, it might seem that a form of Plunge Protection Team serves the interests of investors. However, there are a series of basic issues when it comes to something like a Plunge Protection Team.

To see those issues, let's begin with the premise of an overpriced market where investors quite correctly and rationally want to drop the prices. Now some believe that the purpose of the Plunge Protection Team is to secretly manipulate the markets using vast sums of money in a series of interventions to keep investors from decreasing prices to a more rational level. In this case, the Plunge Protection Team keeps levels artificially high, and many other investors, particularly many naïve investors and index investors, continue to buy stocks (or whatever the asset is) at unfairly high levels.

Viewed from that perspective, a Plunge Protection Team becomes much less desirable. What underlies everything else when it comes to investments and their utility to the public over the long term is that purchasing investments is supposed to work in the investors' interest, not the interest of the financial system.

And that's really what the Plunge Protection Team is, it is a committee that is dedicated not to investors but to the financial system. If in the interest of serving the financial system, government manipulations create excessively high prices - then by definition, investors are being cheated out of future yields.

This is because for any future stream of cash flows - whether it be interest payments, dividend payments, or the future sales price - the higher the price we pay today for what the cash flow will be in the future, then the lower our future profits or returns.

Why does the Plunge Protection Team intervene? It is to make sure that prices are higher than investors would be paying of their own free will, with the best information that they have at that time.

So when the Plunge Protection Team intervenes, whatever the specifics are for how it does it - it is manipulating the market to cheat investors. Nothing is free, and there is no getting around it. The investors are being prevented from acting on the best information they have. And because of that, other investors who don't understand what is going on - such as passive index investors - continue to buy these assets at far higher prices than they really should.

The interests of the system are not necessarily the interests of the investors, and government interventions that favor prices going up and discourage prices going down are something that arguably serves the system at the expense of investor outcomes. Indeed, the essence of the Plunge Protection Team is that it sacrifices the ability of investors to buy at prices that accurately reflect market conditions, for the common good of the system, including financial institutions and the government. This applies regardless of the specifics of the intervention.

The Greatest Risk

What's the greatest risk involved with something like a Plunge Protection Team? The problem is that eventually the market is going to go where it is going to go. There is likely only so long that artificial manipulations can prop it up.

So, the manipulation eventually fails. And because the manipulation fails, we have millions of investors who bought into markets for what could be months or years at far higher prices than they should have paid. This means that they take far greater losses than they should have taken.

Stability was preserved and all the careers and fortunes that were based on the system functioning were maintained. The tab for this stability is eventually picked up by individual investors being blindsided with potentially staggering losses - with that blindside coming specifically because the Plunge Protection Team kept the best information from reaching normal investors.

On the other hand, those in the know would have had that information all along, and what extraordinarily valuable insider knowledge that would be. Such is the problem with the combination of secrets, vast powers and human nature.

A Real Plunge Protection Team

We know that the committee that is referred to as the "Plunge Protection Team" does exist, and that it has met since stock prices began plunging.

Has the Plunge Protection Team recently intervened in some form? Did it have anything to do with the 1,000 point gain in the Dow that at least temporarily broke the downward momentum in the markets, or the snap 600 point recovery in the Dow the following day?

A small group of insiders do in fact know the definitive answers to those questions - and that is extremely financially valuable information to have. However, the rest of us don't know, so it comes down to speculation and the kinds of things that we personally tend to believe.

Some people recall the frequency with which stock indexes seemed to suddenly soar upwards in the last hour or two of trading - for no apparent reason - in the troubled markets of years gone by, and find the return of a Plunge Protection Team intervening on massive scale to be entirely credible. Other people don't believe in such things until they see the dollar amounts from definitive sources in the headlines - and even then, won't change one bit of how they approach investing.

That said, one could say that the case for the Plunge Protection Team actively intervening might be true - but it lacks scale and imagination. So let's consider what a real Plunge Protection Team could look like.

What if there was an entity that was far more powerful the Plunge Protection Team? What if we had a financial player quite openly operating that wasn't coming in with say $100 million here or maybe even $1 billion there, but it was instead spending money by the trillions of dollars?

What if this Plunge Protection Team didn't come and go but it just stayed in the market for years at a time?

What if that Plunge Protection Team took almost half a trillion dollars and used it to save insider banks with no cost to the banks?

What if that same Plunge Protection Team in the process of saving the banks destroyed a key pillar of retirement income and the investor life cycle? What if it reached in and it used its enormous power to strip interest income and financial security from tens of millions of retirees in the process of saving the insiders of the financial system?

Well, the Federal Reserve has in plain sight been doing just those things for many years now. It does massively intervene in the markets - effectively. It does create trillions of dollars out of the nothingness and it uses them to purchase securities and change interest rates.

It did create over $400 billion in a few days in October of 2008, and used the newly created dollars to stop a bank run in process that could have wiped out almost all of the major investment and money center banks. The Fed did intervene to slam interest rates down to near zero percent, and in the process, it destroyed the traditional primary source of income in retirement, which was ample interest payments from high quality investments.

Indeed in all categories, almost all investment prices and yields have been profoundly influenced if not outright determined by these extraordinary interventions. Just think about how closely the stock market is watching and following what the Fed is doing right now.

PPT & Fed Similarities

Let's consider some similarities between the Plunge Protection Team and the Federal Reserve.

As a starting point both are forms of governmental entities - whose interventions can create heightened boom and bust cycles. They are also quite intertwined. The Fed is part of the Working Group on Financial Markets, and whether it or the Treasury is the most powerful group member is an interesting question. So, depending on the specifics, the real power behind the Plunge Protection Team may actually be the Fed, at least in some forms of interventions.

The real costs of the market manipulation that is purportedly involved with the Plunge Protection Team are three forms of investor losses, three forms of cheating investors.

1) It cheats investors by making them pay too much for a security at any given time compared to what they would be paying if the Plunge Protection Team wasn't there.

2) It cheats investors by taking too much of their future profits because they are paying too high of prices today in exchange for any given amount of future cash flows

3) It cheats investors by exposing them to far greater risk of catastrophic losses than they would knowingly take if the Plunge Protection Team was not there.

Now, that the impact of the Fed is more complex. It can take many forms, but in a number of different markets - and this can include stocks, bonds and real estate - the impact of the Fed can be the same three factors.

1) It can effectively cheat investors by creating excessively high asset prices, much higher prices than would likely exist without the Fed's interest rate interventions and unconventional monetary policies such as quantitative easing.

2) It thereby also cheats investors by taking too much of their future profits.

3) Because the Fed's actions can create boom and bust cycles, it can then also cheat investors by making them overpay in the boom portions, and then exposing them to potentially catastrophic losses in the bust portions of the cycles.

That is a very short summary of a large body of work, which I have been developing for a number of years. A quick example of this can be seen in the two graphs below which are part of the Five Graphs analysis linked here.

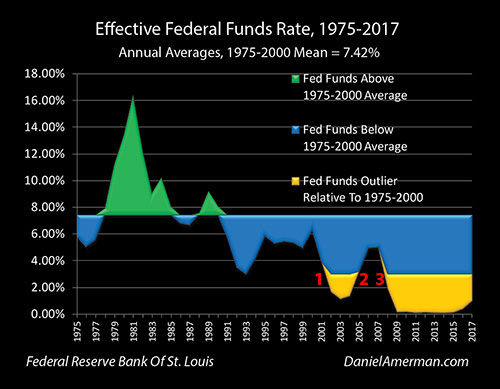

In the first graph we look at the extraordinary interventions by the Federal Reserve when it comes to containing the crises of the tech stock bubble collapse and the financial crisis of 2008, by forcing interest rates to fifty-year lows, and then to all-time lows.

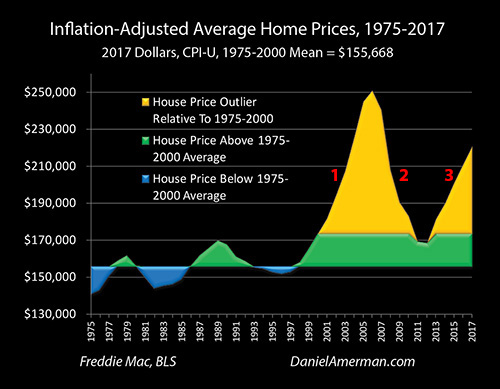

And then we can look at the heightened and entirely different behavior of housing prices since the cycles of crisis and the containment of crisis began.

The other crucial factor to keep in mind is that it isn't necessarily an either/or question. We can have both Federal Reserve and the Plunge Protection Team acting at the same time, which means we have two cycles of heightened boom and bust which can be reinforcing each other, one of them openly, and one of them (more or less) secretly.

PPT & Fed Differences

Let's think about two critical differences between the Federal Reserve and the Plunge Protection Team.

The first one is the difference between a deliberate outcome versus an incidental byproduct.

The whole purpose of the Plunge Protection Team is to intervene in the markets. It is to change prices from what they would otherwise would be, in order to keep plunges from happening.

Apart from the rest of WGFM and in its individual capacity - the Federal Reserve is quite different. The mandates of the Federal Reserve are monetary stability and maximum employment, which it attempts to achieve by influencing the economy with interest rate changes.

So while the Federal Reserve does indeed help create exaggerated and amplified boom and bust cycles that can change almost all investment prices - that's not actually the objective, but is rather more of an incidental byproduct.

This means that we have to use a translation process in going from what the Fed is attempting to do in order to achieve its mandates, to how - often as a byproduct - that then influences prices and returns in almost all investment categories.

The other basic issue is secret versus public knowledge. The fascinating part about the Plunge Protection Team is that even though it has been publicly created by the government - it still looks an awful lot like a conspiracy. We have a group of extremely powerful insiders who are acting in ways that are not being fully described to the public and which the public does not fully understand.

Because they are doing this in secret, it is very easy to believe that maybe they really are spending the money, that they are doing this in their own self-interest, and this is not being done in the interests of the average person. Indeed, it is a pure leap of faith to believe that if the Plunge Protection Team is indeed directly intervening, that it is acting in the interests of the average investor.

It doesn't take much of a knowledge of human nature to see the potential for abuse - but it's also easy to understand. Powerful insiders acting in their own self-interest and cheating the public is part of history, it's part of almost every society.

People get "it", people understand that part of human nature.

However, most people don't understand the Federal Reserve. There is a complexity barrier that exists, that isn't there when it just comes down to human nature and understanding how connected powerful insiders may be secretly acting in their own self-interests.

What makes this particularly unfortunate is that the Federal Reserve's actions are not secret or subject to debate. Yes, they are not entirely public - but they are far more public than the Plunge Protection Team, we know that they are actually doing it, and the ways in which they change investment prices are not a "random walk".

When we understand what the Fed is doing, how it's doing it, why it's doing it, and why the boom / bust cycles are created, then as explored in the analysis linked here, we can identify in advance where the Fed creates heightened risks - so we can seek to avoid them. We can also identify in advance where the Fed creates heightened opportunities - so we can seek them out.

However, for those who have no knowledge of the Fed, then unfortunately, the Fed can create boom and bust cycles where asset prices go far higher than they should, and the prices can then plunge far lower than they should. The heightened highs, the lower lows, and the magnified losses in going from too high to too low will all come as a complete shock to uninformed investors in this case.

So, for those who are not aware of what the Fed is doing and how it can so profoundly change the markets and all of our investment results, the Fed can indeed act as a form of a Plunge Protection Team on steroids - systematically creating exaggerated failures and losses for investors who do not understand what is happening.

What the Fed and the Plunge Protection Team have in common is that they are each powerful entities that are tasked with creating stability for the system. If, for the sake of argument, we say that the WGFM is actually directly intervening in some form, then each can act as outside forces on the markets, transforming investment prices and returns. However, the manner in which these entities create stability for the system is not necessarily based upon the interests of investors trying to achieve individual positive outcomes. Indeed, the wholesale infliction of losses on unknowing investors is the incidental price that the system is quite willing to pay in order to maintain stability.

Taking factors like this into consideration is not part of traditional financial education. But, in these times of Plunge Protection Teams and unconventional monetary policies - perhaps it should be.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2018 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.