The Next Stock Market Crisis is Here and Now

Stock-Markets / Stock Markets 2018 Dec 27, 2018 - 06:14 AM GMTBy: Graham_Summers

The next crisis is here.

The next crisis is here.

And yes, it is a crisis. Ignore anything the media says about this, we are seeing selling that is on par if not worse than the 2008 collapse.

And it’s not over by a long stretch.

Most traders remain in complete denial about what is happening. They think this is some kind of garden-variety correction or that investors are overreacting to the Government shutdown.

It is neither. What is happening is the Everything Bubble has burst.

Starting in 2008, Central Banks created a bubble in sovereign bonds, the bedrock of the current financial system. These bonds represent the “risk free” rate of return, or the rate against which all risk assets including stocks are valued.

So if these bonds go into a bubble, EVERYTHING goes into a bubble.

Which is why, when Central Banks ended their massive QE programs, or worse still for the markets, started raising rates while also engaging in QT as the Fed is doing, the Everything Bubble burst.

Put simply, the financial system is now adjusting to economic realities, or where things should be price WITHOUT Central bank props in place.

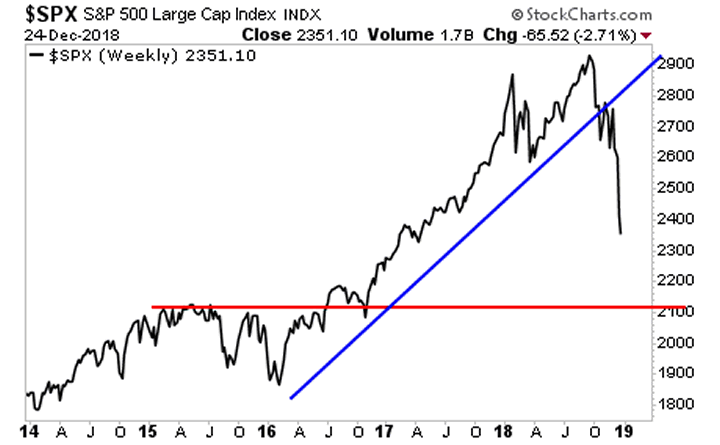

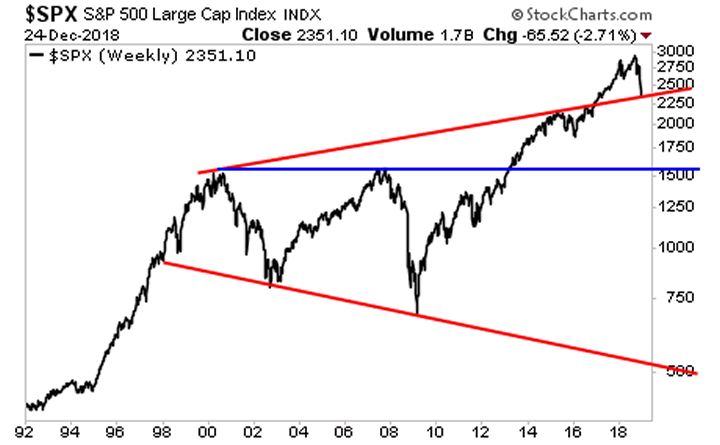

At the very least, this is going to happen.

If that doesn’t hold, the picture gets MUCH worse.

The time to prepare is NOW before it happens.

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

In it, we outline precisely how the crash will unfold as well as which investments will perform best during a stock market crash.

Today is the last day this report will be available to the public. We extended the deadline based on yesterday’s sucker rally, but this it IT… no more extensions.

To pick up yours, swing by:

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.