Stock Market Collapse? Buckle Up, It’s About to Get NASTY

Stock-Markets / Stock Markets 2018 Dec 19, 2018 - 04:28 PM GMTBy: Graham_Summers

The Fed is expected to hike rates today. However, the bulls are hoping that the Fed will ALSO state that it now expects to hike rates FEWER times in 2019.

The Fed is expected to hike rates today. However, the bulls are hoping that the Fed will ALSO state that it now expects to hike rates FEWER times in 2019.

Let that sink in for a moment.

The ONLY reason the Fed would hike rates fewer times in 2019 is if the financial system is in serious trouble. So… the best we can hope for is that the Fed gets dovish because things are getting horrific?

How horrific?

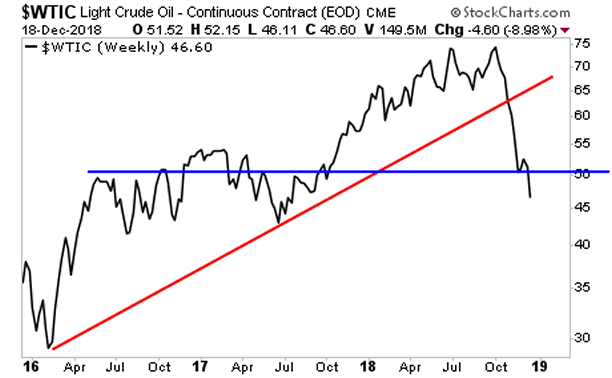

Oil fell nearly 8% yesterday. According to Oil, there is NO growth anywhere at this point. The entire post-election price move is GONE.

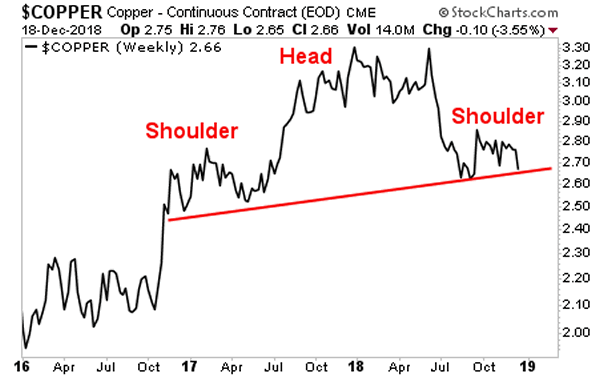

Copper is about to join it… as the economically sensitive commodity is forming a clear Head and Shoulders pattern.

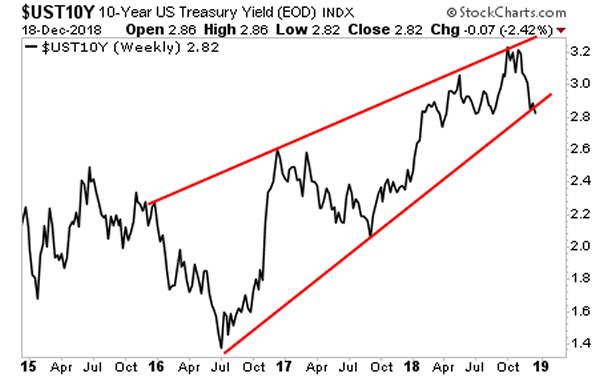

And then there is the yield on the 10-Year US Treasury, which has just broken down from a rising wedge formation. Folks, the only reason Treasury yields would fall at this time is because growth is GONE. By the way, this chart predicts yields are falling to 2.3%.

So… if the Fed DOES wax dovish today, remember it’s because the ENTIRE financial system is screaming that growth is gone and something truly HORRIFIC is coming down the pike.

How horrific?

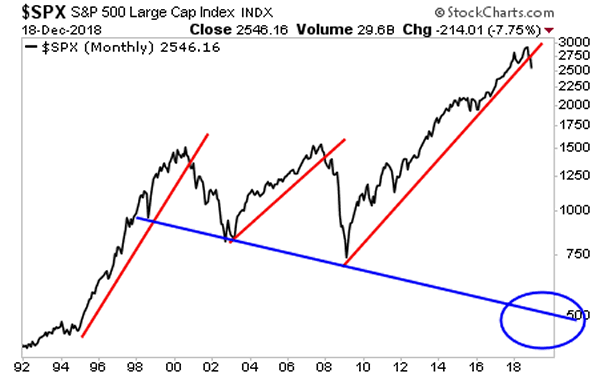

See for yourself.

Guess what’s coming next?

On that note we just published a 21-page investment report titled Stock Market Crash Survival Guide.

https://www.phoenixcapitalmarketing.com/stockmarketcrash.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.