The Coming Financial Storm

Stock-Markets / Financial Markets 2018 Dec 18, 2018 - 02:13 PM GMTBy: FXCOT

The Dow Jones Industrial Average slumped more than 500 points Monday as investors looked ahead to this week’s Federal Reserve meeting amid mounting signs of slowing economic growth around the world. Major indexes opened modestly lower and began a steady descent around midday. All 30 stocks in the Dow industrials and all 11 sectors in the S&P 500 ended lower. The declines pulled the technology-heavy Nasdaq Composite into the red for the year, while the Russell 2000 index of small-capitalization stocks slumped into a bear market--a decline of more than 20% from its Aug. 31 high. And U.S. crude settled below $50 a barrel for the first time in 14 months.

The Dow Jones Industrial Average slumped more than 500 points Monday as investors looked ahead to this week’s Federal Reserve meeting amid mounting signs of slowing economic growth around the world. Major indexes opened modestly lower and began a steady descent around midday. All 30 stocks in the Dow industrials and all 11 sectors in the S&P 500 ended lower. The declines pulled the technology-heavy Nasdaq Composite into the red for the year, while the Russell 2000 index of small-capitalization stocks slumped into a bear market--a decline of more than 20% from its Aug. 31 high. And U.S. crude settled below $50 a barrel for the first time in 14 months.

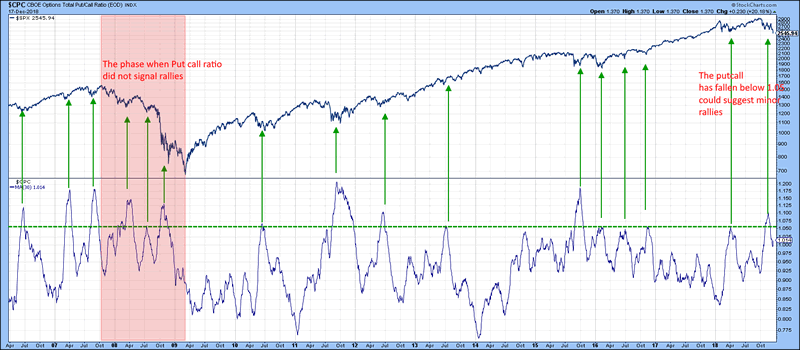

PutCall ratio

The put call ratio has dipped below 1.05 from 1.1. This can suggest some weak bullish signals to a mild rally into year end. However this signal has been weak over the years so we look for some signs.

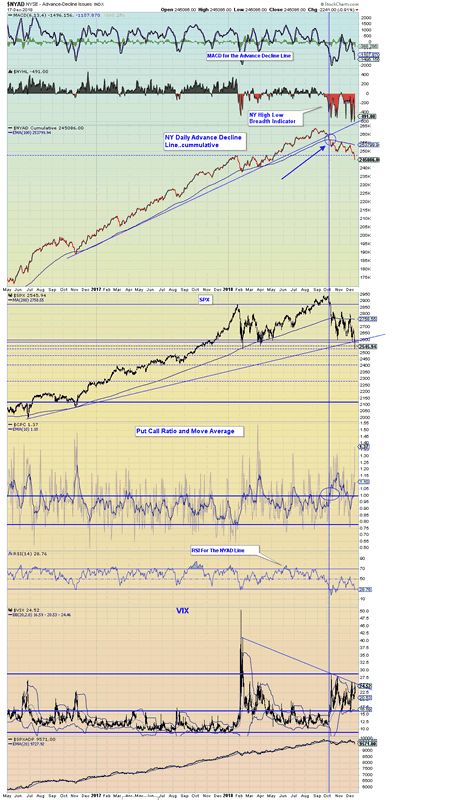

Advance -Decline ratio breaks trend

The trend in the NYSE Advance-decline cumulative has been broken to the downside. The momentum is now starting to accelerate on the downside. The VIX is at 24 which is suggestive of dislocation and fear in the market. We made this point before that VIX has not been this high for a long time. Generally when VIX remains above 20, it comes down after 3 weeks. It is now above 20 for over 8 weeks. Things could get ugly now as the Buy the dip crowd has evaporated and tired. There is a glimmer of hope though. The last panel shows the SPX AD line which is still relatively stable to long term uptrend. However our suggestion is now to sell the rallies.

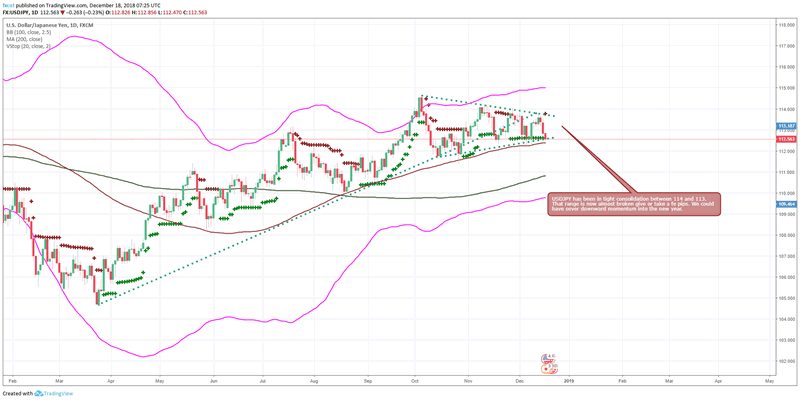

USDJPY Triangle break

USDJPY has been in tight consolidation between 114 and 113. That range is now almost broken give or take a fe pips. We could have sever downward momentum into the new year.

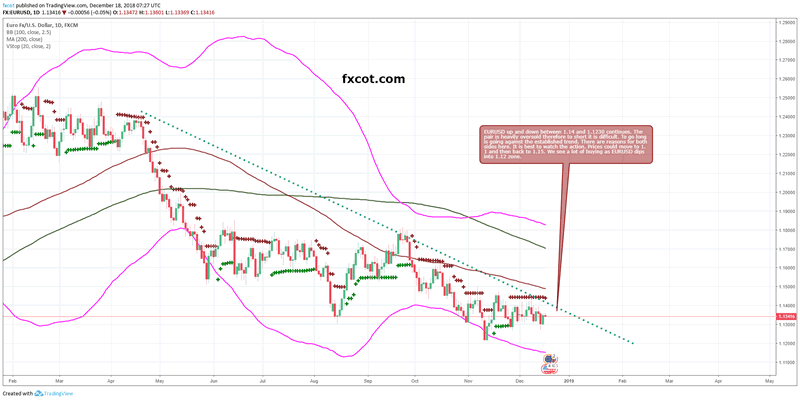

EURUSD: In mud

EURUSD up and down between 1.14 and 1.1230 continues. The pair is heavily oversold therefore to short it is difficult. To go long is going against the established trend. There are reasons for both sides here. It is best to watch the action. Prices could move to 1.1 and then back to 1.15. We see a lot of buying as EURUSD dips into 1.12 zone.

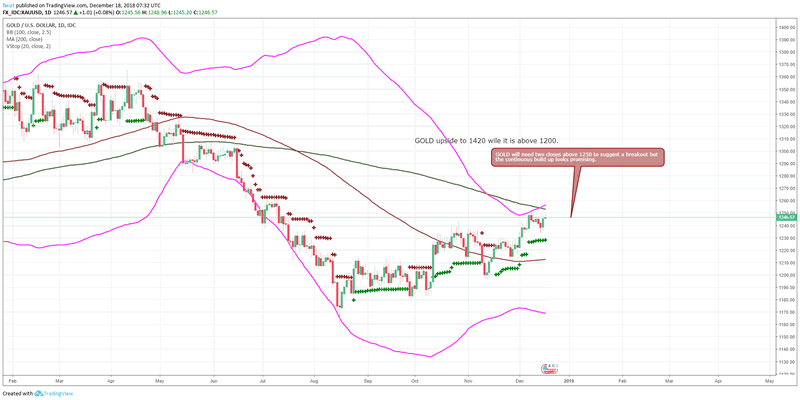

GOLD: ominous break ahead

GOLD will need two closes above 1250 to suggest a breakout but the continuous build up looks promising.

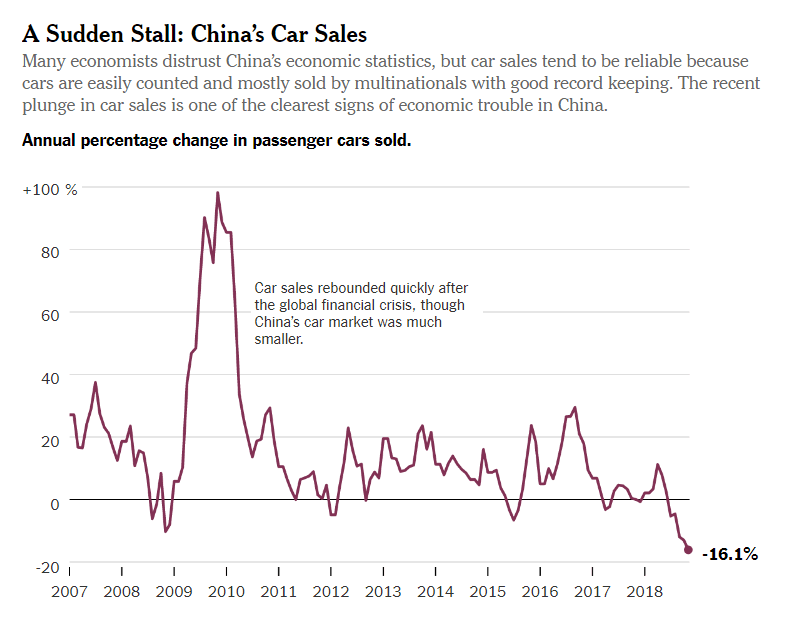

Fundamentals: Slow Economy everywhere

Chinese cars volume sales fell 16% in November. Things are looking even more sever in other part of Asia. In India too, Auto numbers are looking dreadful for November. Car manufacturers across the board have cut production sharply due to a tepid festive season demand. As per the Society of Indian Automobile Manufacturers (SIAM) data, car makers cut output by 20 percent in November. Maruti Suzuki has cut production by almost 12 percent. Mahindra & Mahindra has cut production by almost 26 percent and Tata Motors reduced production by 22 percent

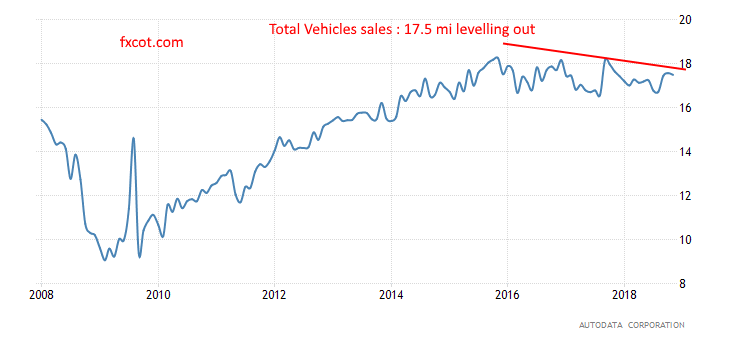

Car sales levelling out

In the US, the total vehicle sales have levelled out. Growth has petered out. Car sales is one of the most reliable indicators of a economy's strength. Higher mortgage rates and lower consumer sentiment is starting to take it toll.

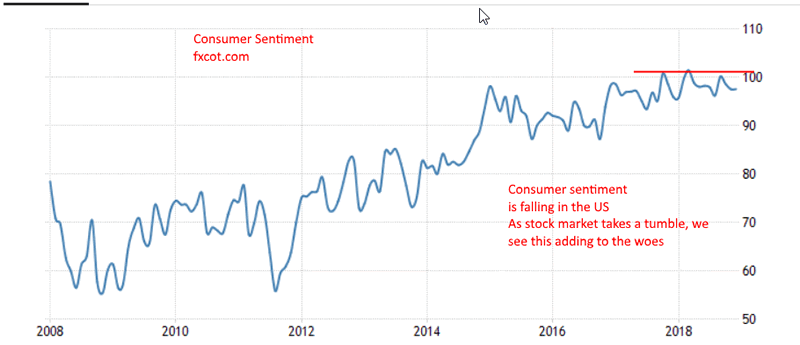

Consumer Sentiment

The sentiment is still in the high numbers. But things will get nervy once the consumer start to digest the falling stock prices. This together with high rates and stagnating wage growth will have an effect on future sentument reading. That will further kick the spending habits and trigger the vicious spiralling of lower spending and lower stock prices.

FXCOT Trade copier: In the midst of all uncertainty, the system is performing very well

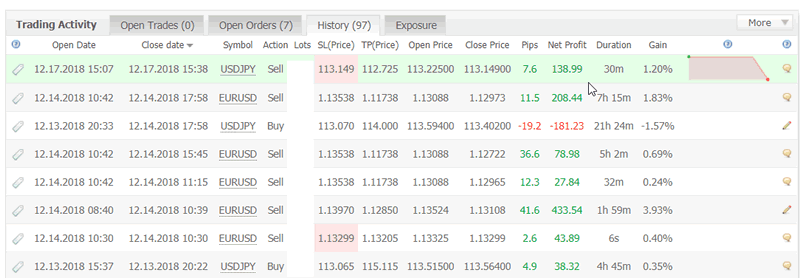

Last Few Trades

The history of trades can be seen. High quality trades which combine both scalping and volatility trades. December has see a pickup in volatlity so its very good news for trading.

Every year, it has been making over 20,000 pips a year. It has been more than doubling the capital at 1x exposure on a yearly basis. Basically a client is expected to more than double his money every 12 months easily without taking much risk. That is how a small account in 2010 hit 15.7 million in 2018. This is the only system that has the potential to generate a few millions from a few thousands.

That is the system history from 2010. Incredible powerful system through various market conditions. It has a high profit factor and high winning ratio. Over 28000 trades taken. Excellent performance year after year It has made over 100% every single year since 2010- 2018. The FXCOT system has made over 200100 pips between 2010 and 2018. The profit factor has been 2.1x with a sharpe ratio of 0.1. (Sharpe ratio of 0.1 is top decile for forex markets). The win rate at 82% is among the very best. Every trade has tight stops and has Trailing stops. Risk management is tight and inflexible. The FXCOT system is the very best in the world at the moment. It is designed for markets like the one we find ourselves in where pairs move one way and then the other way in quick succession. The system is active on EURUSD, USDJPY.

If a client starts with 20,000 $,if the system is as stable as before, it will end up making well over 15 million in profits in the next 8 years of operation. It is the most profitable system today active on the market. Nothing even comes close to this performance.

You can contact us for setting up

Teamcot

FXCOT is Investment Management firm specializing in futures and forex trading. We run a high return trading system for our premier clients. The trading systems uses four different strategies to take advantage of various market conditions. We also send daily trade setups and economic commentary.

© 2018 Copyright FXCOT - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.