The stock market fails to rally each day. What’s next for stocks

Stock-Markets / Stock Markets 2018 Dec 14, 2018 - 02:55 PM GMTBy: Troy_Bombardia

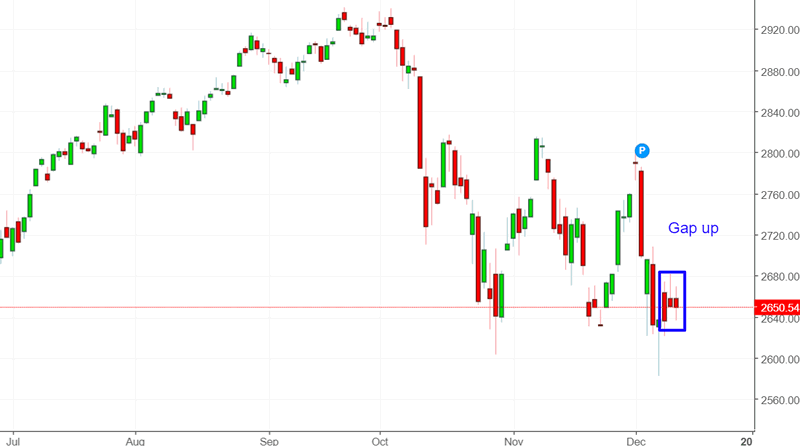

The U.S. stock market has been been gapping up on the open and selling off later in the day recently.

Go here to understand our fundamentals-driven long term outlook.

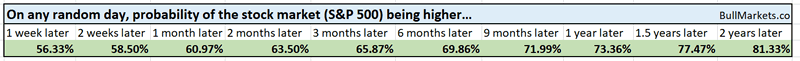

Let’s determine the stock market’s most probable medium term direction by objectively quantifying technical analysis. For reference, here’s the random probability of the U.S. stock market going up on any given day, week, or month.

*Probability ≠ certainty. Past performance ≠ future performance. But if you don’t use the past as a guide, you are walking blindly into the future.

Failed gap ups

The S&P has gapped up each morning on the OPEN, only to close lower.

Is this a bearish sign for the stock market? Is this a sign of “distribution selling”? (The permabears would have you believe that some “evil force” is purposely pushing the market higher before the open, only to unload stock to “dumb mom and pop” during the day.)

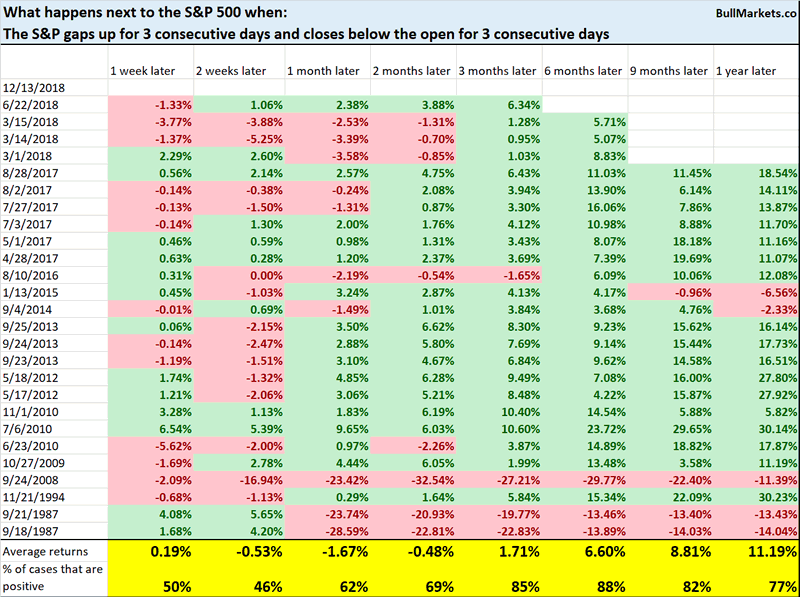

Here’s what happened next to the S&P 500 when it gapped up 3 days in a row, while each day’s CLOSE was below the OPEN.

*Data from 1962 – present

As you can see, the stock market does quite well 3-9 months later.

Remember: for every 100 conspiracy theories, 99 turn out to be false.

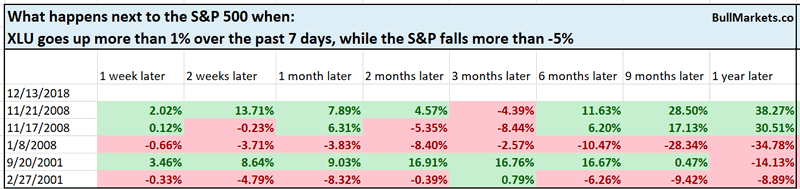

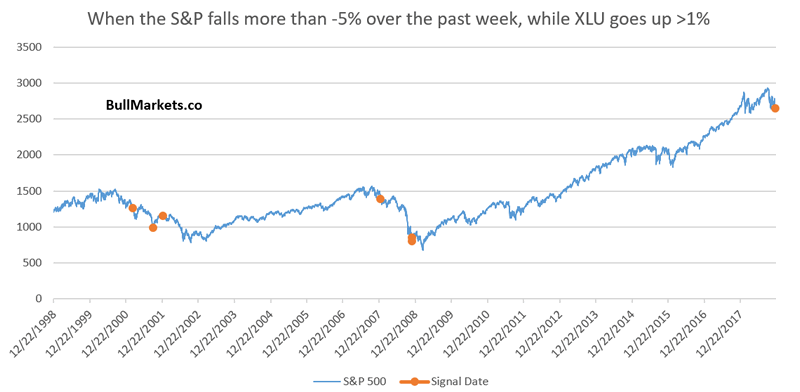

Defensive sector outperformance

One of the things that continues to worry me about the stock market’s current decline is XLU’s massive outperformance. It’s generally not a good idea to use 1 stock or 1 sector to predict the whole stock market, but this one is worth watching. XLU’s outperformance is quite extreme, which tends to happen towards the end of a bull market.

Over the past 7 days, XLU has gone up more than 1% while the S&P 500 has tanked more than -5%.

It’s common for XLU to outperform when the S&P goes down (i.e. XLU falls less than the S&P). However, it’s uncommon for XLU to go in a completely different direction from the S&P when the S&P goes down. That’s a long term warning sign.

Here’s what happened next to the S&P 500 when XLU went up more than 1% over the past 7 days while the S&P fell more than -5%.

*Data from 1998 – present

As you can see, the first time this happened was February 2001 and January 2008. The data is limited from 1998 – present, so take this long term bearish sign with a grain of salt.

AAII

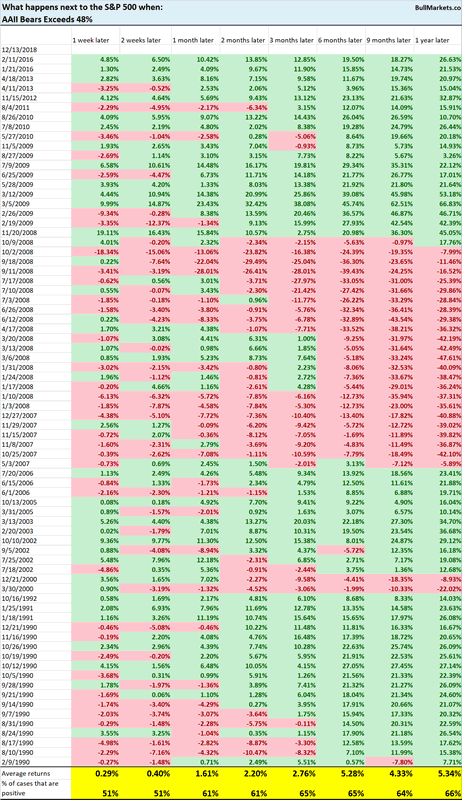

Investors have turned quite bearish on the stock market recently, prompting AAII Bears to exceed 48% (AAII is a sentiment survey).

Is this a bullish contrarian sign?

Here’s what happened next to the S&P 500 when AAII Bears Exceeds 48%.

As you can see, forward returns are no different from random on any time frame.

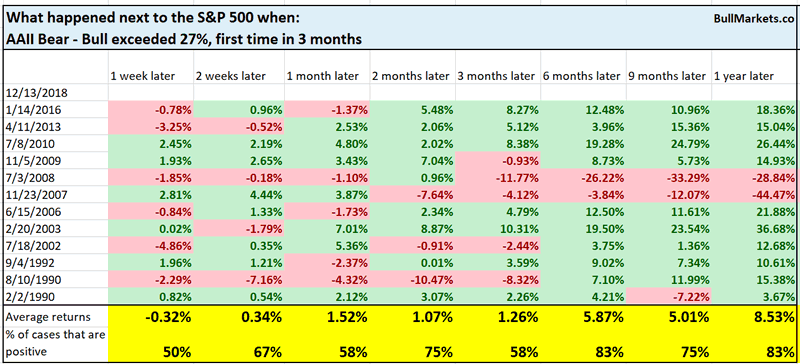

Here’s another way to look at the AAII sentiment survey.

Here’s what happened next to the S&P 500 when AAII Bear – Bull exceeded 27%.

In this case, there is a bullish lean 6 months later.

I generally don’t like sentiment surveys. They have just as many accurate signals as false signals. Sentiment will mark the bottom in a bull market, but sentiment is useless in a bear market. Extremely oversold becomes even more extremely oversold. And of course, you only know with 100% certainty that it’s a bull/bear market with 20/20 hindsight.

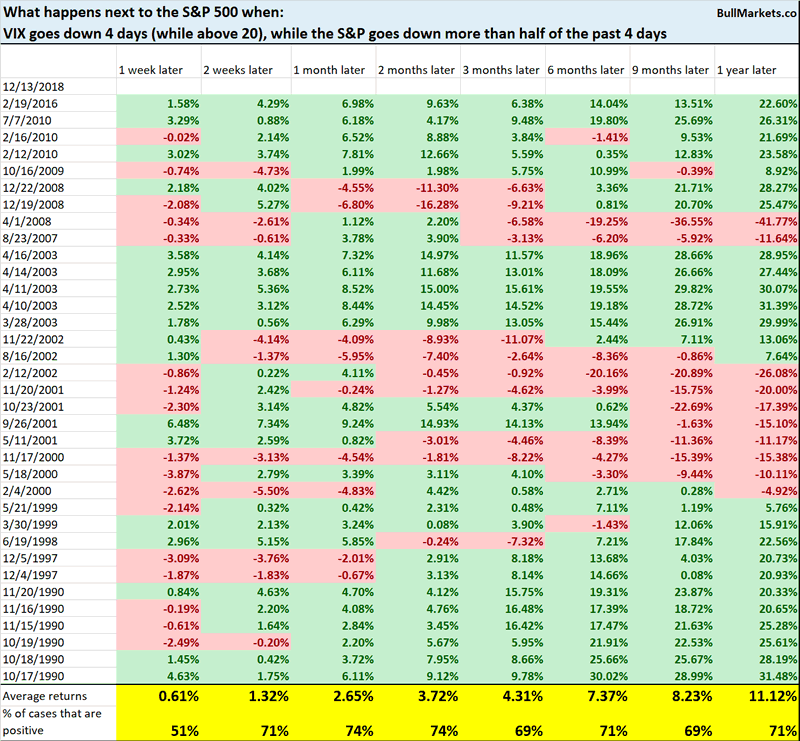

VIX signal

VIX has been going down over the past 4 days while the S&P has been mostly flat. Going into this study, I had the belief that this was a bullish sign for the stock market.

But our eyes are deceiving, and we see what we want to see when staring at charts (that’s how the human brain works).

Here’s what happened next to the S&P 500 when VIX went down 4 days in a row (while above 20), while the S&P went down more than half of those 4 days.

*Data from 1990 – present

Once again, this is not consistently bullish nor bearish on any time frame.

Click here for yesterday’s market studies

Conclusion

Here is our discretionary market outlook:

- For the first time since 2009, the U.S. stock market’s long term risk:reward is no longer bullish. This doesn’t necessarily mean that the bull market is over. We’re merely talking about long term risk:reward.

- The medium term direction is still bullish (i.e. trend for the next 6-9 months)

- The short term is a 50/50 bet

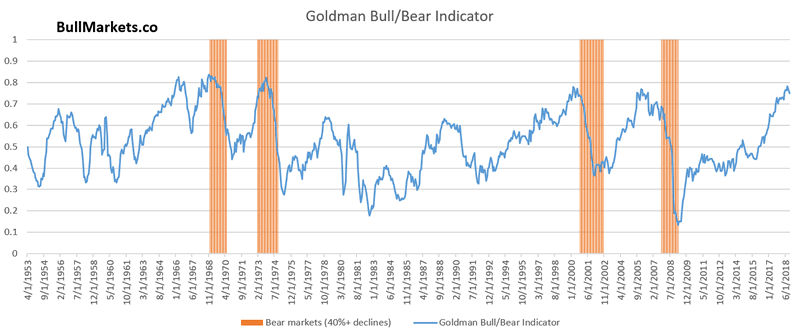

Goldman Sachs’ Bull/Bear Indicator demonstrates that while the bull market’s top isn’t necessarily in, risk:reward does favor long term bears.

Our discretionary outlook is not a reflection of how we’re trading the markets right now. We trade based on our clear, quantitative trading models, such as the Medium-Long Term Model.

Members can see exactly how we’re trading the U.S. stock market right now based on our trading models.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.