Dollar Index Trends, USDJPY Setting Up

Currencies / Forex Trading Dec 13, 2018 - 02:16 PM GMTBy: FXCOT

Risks and markets events continue to aid trading. Volatility is helping our trading system make tremendous returns. FXCOT system is able to use high volatility and low volatility to its advantage. Returns are summed at the end of post.

Risks and markets events continue to aid trading. Volatility is helping our trading system make tremendous returns. FXCOT system is able to use high volatility and low volatility to its advantage. Returns are summed at the end of post.

U.S. stocks rebounded Wednesday, extending a recent stretch of volatility as signs of easing trade tensions boosted the outlook for global economic growth. Afternoon trading was again rocky for major indexes, which eased well off their intraday highs in the final 90 minutes of the session. Stocks have been hypersensitive to trade-related headlines in recent days, with the Dow swinging more than 550 points from its high to its low on both Monday and Tuesday.

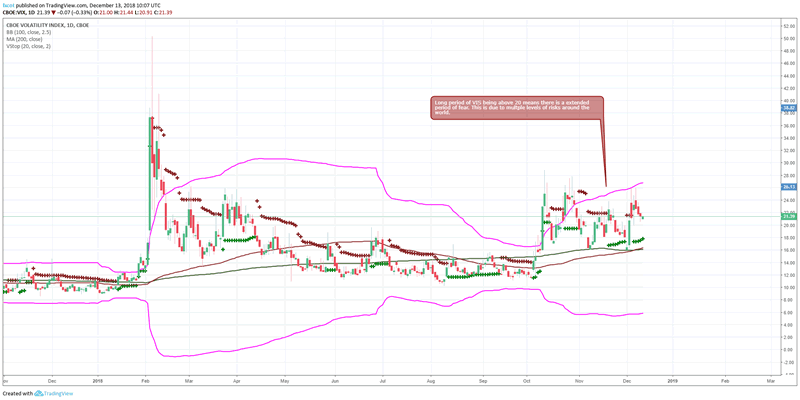

We look at key trading setups and trends. We continue to be bullish the dollar despite the trend being weakly bullish. Equity markets has been moving in long ranges but the fear index, VIX has stayed above the 20 levels , more than 4 weeks which is a new record in this bull run.

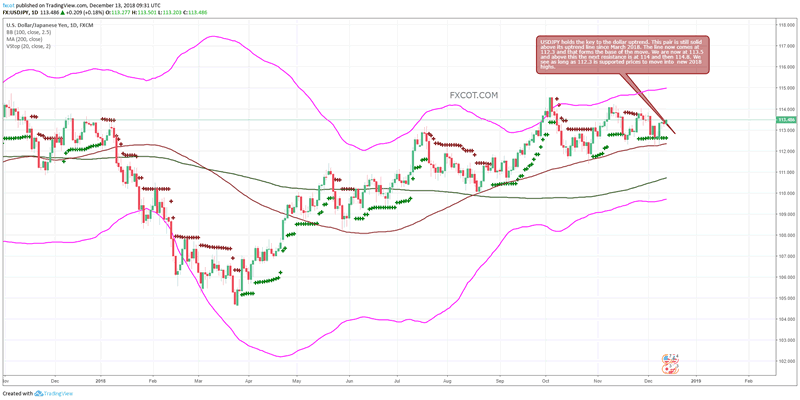

USDJPY Daily

USDJPY holds the key to the dollar uptrend. This pair is still solid above its uptrend line since March 2018. The line now comes at 112.3 and that forms the base of the move. We are now at 113.5 and above this the next resistance is at 114 and then 114.8. We see as long as 112.3 is supported prices to move into new 2018 highs.

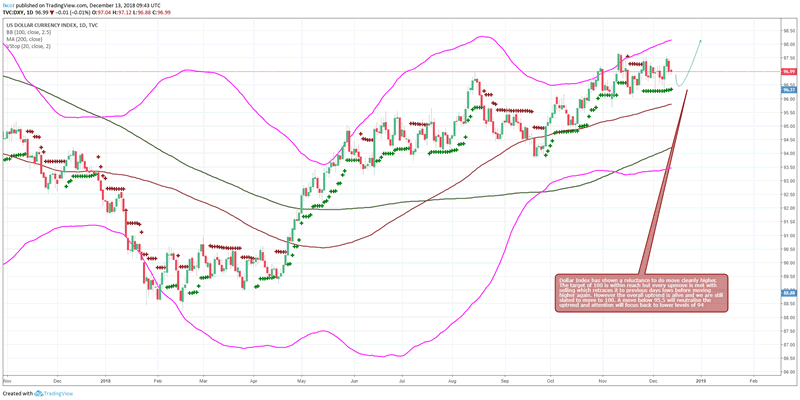

Dollar Index Daily

Dollar Index has shown a reluctance to do move cleanly higher. The target of 100 is within reach but every upmove is met with selling which retraces it to previous days lows before moving higher again. However the overall uptrend is alive and we are still slated to move to 100. A move below 95.5 will neutralise the uptrend and attention will focus back to lower levels of 94

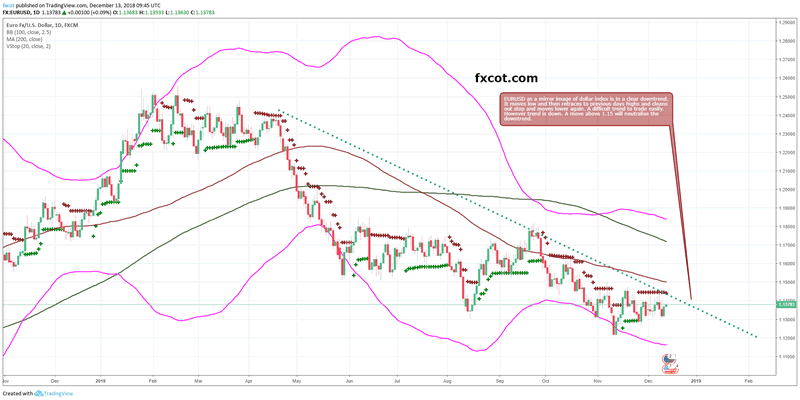

EURUSD Daily

EURUSD as a mirror image of dollar index is in a clear downtrend. It moves low and then retraces to previous days highs and cleans out stop and moves lower again. A difficult trend to trade easily. However trend is down. A move above 1.15 will neutralise the downtrend.

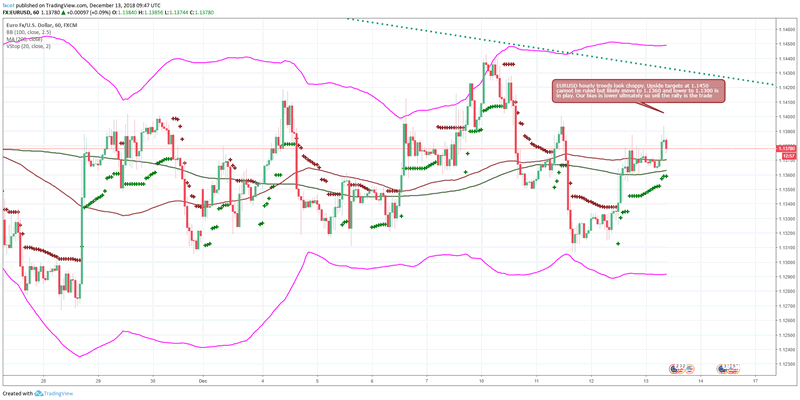

EURUSD hourly

EURUSD hourly trneds look choppy. Upside targets at 1.1450 cannot be ruled but likely move to 1.1360 and lower to 1.1300 is in play. Our bias is lower ultmately so sell the rally is the trade

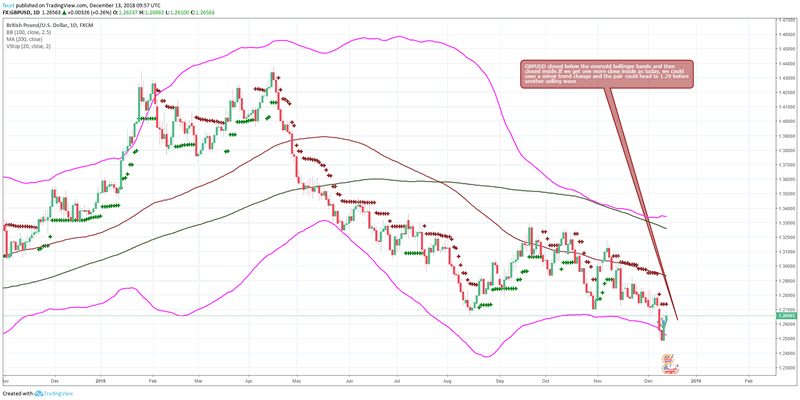

GBPUSD Daily

GBPUSD closed below the oversold bollinger bands and then closed inside.If we get one more close inside as today, we could ssee a minor trend change and the pair could head to 1.29 before another selling wave

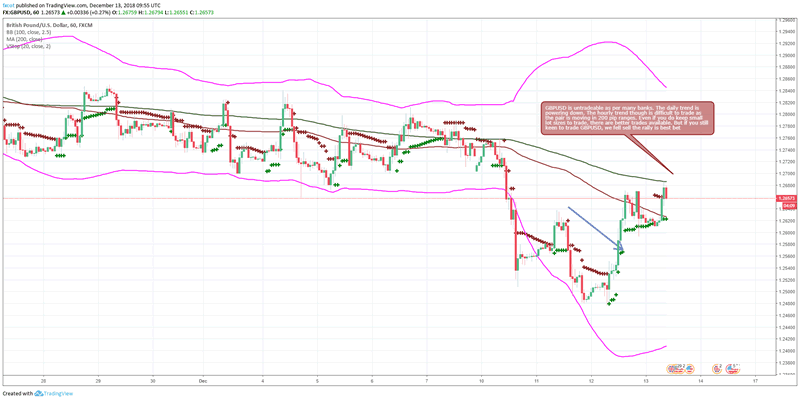

GBPUSD Hourly

GBPUSD is untradeable as per many banks. The daily trend is powering down. The hourly trend though is difficult to trade as the pair is moving in 200 pip ranges. Even if you do keep small lot sizes to trade, there are better trades available. But if you still keen to trade GBPUSD, we fell sell the rally is best bet

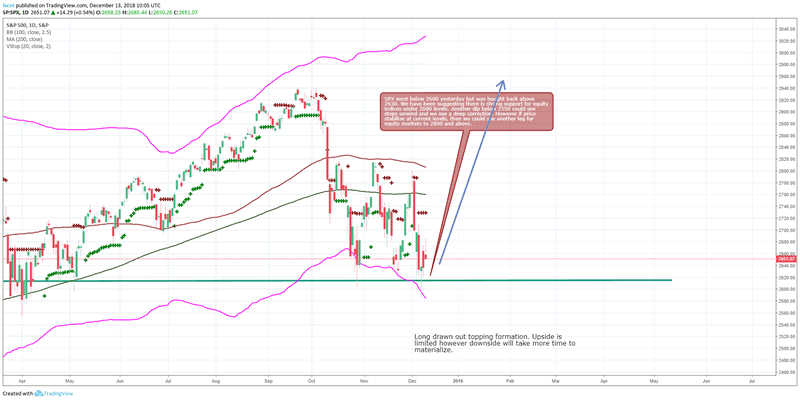

Equity Markets

Our view has been consistently that Equity markets are not ready to crash or correct significantly below 2550. We could potentially see some mild moves to 2750 into year end. But any attempts to break 2500 will mean tremendous selling pressure and could lead to potential flash crash to 2300 as well. So the whole upside move is hinging on support at 2550.

Long period of VIX being above 20 means there is a extended period of fear. This is due to multple levels of risks around the world. EU is getting caught up in protests and there is likelihood this will spread. The french PM has been made to cower down to protesters. UK is struggling with Brexit. China continues to slowdown and is in an active trade war with US. US on the other hand has seen peak growth and its downhill starting April 2019. Therefore the fear index has been at elevated levels. But there is comfort in that it has not moved into a runaway move to 30 35 which are levels at which SPX will break 2500 as flagged above.

TradeCopier performace Our trade copier is performing excellent. It made +19.5% for clients in November. As you know, it is unique in the way it works. Read about it here: Trading Strategy and Membership

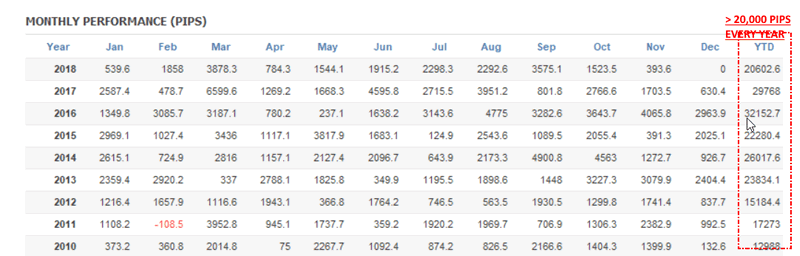

The system has made 15.75 million AUD from 2010-2018 starting at a small 20,000 account. The most profitable system ever created and available on internet. If you are trading forex, then this system has to be on your account. No system has made money as this one. To top it all, it is absolutely free to trade on your account. Contact Us

Teamcot

FXCOT is Investment Management firm specializing in futures and forex trading. We run a high return trading system for our premier clients. The trading systems uses four different strategies to take advantage of various market conditions. We also send daily trade setups and economic commentary.

© 2018 Copyright FXCOT - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.