Trading Charts and Setups: Chances of a FED Interest Rate Hike Falling

Stock-Markets / Financial Markets 2018 Nov 26, 2018 - 05:16 PM GMTBy: FXCOT

As equity markets make a topping formation and US 10 year yield retest 3% level, the chances of a FED hike in 2019 is declining. Govt pressure will build up on Powell into 2019 and we believe this will damage FED ability to freely raise rates even if they wish to. We highlight a few key charts and setups to watch out for as you start a new trading week.

As equity markets make a topping formation and US 10 year yield retest 3% level, the chances of a FED hike in 2019 is declining. Govt pressure will build up on Powell into 2019 and we believe this will damage FED ability to freely raise rates even if they wish to. We highlight a few key charts and setups to watch out for as you start a new trading week.

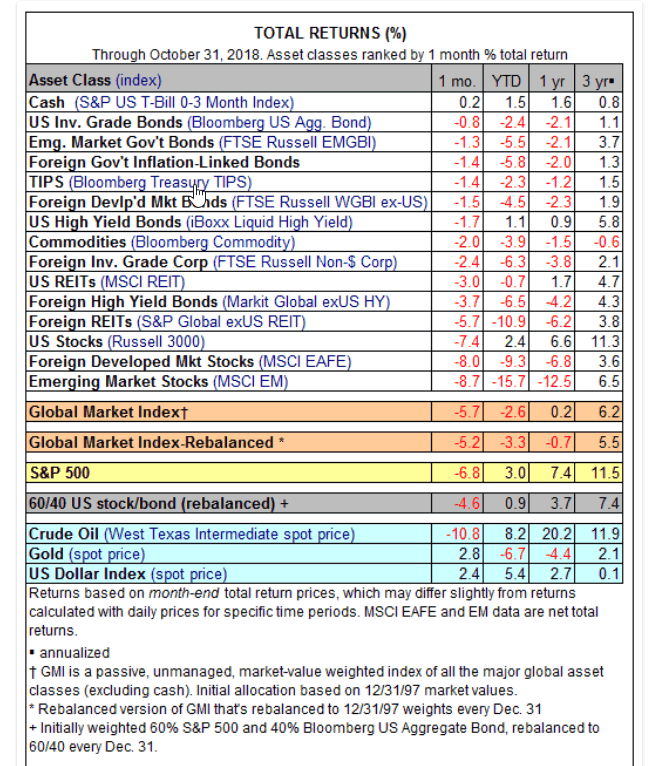

2018 has been a difficult years for every single asset class. The mutual fund industry is bleeding and hedge fund managers are struggling to stay afloat. Traditional investment models do not work any more. This is a year in which both bonds and stocks fell together. Traditional models work on shifting money from one asset class to another. However this year, all classes bled. This year, set apart the genius managers from the ordinary. Fxcot trading system which is primarily a EURUSD, USDJPY trading system has made over 90% this year which is truly incredible given the performance of hedge funds.

As you can observe, everything lost money on a YTD basis. However Fxcot trading system made over 90% return. If you want to know more or take a trial of our systems, please send us a email at teamcot@fxcot.com or reach out to us at our site.

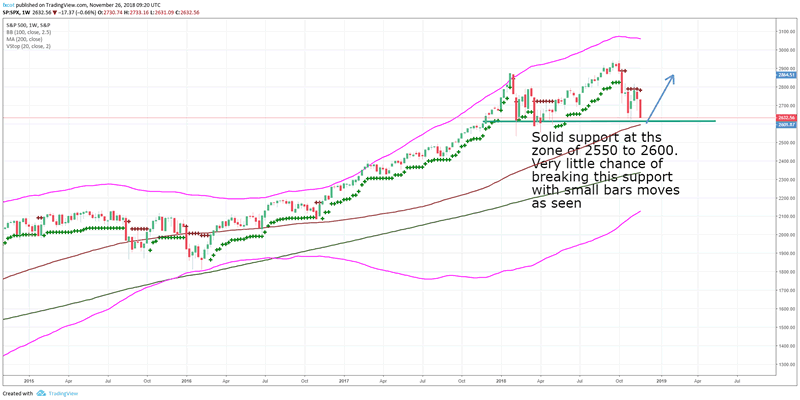

Equity: Choppiness ahead

The SPX is looking increasingly likely to form a base at 2600. It is a are of solid support. Expect range based moves between 2550 and 2950 over the next 6 months. Economy is doing just ok while FED scales back expectation of any agressive hikes into 2019. Equity markets will slowly form a top over the next few months before the correction begins in 2019 somwhere near March/April.

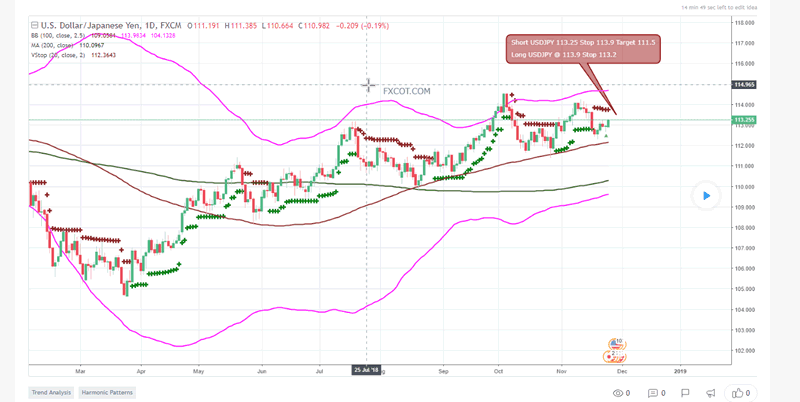

USDJPY: Looks a two way trade

USDJPY is going to react to the falling US yields at some point. We suspect that the next move in USDJPY could be down. However a move above 113.7 will neutralise our downward bias and we will be looking to long at 113.9.

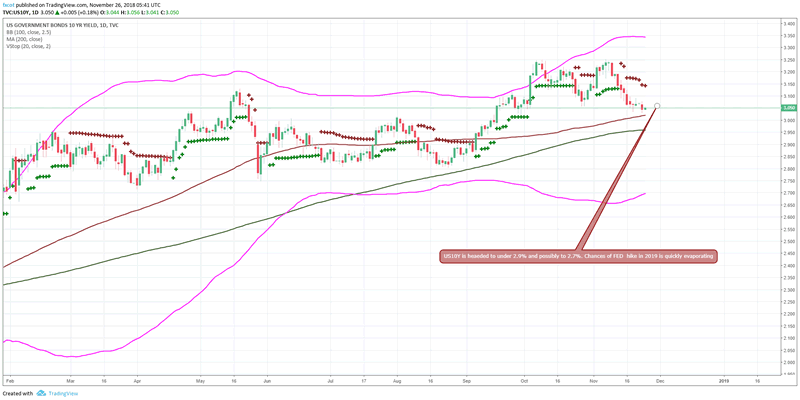

US 10 year yield: Is it a trend change ?

The US 10 year yield has contracted from 3.15% to 3.050%. This is reflecting

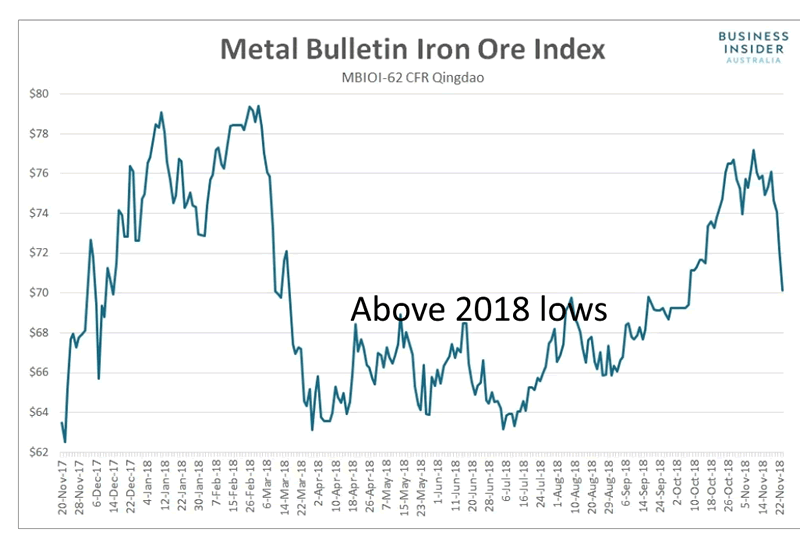

Iron Ore: Not as negative as it sounds

According to Metal Bulletin, the price for benchmark 62% fines slumped 2.8% to $70.13 a tonne, leaving it at the lowest level since October 8. It’s now lost 9.2% since November 9, including 6.1% in the past three sessions alone. However they are well above the 2018 lows seen in low 60s. So while the dollar had rallied above 97, Iron ore continued to be above the lows. Good buying despite the recent falls. Once dollar starts to weaken, Iron ore could pickup fairly sharply to 80$.

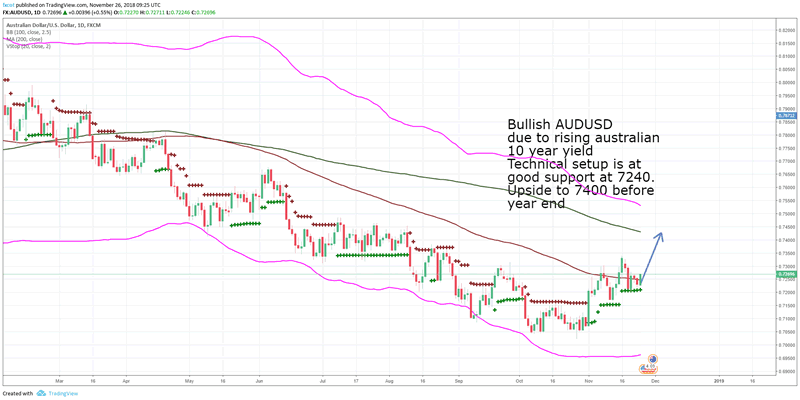

AUDUSD is above 50 DMA suggesting a trend change in its downward direction. We see a confirmation of our thesis that AUDUSD will move to equilibrium to 7400.

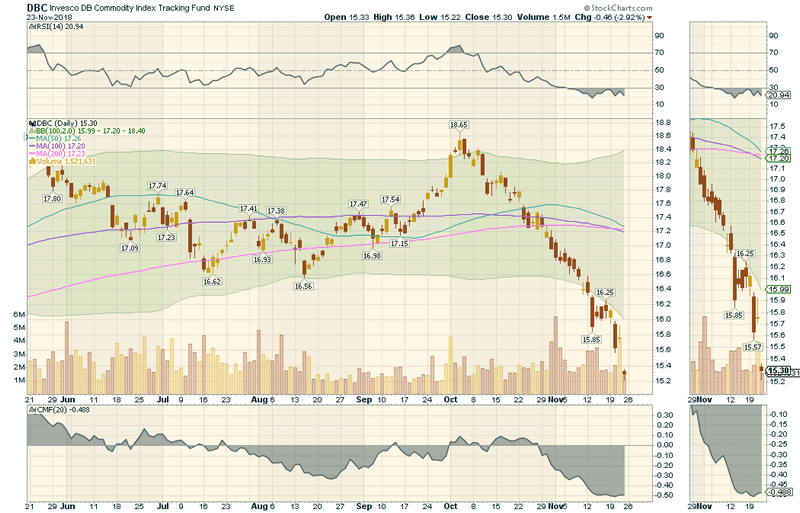

However the DBC which is the commodity tracking fund is own to 2018 lows. It tells us that it is oversold and hence a bounce is expected. That will help commodities to rise.

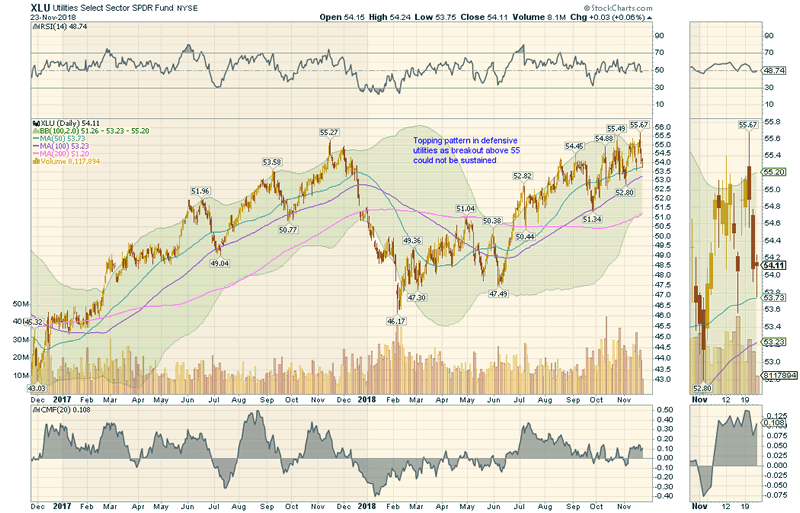

The XLU is the defensive ETF

and is driven by utilities. Smart Money often moves into this ETF before market correction. As things stand now, we see XLU weakening after breaking above to new highs and then dipping below. We see a period of choppy action in XLU into year end. This suggests that equity markets generally will not see any deep correction and will recover starting 2019.

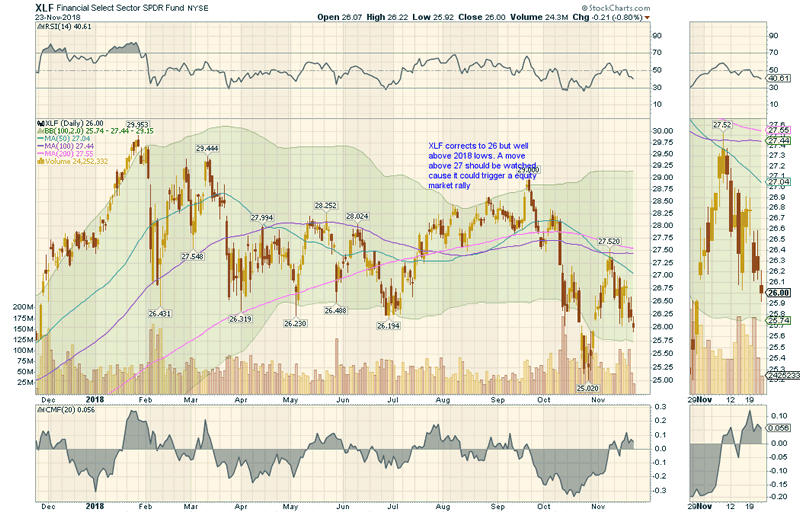

The financial ETF which preruns a broader equity rally, is consolidating at 26. There was a dip to 25 but then a recovery suggesting that the downward momentum has been broken. However only above the strong resistance at 27-28 can we confirm that the current downtrend is fully over.Watch those levels.

Fxcot.com is a trading and investment management firm, so our advice is more tuned to help you position for investing. We run one of the best forex trading programs making over 100% return every single year since 2010. If you are interested, please fill the form here: Contact us. You can simply email us at teamcot@fxcot.com.

Our trading system is explained here: FXCOT Trading system

Teamcot

FXCOT is Investment Management firm specializing in futures and forex trading. We run a high return trading system for our premier clients. The trading systems uses four different strategies to take advantage of various market conditions. We also send daily trade setups and economic commentary.

© 2018 Copyright FXCOT - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.