OECD Recommends Potential Major US National Debt Increases: The Impact On Retirement

/ US Debt Nov 23, 2018 - 05:24 PM GMTBy: Dan_Amerman

The Organization For Economic Cooperation and Development (OECD) is urging the nations of the world to be prepared for and have a coordinated plan to simultaneously engage in major "fiscal stimulus" in the event of a downturn in the global economy.

The Organization For Economic Cooperation and Development (OECD) is urging the nations of the world to be prepared for and have a coordinated plan to simultaneously engage in major "fiscal stimulus" in the event of a downturn in the global economy.

"Fiscal stimulus" is how economists refer to a government substantially increasing spending, while holding taxes constant or even reducing them. By pouring more money into the economy, while not taking more money out (or taking even less money out), the theory is that the economy and employment will get a large and positive jolt, and that this jolt will hopefully create sustainable economic and employment growth rates that persist after the stimulus is gone.

In other words - the OECD is urging the aging and heavily indebted major economic powers of the world, to be prepared to act in concert to simultaneously and rapidly borrow more money to pay for the fiscal stimulus, and thereby rapidly increase their national debts (and ongoing budget burdens in paying for those debts thereafter).

This premise of this analysis is that what is "in play" with such recommendations is not just the abstractions of international economics, but properly understood, this is the sort of reality-based information that should potentially have a quite direct impact on individual decisions for long term investment strategies, as well as retirement planning.

This analysis is part of a series of related analyses, an overview of the rest of the series is linked here.

The Recommendation

As covered in a recent Wall Street Journal article titled "With Central Banks Out of Ammo, Governments Urged To Ready Stimulus for Next Downturn" (11/21/18, link here), the OECD is urging the governments of the world to prepare big and coordinated spending plans.

"Governments around the world must prepare spending plans they can roll out quickly and in concert should the global economy slow sharply, given that central banks have largely run out of ammunition to fight a slowdown, the Organization for Economic Cooperation and Development said."

The reason for this recommendation is that the central banks of the world have not yet recovered from the last crisis, and they are currently "out of ammo" to fight another economic slowdown or recession.

"Central banks did most of the heavy lifting in steering the global economy out of the sharp slowdown that accompanied the financial crisis. But they are largely out of ammunition, the OECD said. Policy interest rates are already negative across much of Europe and Japan..."

"With central banks sidelined, it would be down to other parts of governments to provide the stimulus needed to support growth in a future crisis."

Now, Laurence Boone, who is the chief economist for the OECD, was clear that they still officially expect a "soft landing", even though they have reduced their forecasts for global growth in the next few years. (The OECD is also forecasting real economic growth for the U.S. slowing to 2.7% in 2019, and 2.1% in 2020.)

However, the OECD sees interlinked dangers from tariff wars, trade barriers, further deteriorations in emerging market economies and higher oil prices that could pose an imminent threat to the global economy. And they are therefore recommending that the nations of the world act immediately to develop coordinated spending plans so they can take quick stimulus actions in concert if and when needed.

Stacking Debt On Top Of Debt

Keeping in mind that "stimulus" by definition means major deficit spending which means major increases in the national debt - the OECD's recommendation might seem more than a bit surreal to many people.

The United States is already more than $21 trillion in debt. Near term annual deficits are already estimated to be in the $1+ trillion range. Those annual deficits are already projected to sharply increase into the $2+ trillion range as aging Boomers increasingly claim their promised Social Security and Medicare benefits.

And over and above all of that, the OECD is urging that the United States and other member nations immediately set up contingency plans to quickly spend still more trillions upon trillions of dollars, and ramp up the national debts that much faster still.

The United States is not alone. Japan already has a national debt that is in excess of 230% of its GDP. And yet, the OECD is recommending that Japan be prepared to rapidly increase spending without increasing taxation - and thereby rapidly drive up their national debt as well.

From a common sense perspective, such recommendations might seem absurd. Why would a nation in normal circumstances even consider such actions?

The answer is that a nation in normal circumstances would not - but neither the United States or much of the rest of the world is currently in "normal circumstances". Interest rates are still far below average in the United States, as a direct result of the last cycle of the containment of crisis. If a new cycle of crisis leads to a new cycle of the containment of crisis, attempting to limit the damage while rebooting the economy is likely to require drastic measures. This is even more true for Europe and Japan.

Retirement Security & The Ongoing Costs Of The Last Stimulus

So what does any of this have to do with retirement planning?

Some people might say "everything", and other people might say "nothing".

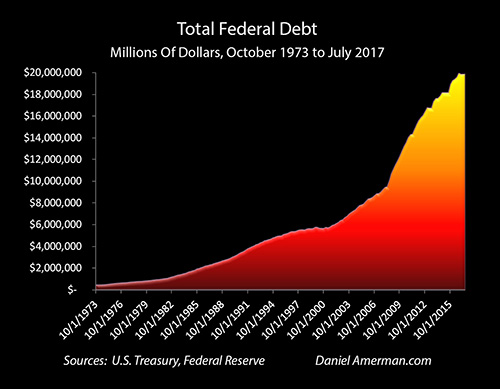

A potentially useful perspective for practically answering that question can be seen in the graph below, which shows that we already just "did this." In the attempt to contain the damage from the 2008 Financial Crisis, the United States did use fiscal stimulus policies, which did produce enormous deficits and enormous borrowing, and did rapidly double its national debt in the space of few years.

If we look around us, the cost of those few years of stimulus is still very much with us today, and is likely to be with us for many years and decades to come.

The government is likely to only have so much money at any given point now or in the future, all else being equal. So major increases in national debt levels have the potential to lead to major conflicts of interest, with some of those conflicts of interest being with retirees and retirement investors.

One example is that if that if the national debt soars, then (all else being equal) interest payments on the national debt soar as well. Which means that that much less money is then available for paying for normal government services, or defense and national security - or Social Security and Medicare.

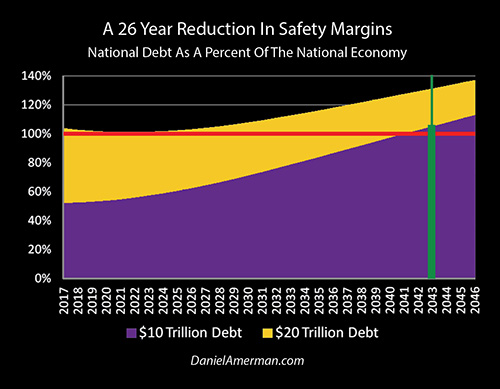

The graph above (detailed analysis link here) shows the projected national debt as a percent of GDP (per underlying CBO assumptions) under two scenarios. The gold scenario is the world as it is, with the national debt having rapidly doubled due to stimulus spending in the attempt to contain the financial crisis of 2008.

The purple scenario shows the world as it could have been, if the enormous previous stimulus spending had not occurred, and if the national debt were half what it is.

Huge annual deficits are projected for the future, if we look at the discrepancies between expected payroll taxes and expected Social Security and Medicare payments. What the purple area shows is what happens if every dollar of those promises were to be paid in full - with the shortfalls not being made up with tax increases, but simply borrowing every dollar of it.

The interesting part is that if the debt had not been doubled to pay for stimulus payments, and the borrowing power had been used instead to cover Social Security and Medicare deficits in full, then that same borrowing power could have covered every dollar of benefit payments in full through 2043, with no reductions in benefits or increases in taxes, and with the nation nonetheless being in continually better financial shape for that entire time than it is today.

So, rephrased, the borrowing power did exist to make Social Security and Medicare payments in full for life for the great majority of current retirees, as well as the substantial majority of most Boomers who have yet to retire - but that particular borrowing power is no longer there because it was used up instead for stimulus spending.

Now, the government at that time was of course very, very careful to never say "oh by the way, this throwing money at the economy as fast as we can will be taken out of your retirement benefits in 20 or 30 years". Even as the current government is careful not to present higher deficits today being potentially paid for by lower benefit payments in the future.

But that said, using up borrowing power is not a difficult concept, even if governments using deficit spending don't like to talk about it. A young person running up the credit card to buy clothes this week, means that the borrowing power isn't there to go to take the beach vacation next year. Run up the national debt to pay for stimulus spending now, and the same borrowing power is not available to use to pay retirement benefits in full in the future.

(None of these comparisons are meant to endorse the idea of running up debts for current spending, which is generally a really bad idea for both governments and individuals. But reality is what it is, and this is a useful way of looking at the real costs and tradeoffs for individuals when it comes to what is usually the abstraction of government deficit spending.

The other obvious issues that go well beyond the scope of this particular analysis relate to whether the previous or potential future rounds of stimulus were or will be "successful" or not. How long would the recessions last absent fiscal stimulus, and what would GDP be without stimulus spending?)

Economic Theory Can Have Life Changing Implications For All

The past is the past, and the reason for this review is not to revisit the past - but to consider the quite real world effects of a government following the recommendation of the OECD, and potentially running up the national debt in the future. This may seem an abstraction to many people - but the individual impacts can be very real and even life changing.

According to the OECD - the world may effectively be stuck between a rock and a hard place. There are rising risks - not certainty, but rising risks - that a global slowdown could hit. If another cycle of recession and potential crisis hits, then in the OECD's opinion the global central banks simply don't have the ammunition to attempt to contain the crisis in the same way as they did the last time. This is because they never have recovered, the balance sheets are already expanded, and negative interest rates still prevail in the Eurozone and Japan.

So, the OECD's thinking is that if monetary policy is mostly unavailable, that leaves fiscal policy to reboot economic growth, and that necessitates a rapid return to stimulus spending, which requires running up the deficits and sending national debts soaring upwards again around the world.

This may seem like a quite twisted logic - but it also contains critically important investment information. Individuals all too often think in terms of either bad things happen or they don't, and either there is a crisis or there is not. International organizations and governments move right ahead to cycles of crisis and the containment of crisis.

The economists involved don't stop at considering a possible future downturn or recession - but go straight to how to get out of that crisis. And, as I have been exploring, that process can often involve turning the investment world upside down, which can then create a cyclical sequence of major losses and profits in all the major investment categories in a non-random manner.

Because the central banks still haven't recovered the ammunition used in containing the last crisis, a different approach may be required in the event of another crisis, and the best option the OECD sees for the globe in general when it comes to another cycle of the containment of crisis is to have a detailed and concerted plan for spending - that will as an unavoidable side effect, send those national debts leaping upwards.

If that happens, and the U.S. were to follow the OECD's advice and a second major stimulus round were to begin less than ten years after the last round ended - then yes, the resulting increases in the national debt could indeed have numerous and powerful effects on retirement investments and on retirement planning.

Realistic Possibilities & Prudent Retirement Planning

There is an easy sort of categorization that many people do when it comes to subjects such as the one covered in this analysis. That categorization involves putting it in a slot such as "negative / pessimism / gloom & doom thinking", and to either embrace it as such, or to discount it and ignore it as such.

There is a different approach, and that is say that this is reality, this is the reality of how the world actually is at this point in time, and factors like this may very well turn out to be a governing reality when it comes to how our future retirements work in practice.

With the corollary being that if it is reasonable for a prudent person to believe that there is a respectable chance that this or something related to it could be our future reality, and we choose to completely ignore it because we just don't like it - then necessarily, we have introduced elements of fantasy and wishful thinking into the very heart of our retirement planning process. And this is true no matter how eminently respectable or widespread the retirement planning approach is which completely discounts such factors.

None of this to say that recession is inevitable within the next year or two, or that some sort of financial armageddon will necessarily occur in the near future. That is going too far the other direction. There is a vast, vast gap between completely ignoring the current still financially troubled state of the world, and going all the way to gloom, doom, retreating into a financial bunker and closing the door. And let me suggest the chances are very good that the reality of what is to be will fall somewhere in that vast gap.

The OECD is far from all-knowing - but they are in the top tier when it comes to international economic organizations. So, when the OECD has just urgently warned its member states of the need to prepare coordinated plans to massively boost their respective national debts (as a necessary part of financial stimulus) in the event of a global economic downturn - that does meet the test of being materially important information that a reasonable and prudent person should at least be aware of and take into account as a possibility when evaluating their individual retirement and other financial planning.

One very practical implication is that savers should be prepared for the possibility of even lower interest rates into the indefinite future. Higher national debts mean a much greater conflict of interest between heavily indebted nations needing very low interest rates, and retirees hoping to live off of their interest earnings.

Another very practical implication is that those planning for retirement should consider increasing their "discount rate" when it comes to evaluating the likely true value of payments from such government retirement programs as Social Security and Medicare in future years and decades. Higher national debts create another form of conflict of interest, which is the ability to service those much higher debts while still paying retirement promises in full.

A third very practical consideration is that the OECD believes that the chances are rising that the nations of the world will be going through another cycle of crisis and the containment of crisis, and they feel so strongly about it that they are urgently warning their member governments to be prepared. As discussed in the analysis linked here, that means investors should also be prepared for another cyclical sequence of rapid price movements for stocks, bonds, home prices, REITS and precious metals, that could involve some of the largest cyclical profits and losses that we have seen to date.

To take the already staggering national debts of the United States and other nations, and to consider deliberately rapidly adding still more trillions on top of that, might seem like a highly unlikely nightmare scenario. But yet - making detailed plans for exactly that scenario is what the OECD is now recommending for its member nations.

Hopefully this scenario will not come to pass. However, if the chances are increasing, then making realistic retirement plans requires being at least aware of that rising possibility, why the possibility exists, and to be thinking through the potential personal implications before it is too late to do anything about them.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2018 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.