US Stocks: Whither from Here?

Stock-Markets / Stock Markets 2018 Nov 14, 2018 - 03:25 PM GMTBy: The_Gold_Report

Sector expert Michael Ballanger muses on the forces at play on the markets and precious metals, and also mentions uranium. Back in the 1960s, from time to time, many of my elementary school classmates would have great difficulty paying attention to the teacher. It would usually take the form of doodling with a pencil, drawing prepubescent renditions of monsters or hot rods or animals. The polite term for such distraction was the "inability to stay on task." The remedy for failing to show the appropriate focus on the teacher was either a) a scolding, b) ridicule (sometimes the worst if a particularly cute girl was present), or c) a sharp crack on the knuckles with a yardstick, because in the 1960s, classrooms commanded order where corporal punishment was not only accepted, it was promoted.

Sector expert Michael Ballanger muses on the forces at play on the markets and precious metals, and also mentions uranium. Back in the 1960s, from time to time, many of my elementary school classmates would have great difficulty paying attention to the teacher. It would usually take the form of doodling with a pencil, drawing prepubescent renditions of monsters or hot rods or animals. The polite term for such distraction was the "inability to stay on task." The remedy for failing to show the appropriate focus on the teacher was either a) a scolding, b) ridicule (sometimes the worst if a particularly cute girl was present), or c) a sharp crack on the knuckles with a yardstick, because in the 1960s, classrooms commanded order where corporal punishment was not only accepted, it was promoted.

Baby boomers, who love to reminisce about the "gold ol' days," think fondly of elementary school and can readily recall which teacher was a nightmare with the strap or the yardstick or the back of his (or her) hand. I assure you that not one Boomer ever suffered any sort of long-lasting trauma, either physical or psychological, over being punished for acting out in class. For that reason, bad behavior was rare in classes where Edwardian punishment was common and there was no such thing as "attention deficit hyperactivity disorder," because the antidote wasn't Ritalin or Adderal of Focalin. It was a non-chemical preventative called pain and/or embarrassment. And there were no "safe places" or support groups for the guilty party.

So when I look at the last week of trading, I am forced to simply shake my head in disbelief and acknowledge the existence of some rare form of memory-sapping disease that has been spread like the Ebola virus around the trading desks of every firm on the Street. It was only ten days ago that the 2-and-20 world was coming to an end, but a bunch of Xbox junkies representing the first generation in history who prefer a telephone to a widescreen, theater-sound room for personal entertainment, is now incapable of remembering exactly why they were soiling their undergarments during the final days of October. They are leveraging to the absolute max to make this rally a "life-changing event," and you know what? They just might, albeit for the wrong reasons, get an oh-so deleterious outcome.

I was part of the "security staff" in 1975 when Led Zeppelin played the old Saint Louis arena, and I vividly recall the moments when the lights went down and a massive deluge of kids rushed the stage. We had set up a barrier line, but Zeppelin was so incredibly popular with stoners that we had to stand at the barrier actually "catching" these 90-pound hippies, so intent upon being inches from Robert Plant's blue jeans, and literally throw them back into the crowd. It's a defining moment in a young athlete's life when your high school rock-and-roll heroes are now at the mercy of a crowd of whacked-out teenagers and you are suddenly on the side of "darkness" as opposed to the "Forces of Good."

Well, after the brief (but terrifying) skirmish ended with the first chords of Jimmy Page's bone-rattling rendition of "Heartbreaker," life returned to normal and the music plus the mass medication put the crowd back into "mellow mode," and back I went to the front of the stage, arms crossed and scowling fiercely so as to keep the zoned-out hipsters at bay. Today's market participants remind me of that crowd back in '75, with Fed speeches and interventions taking the place of recreational medication and smuggled-in booze.

Here is another comparison. In the 70s and 80s, it took months to turn sentiment; today it takes a couple of well-planned Fed member orations and a few tweets from DJT to turn the prevailing sentiment from bearish to bullish, such that there is a new meaning to the word "prevailing." How about "fleeting sentiment" or "temporary sentiment" or "subject to drug-induced paranoia sentiment?"

The current market environment is analogous to the final flailings of a beheaded chicken—furious, directionless movements until it collapses from its own lack of neural leadership. The kids manning the trading desks think that "all is well" because the S&P reclaimed the 200-daily moving average (dma), while I contend that this very hungry bear knows he is going to be feasting on a great many unsuspecting millennial carcasses in the next few months. What better way to ensure a feeding pool than by encircling a larger population of prey through the installation of false confidence during these desperation-fueled rallies?

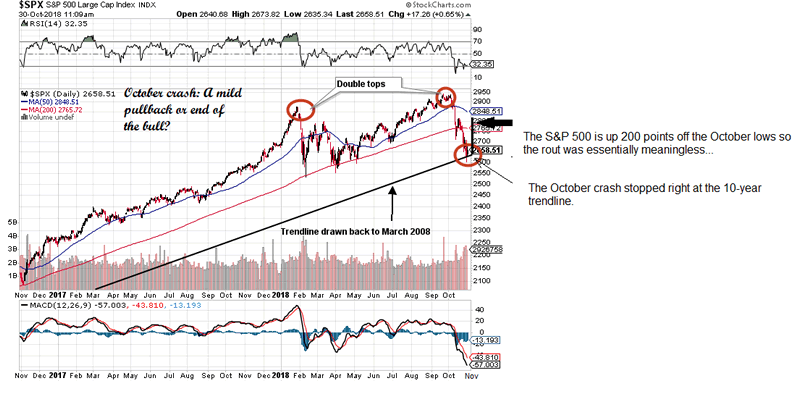

On Oct. 30, I constructed a missive entitled October's Rout Was Meaningless, posted a chart of the S&P500 dating back to 2009 and submitted that the October correction was finished at the precise point where the October decline hit the ten-year trendline drawn off the March 2009 low. Sure enough, we are now up 200 S&P points and about 2,100 Dow points from the lows, as underperforming managed money implements its desperate "carpe diem" and buys up all of the momentum names in an effort to save years (and bonuses) from disaster.

I have elected to raise cash into the rally and then try to determine whether there are enough animal spirits and irrational overexuberance to drive the indices back to the summer highs, which I think is entirely possible but by no means probable. As we all learn from our mentors, legendary traders have always confessed that the most money they made was never anticipatingthe top but rather exploitingthe top, once it was in. While I think that the double tops shown below are now cementedand in place, we are still a long way off the 2018 high of 2,940 for the S&P 500. The great challenge for me will be trying to short this garbage as close to the 50-dma as possible without the chance of a whipsaw on a spike to 2,945 in early January, as the final sputter of the tank-empty engine resigns itself to a long winter's nap.

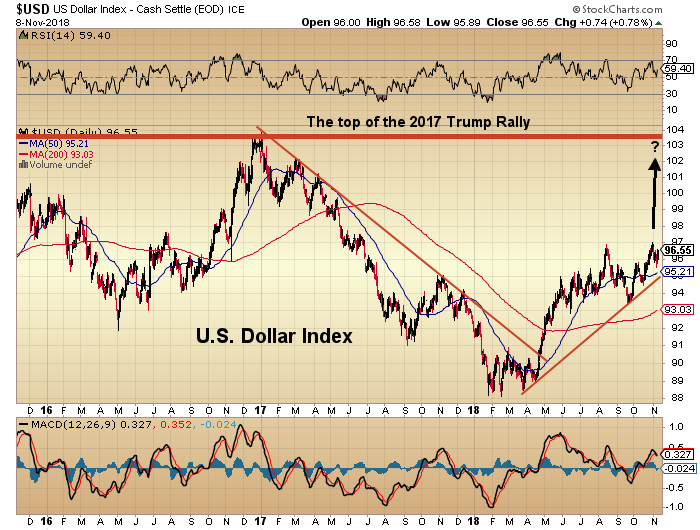

Another thing that is annoying, verging upon maddening, is the inability of the precious metals (PMs) to break their bondage to the U.S. dollar. We had four brief spikes in gold on Oct. 2, 11, 15 and the 23, and the last one on Nov. 1 but there is never any follow-through and as such, the PMs remain range-bound, with $1,210-1,220 as support and $1,235-1,240 as resistance. Once again, Fed policy and member jawboning are contributing to the malaise in the metals, because the algobots have glommed on to the notion that interest rates are going to continue higher for the balance of the year. Since the rest of the world is dead set against the mere mention of the term "quantitative tightening" (sounds like a cosmetic surgery of sorts, no?), fixed income investors are swarming in droves into the U.S. 10-year treasury at the recent 3.24% yield because it is sharply more generous than comparable Eurozone or Asian bonds of similar duration andthey get the bump in the currency.

The problem with chasing the 10-year is that once the stock market reasserts its new primary trend to the downside, the negative asymmetrical "wealth effect" of declining asset prices is going to start showing up in the economic numbers, resulting in a sudden and sharp policy reversal—i.e., rates stop going up. When that happens, the yield advantage will be yanked out from under their feet and the ensuing currency crash will wipe out the "edge" afforded by higher yields.

As always, timing these policy reversals isn't just difficult; it is impossible. But if I am right in my strategy, all risk assets including stocks, base metals and gold/silver will have a violent upside reaction once the Fed blinks. DJT will leave Chairman Powell be for the moment because his beloved legacy benchmark (the stock market) is enjoying a wonderful relief rally and he feels rather cocky, so the widely anticipated December rate increase is probable assuming this stock rally lengthens out to a year-end rally. That sets the target period for a possible policy shift as Q1/2019, so my forecast of a $1,400 gold price by New Year's Day is probably going to need to be revised.

However, if the rally fails and, in fact, heads into another major down leg here in November, the odds of the policy reversal spike up and the risky assets may get an early jolt. The point is that once again, Fed policy and member blathering are the drivers and a much as it makes me want to hurl my quote screen into lovely Lake Scugog, I am forced to simply deal with it.

Trade accordingly and keep an eye on the uranium plays—at $29.20/lb., they might catch a bid very shortly and when the U308 stocks catch fire, the returns are scary. The trigger will be $30-plus uranium and that could happen next week.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Disclosure: 1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. 2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports. 3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images and charts provided by the author.

Michael Ballanger Disclaimer: This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.