The Economic Costs of Corruption in Philippines

Economics / Phillippines Nov 07, 2018 - 12:47 PM GMTBy: Dan_Steinbock

The recent $200 million customs debacle may be just a tip of the iceberg. Due to illicit financial flows, Philippines has lost almost $10 billion annually. Tax evasion may be as costly. In this status quo, only a fully independent anti-graft campaign can succeed.

The recent $200 million customs debacle may be just a tip of the iceberg. Due to illicit financial flows, Philippines has lost almost $10 billion annually. Tax evasion may be as costly. In this status quo, only a fully independent anti-graft campaign can succeed.

In August, 500 kilos of shabu (methamphetamine), estimated at ₱4.3 billion (over $80 million), that entered the country was intercepted by the Bureau of Customs at Manila’s container port. The next day, authorities found similar containers, but not the drugs estimated at ₱11 billion (almost $210 million).

In early November, former Customs intelligence officer Jimmy Guban, suspected member of a drug syndicate, was turned over to the Department of Justice after days of detention in the Senate. Accepted into the government’s Witness Protection Program, Guban is believed to be a vital witness in the smuggling into the country of billions of pesos worth of shabu.

Unsurprisingly, Dr Dante A. Ang, chairman emeritus of The Manila Times, has said that corruption has “become a way of life in high places in government.” While President Duterte’s campaign against illegal drugs has effectively interdicted the narco-state trajectory, he fears the country may still become “another Colombia.”

If corruption and illegal drugs are two sides of the same coin, Ang asks: “Whom can President Duterte trust?” The short answer is: “Nobody.”

From drug trade to illicit financial flows

While illegal drugs entered the Philippines before the President Aquino III era, it was during his watch that drugs grew embedded with most Filipino neighborhoods.

Yet, the drug scourge was downplayed by the mainstream media in the Philippines and largely ignored by international media, despite the expansion of the kitchen labs by drug syndicates, warnings by U.S. State Department, the Discovery documentary about drug leaders’ luxurious life in the New Bilibid Prisons and collusion by government authorities, including former Justice Secretary Leila de Lima.

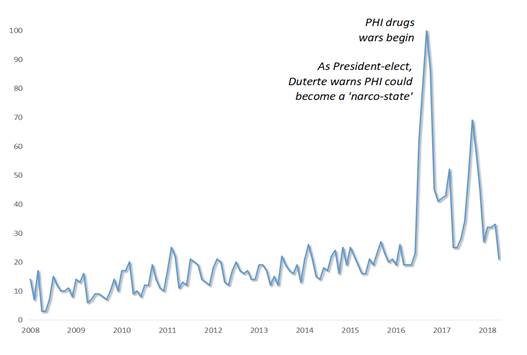

As a Google Trend search demonstrates, it was only after Duterte won the 2016 election and began the war against the drugs that Philippines discovered it had a drug problem. That, in turn, casts a long, dark shadow over the years when the country was ruled by the Liberal Party (Figure 1).

Figure 1 The Long silence about PHI drugs until the Duterte Era

Source: Google

Of course, corruption is not a Philippines monopoly. Setting aside the lucrative multibillion dollar drugs business, illicit financial flows involve huge economic stakes that are not disclosed in national accounts or balance of payments figures. Rather, these flows typically comprise trade mispricing, bulk cash movements, informal transactions, and smuggling.

According to research, illicit flows nearly doubled to $130 billion in emerging Southeast Asia between 2003 and 2014. Concurrently, their cumulative value amounted to more than $1 trillion.

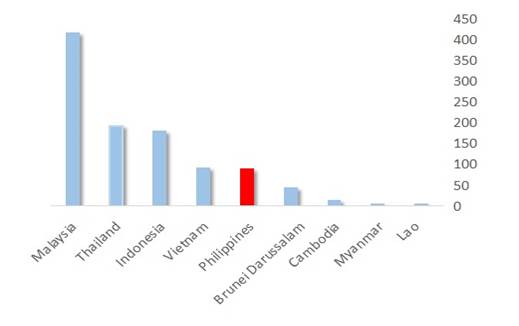

In country comparisons, Malaysia ranks highest in cumulative illicit financial flows. Between 2003 and 2014, it lost $420 billion in this way. Next come Thailand and Indonesia, while Philippines ranks at par with Vietnam. Each of the last two lost more than $90 billion in cumulative illicit financial flows during the period (Figure 2).

Figure 2 Illicit Financial Flows: Emerging Southeast Asia ($ Billion)

Source: GFI

Today, even Colombia is in a different league than Philippines in illicit financial flows. Between 2003 and 2013, Colombia lost "only" $15 billion in cumulative illicit flows. Philippines lost an estimated $75 billion more.

The costs of corruption

According to the IMF, the annual cost of bribery alone has been estimated internationally at $1.5 to $2 trillion (2% of global GDP). Yet, bribery is just a part of the big picture. Historically, corruption that arises from the abuse of public office for private gain has been evidenced by powerful networks between business and government. These dark networks reflect the de facto privatization of public policy.

Internationally, corruption has been found to undermine economic development:

- Since corruption weakens the state’s capacity to raise revenue and perform its core functions, it increases tax evasion. According to the 2017 UNU-Wider report (2013 data), tax evasion costs Philippines almost $7.4 billion annually, or 2.7% of its GDP. In these terms, the country ranks at par with Haiti, Morocco and India.

- By inflating costs in the public procurement process, corruption undermines the quantity and quality of public spending. In addition to procurement abuses, the pork barrel scam (PDAF) illustrates such challenges. In the Philippines, the history of such funds began already in the American colonial period but seems to have intensified following President Corazon Aquino’s creation of the Countrywide Development Fund in 1990.

- Because of lower public revenues, countries tend to rely more on central bank financing, which creates an inflation bias. In the Philippines, examples include recent inflation concerns that seem to have been fueled by supply abuses and hoarding of rice and the consequent destabilized prices (rice smuggling had soared already in the Benigno Aquino III era).

- As corruption can even raise the cost of accessing financial markets since lenders factor in corruption, resources are allocated to rent-seeking rather than productive activities. In the Philippines, one cannot help but wonder why it was so important to focus on financial wealth rather than infrastructure investment in the pre-Duterte era.

International precedents

No country can or should tolerate a status quo, where growth and employment prospects remain subdued while a number of high-profile corruption cases undermine economic growth.

Evidence from Singapore, Hong Kong and China demonstrates that anti-corruption struggle can be effective, but only when the anti-graft authorities report directly to the chief executive - not to government agencies, policymakers, police, or military.

What the Philippines needs is effective zero tolerance toward corruption.

Dr Steinbock is the founder of the Difference Group and has served as the research director at the India, China, and America Institute (USA) and a visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more information, see http://www.differencegroup.net/

© 2018 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.