Positive Implications for Gold Miners if Crude Oil Breaks Down

Commodities / Crude Oil Nov 06, 2018 - 12:51 PM GMTBy: Gary_Tanashian

It’s an over obsessed upon commodity, previously hyped for its (Hubbert’s) “peak” status by “experts” like T Boone Pickens and a whole clown show of promoters amplified by the media at the time.

It’s an over obsessed upon commodity, previously hyped for its (Hubbert’s) “peak” status by “experts” like T Boone Pickens and a whole clown show of promoters amplified by the media at the time.

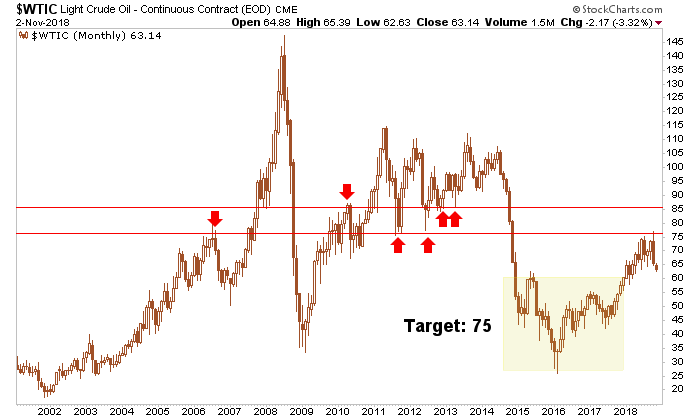

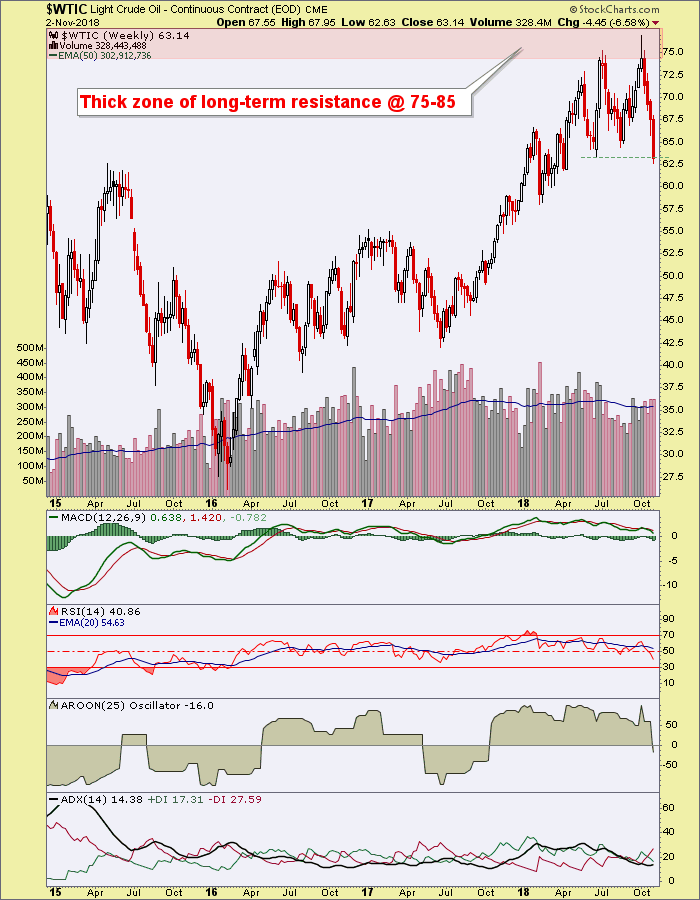

Now WTI Crude Oil has reached a thick resistance zone (as managed in NFTRH for the last couple of years) and may be breaking down from a peak of a whole other kind. Here is the monthly chart we use.

It is preliminary, and one weekend OPEC jawbone could put oil back up in the consolidation. But as of now the price has ticked below the previous 2018 low to close the week. It is not a good look… unless you’re a gold bug, that is. More on that later.

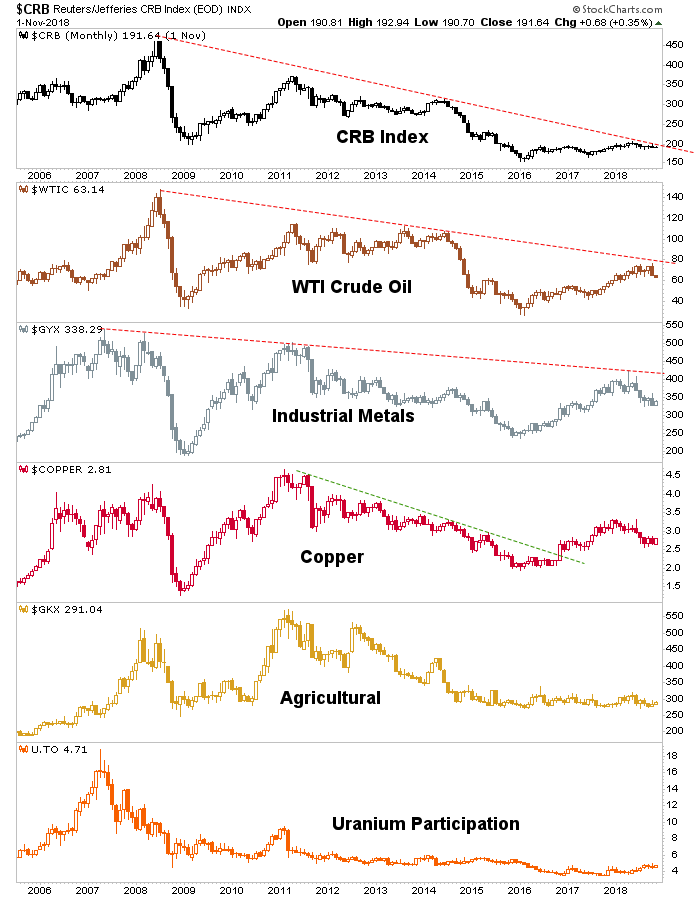

Here is a standard chart we use in NFTRH to keep an eye on the commodity complex from a big picture perspective. If Crude Oil were to hit the upper end of our resistance target it would break the trend line shown below. But it, Industrial Metals and the CRB index itself are all consolidating downward from these long-term trend lines. It’s a key time for commodities and the ‘inflation trade’. Break out or break down. Those are the options.

Meanwhile, American job creation is brisk and the president is pumping all of this 24/7 leading into the mid-terms. But why are commodities so weak in this fiscally stimulated and reflated economy?

If feels a lot like 2000 right now and in NFTRH last week we drew some important parallels to that time frame (when the gold miners bottomed) and today. That was a view of what the S&P 500 did back then and what it may well be in a process of doing now. All of that came at a time when the economy could not have been better as well.

Think about that. Gold vs. Stock Markets is a macro fundamental indicator for gold stocks. In other words, why buy the miners when stocks are out performing gold? So why again did we follow the 3 Amigos – including Amigo #1 (stocks vs. gold) – so closely? The answer is obvious. No rise in gold vs. stocks… no bull backdrop for the miners.

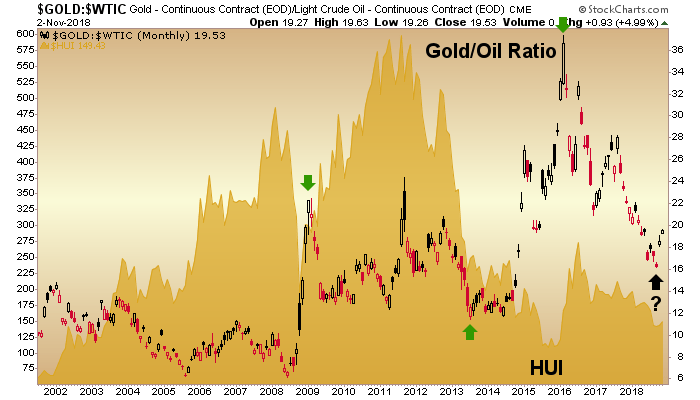

The Gold/Oil Ratio (GOR) is a sector (as opposed to macro) fundamental for gold mining. Oil is a cost input and gold is the product. Simple. The monthly chart below shows how over valued the miners (HUI) had become relative to this important ratio at various times in the past. Since 2016 however, as the ‘inflation trade’ wore on, gold has been drubbed vs. oil. A few notes here…

- HUI has done value oriented gold stock players a great service by not rising – or even remaining flat – against a declining GOR, and

- If the GOR turns up, HUI could make your head spin to the upside if and when a proper valuation is applied the sector.

- The 2016 upturn in gold stocks came against a big upturn in the GOR. But a lid was kept on the gold mining sector in the form of recovering US and global stock markets (there’s that all-important macro consideration again!).

- The result has been chronically pressured valuations.

Now, we gold bugs often need moderators, so know that the above is a slow moving monthly chart, we are in the heart of tax loss selling season with yet another losing year for gold stocks (as a whole, some quality operations did just fine) wrapping up. So this post is not implying people should run out and scoop ’em up hastily. I am personally trying to position with patience while trading around the shorter-terms.

But if a different kind of peak is hitting Crude Oil and if the stock market resumes a bearish phase, we are likely nearing the end of a long wait for the next gold stock bull market to get going. Not hype; just the reality of the charts in this case.

Subscribe to NFTRH Premium (monthly at USD $33.50 or a 14% discounted yearly at USD $345.00) for an in-depth weekly market report, interim market updates and NFTRH+ chart and trade setup ideas, all archived/posted at the site and delivered to your inbox.

You can also keep up to date with plenty of actionable public content at NFTRH.com by using the email form on the right sidebar and get even more by joining our free eLetter. Or follow via Twitter ;@BiiwiiNFTRH, StockTwits or RSS. Also check out the quality market writers at Biiwii.com.

By Gary Tanashian

© 2018 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.