Saudis Might Embrace A 'Take-The-Money-And-Run' Strategy Post Khashoggi

Politics / Saudi Arabia Nov 03, 2018 - 03:01 PM GMTBy: Steve_H_Hanke

Since the murder of Jamal Khashoggi in the Saudi Consulate in Istanbul, oil prices have plunged by 11.92%. Just today, West Texas Intermediate (WTI) shed 4.56%. At present, WTI is trading at $66.05/bbl. That’s well below the high for the past year of $76.90. It’s also well below my forecast for the year’s end price of $75/bbl.

To shed some light on what might be driving the crude oil market, let’s use the flickering candle of the economics of production. The economic production rate for oil is determined by the following equation: P - V = MC, where P is the current market price of a barrel of oil, V is the present value of a barrel of reserves, and MC is the marginal recovery cost of a barrel of oil.

To understand the economics that drive the Saudis to increase their production, we must understand the forces that tend to raise the Saudis’ discount rates. To determine the present value of a barrel of reserves (V in our production equation), we must forecast the price that would be received from liquidating a barrel of reserves at some future date and then discount this price to its present value. In consequence, when the discount rate is raised, the value of reserves (V) falls, the gross value of current production (P - V) rises, and increased rates of current production are justified.

When it comes to the political instability in the Kingdom, and Middle East in general, the popular view is that increased tensions will reduce oil production. However, economic analysis suggests that political instability and tensions (read: less certain property rights) will work to increase oil production.

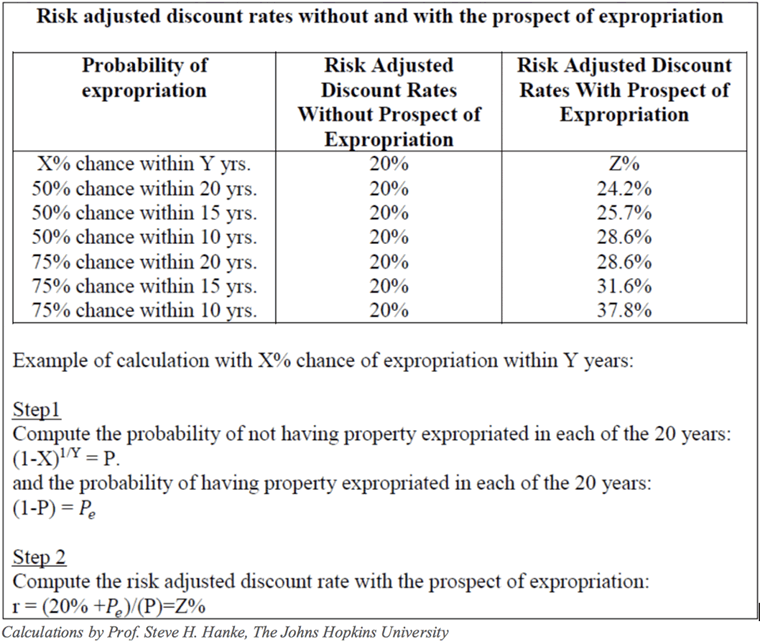

Let’s suppose that the real, risk-adjusted rate of discount, without any prospect of property expropriation, is 20% for the Saudis. Now, consider what happens to the discount rate if there is a 50-50 chance that a belligerent, whether they be an external force or internal coup, will overthrow the reigning regime House of Saud within the next 10 years. In this case, in any given year, there would be a 6.7% chance of an overthrow. This risk to the regime would cause them to compute a new real, risk-adjusted rate of discount, with the prospect of having their oil reserves expropriated. In this example, the relevant discount rate would increase to 28.6% from 20% (see the table below for alternative scenarios). This increase in the discount rate will cause the present value of reserves to decrease dramatically. For example, the present value of $1 in 10 years at 20% is $0.16, while it is worth only $0.08 at 28.6%. The reduction in the present value of reserves will make increased current production more attractive because the gross value of current production (P - V) will be higher.

So, when the Saudi Princes are nervous, we can anticipate that pumping more oil today, not tomorrow, makes sense. As they say, the neighborhood is unstable. And, at present, Crown Prince Mohammad Bin Salman has ramped up the prospect of instability. In consequence, the regime’s property rights are more problematic. This state of affairs suggests that a more rapid exploitation of oil reserves might just be in the cards, and in the markets, too. Yes, a take the money and run strategy makes sense because the current regime knows the oil reserves might not be theirs tomorrow.

By Steve H. Hanke

www.cato.org/people/hanke.html

Twitter: @Steve_Hanke

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2018 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.