Palladium Technical Analysis Price Forecast

Commodities / Palladium Nov 03, 2018 - 02:23 PM GMTBy: Nadeem_Walayat

This a technical look at the prospects for the Palladium price. This analysis was first made available to Patrons who support my work. So to get immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Technical Analysis

Palladium is clearly in a very strong bull market that has resumed following it's recent significant correction from $1133 to $815, followed by a strong rally to $1090. So the technical's for the Palladium bull market look good.

Long-term Trend Analysis

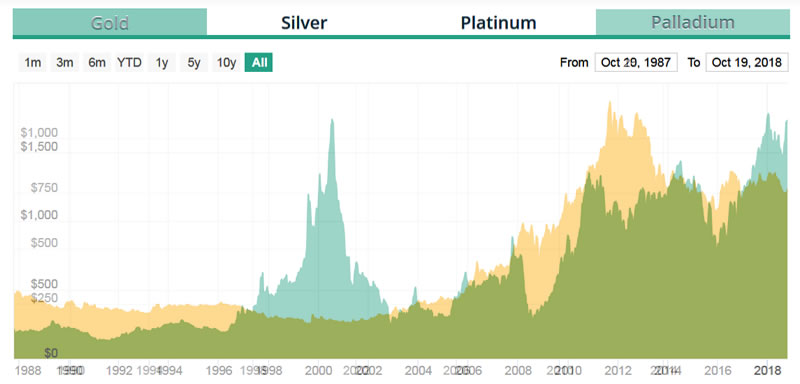

Two things stand out from the long-term chart:

1. Palladium trends

2. Palladium tends to cycle between peaks of approx $1000 and troughs of $200.

However the trend since 2014 appears to have broken this cycle by setting a new floor at approx $450, and thus a higher high that remains to be determined. Which is what one would expect to happen courtesy of the exponential inflation mega-trend i.e. continual debasement of all currencies.

So it looks like the Palladium bull market has a little further to run to the upside, possible to as high as $1350 before the market succumbs to over supply seeking to capitalise on the high prices.

Inter-Market Analysis

Palladium - Gold

The normal tendency is for Palladium to under-perform Gold. Apart from the times external demand far exceeds market sentiment such as occurred in 2000 and today in 2018. Which suggest that the bull market in Palladium is temporary as ultimately the price should underperform gold which implies a $800 Palladium price, unless the Gold price starts to soar upwards, which as per my most recently analysis is unlikely anytime soon.

Palladium - Silver

The chart shows significant deviation in trend to the upside against Silver, which is likely due to industrial supply / demand issues rather than market speculative sentiment.

Palladium Demand

Given that the charts suggest outside pressure on price rather than speculative sentiment then it would be wise to understand the primary uses for Palladium. The primary industrial use for Palladium is in catalytic converters i.e. use in Diesel and Petrol engine cars which does not bode well for future demand given the unfolding mega-trend for the emergence of electric cars, then unless some new mega-demand application takes petrol and diesels car place then the current palladium bull run is unsustainable as diesel car production in particular is phased out in favour of electric vehicles.

So my forecast conclusion is that it Palladium is targeting a trend to $1350 before it is likely to enter into a bear market that targets $800.

Beyond which the very long-term prospects for Palladium are not good due to the growing market share of electric cars and the phasing out of diesel cars. However given the slow roll out of electric cars as a share of the global car market then the market impact of electric cars remains many years away.

So the Palladium price could oscillate in a range of $450 to $1300 for many more years before ultimately electric cars sound the deathnell for Palladium sending it to a sub $250 price. But again this is many years from now.

The bottom line is if your invested in Palladium then take this bull run as an golden opportunity to OFFLOAD your holdings before the next bear market sets in that would likely first target $800.

This analysis was first been made available to Patrons who support my work. So to get immediate First Access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $3 per month. https://www.patreon.com/Nadeem_Walayat.

Your analyst,

Nadeem Walayat

Copyright © 2005-2018 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 30 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.