Kitchin Cycle Warned of Stok Market Volatility

Stock-Markets / Cycles Analysis Oct 28, 2018 - 09:07 AM GMTBy: readtheticker

Here are some names of cycle masters: Kondratieff, Dewey, Kitchin, to name just a few. Cycles are in all matters of life, including the SP500.

Here are some names of cycle masters: Kondratieff, Dewey, Kitchin, to name just a few. Cycles are in all matters of life, including the SP500.

From Wiki

.."Joseph Kitchin (1861–1932) was a British businessman and statistician. Analyzing American and English interest rates and other data, Kitchin found evidence for a short business cycle of about 40 months.[1] His publications led to other business cycle theories by later economists such as Nikolai Kondratieff, Simon Kuznets, and Joseph Schumpeter"..

If you are a regular stock market watcher, you will notice during cycle up swings the media, bloggers, tweets are all positive and talk about the next 50% upward move, and during cycle down swings it is the exact opposite, doom and gloom and a crash is near. Some call this a measure 'sentiment', and determining when the market changes in sentiment is the basis of creating wealth.

The news breaking now is :

- Amazon earnings profit jump, but shares slump

- Caterpillar stock falls as warning of peak earnings

- 3M peak earnings

Great earnings, but stock slide, this is cycle ending type news. The massive story behind these news headlines is the US economy is changing back to pre-globalism. This is US producers switching from foreign commodities and parts to local sources. For example Ford, switched from Chinese steel to US steel, and will suffer the increase costs. The cost will be pushed on to consumers, resulting in inflation.

This is the US economy changing from a low cost external sourced raw material to a more internal higher cost sourced economy. In short this is transferring GDP from out side the US to inside the US, this will result in more local jobs and eventually inflation. This is the TRUMP plan which is better for main street, not so good for (1) Wall street, (2) those foreign sources who relied on the US demand engine and (3) the massive debt financing the globalism model.

The debt in emerging markets and China is growing in riskier every day. This fundamental change in the massive US demand model has yet to be played out in equity markets fully.

The Kitchin Cycle suggest the unwinding of the leverage behind Globalism to American First policy has only just begun. After all globalism has been in operation for 40 years, hence you can expect at least 2 to 4 years of adjustment. No wonder the bankers and globalists CEO's do not donate to TRUMP 'make a America super dooper again'. And you can not blame the US middle class, they missed out on their billions, as globalism went to far, stripping out GDP from the heartland. Now the economic pendulum is swinging back (well while Trump is in power) and the change will bring pain to those who lose.

POINT: The point is the globalism leverage will crash. You can not make an American First omelet without breaking a few globalist eggs. Yes, this process will be messy, and the stock market will not be able to hide from it, after all 45% off all SP500 revenue comes from globalist activities (i.e exports).

Investors will eventually rotate into defensive sectors: Bonds and metals. Watch for the change as the Kitchin cycle swings down.

Here is a reminder how 'Wall Street Works'

.."The investing public are the sheep, the broker is sheep dog, the farmer is the back room strategist, and the paddock gate is the point of commission. Moving from one paddock to another is the change from one investing theme to another, and if the sheep do not move fast enough the sheep dog scares them enough to move. Yes this is Wall Street in its purest form!"..

POINT: Try to be first through the gate, and stay of trucks going to the meat works!

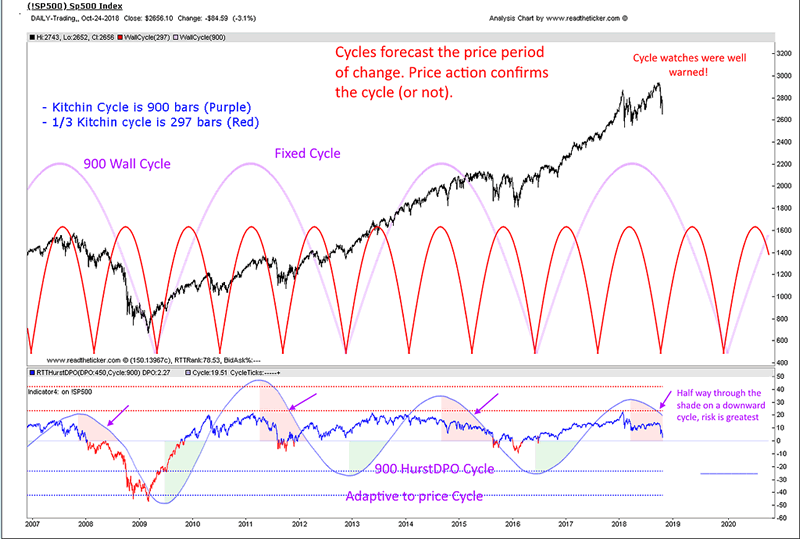

with Kitchin cycle (readtheticker.com allows members to draw all cycle types):

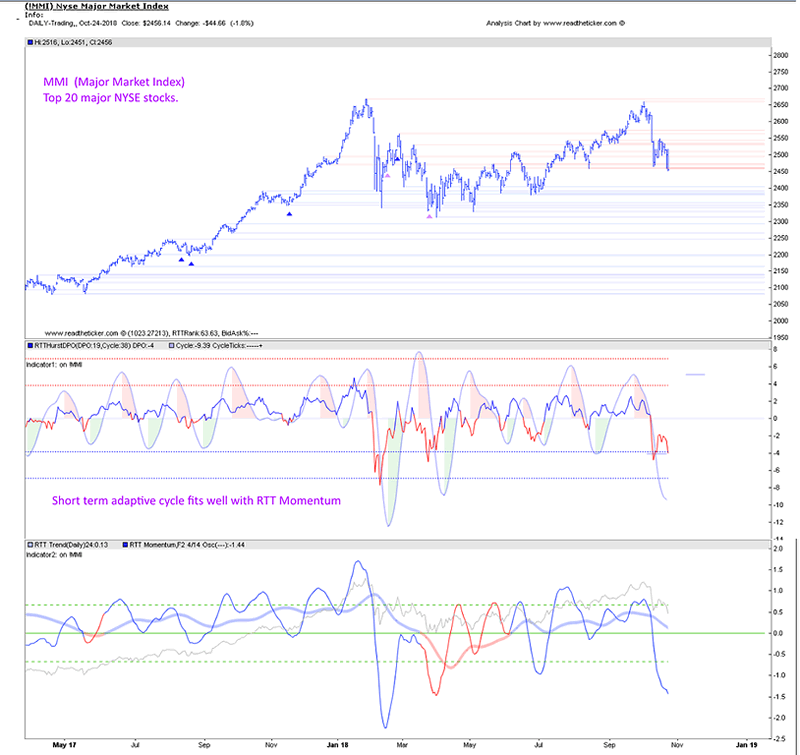

A shorter cycle example

Fundamentals are important, and so is market timing, here at readtheticker.com we believe a combination of Gann Angles, Cycles, Wyckoff and Ney logic is the best way to secure better timing than most, after all these methods have been used successfully for 70+ years. To help you applying Richard Wyckoff and Richard Ney logic a wealth of knowledge is available via our RTT Plus membership.

NOTE: readtheticker.com does allow users to load objects and text on charts, however some annotations are by a free third party image tool named Paint.net

Readtheticker

My website: www.readtheticker.com

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2018 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.