Systemic Failure of the United States- Game Over

Stock-Markets / Credit Crisis 2008 Sep 18, 2008 - 04:36 PM GMTBy: Jim_Willie_CB

We are in historically unprecedented times. The foundation is being laid for a default of USTreasurys in the wake of the greatest regulatory failure in modern history, and the collapse of the US financial system. Anyone who cannot see that suffers from poor vision, chronic nostalgia, low mental wattage, a paycheck from Wall Street, a post in financial press media, or owning an Economics advanced degree. So many changes come with each passing day, not week, that it boggles the mind. Many of us predicted $100 updays for gold, and we almost saw one. The wheels came off the US financial wagon long ago, but only now that fact is being recognized. The monetization largesse finally has gone beyond the corrupt bailouts of fraud kings on Wall Street.

We are in historically unprecedented times. The foundation is being laid for a default of USTreasurys in the wake of the greatest regulatory failure in modern history, and the collapse of the US financial system. Anyone who cannot see that suffers from poor vision, chronic nostalgia, low mental wattage, a paycheck from Wall Street, a post in financial press media, or owning an Economics advanced degree. So many changes come with each passing day, not week, that it boggles the mind. Many of us predicted $100 updays for gold, and we almost saw one. The wheels came off the US financial wagon long ago, but only now that fact is being recognized. The monetization largesse finally has gone beyond the corrupt bailouts of fraud kings on Wall Street.

My longstanding forecast has been that when the monetary inflation machinery spits output beyond the sanctimonious walls of the Wall Street whorehouses, INTO THE MAINSTREAM, that the gold price would rise substantially. That process has begun, starting with Fannie Mae & Freddie Mac, and now moving to AIG. Only when phony money floods the system where people live, not where the elite conmen with strangehold control the counterfeit processes, will gold shine. So many unexpected upcoming events will occur, enough to make a forecaster dream. Let's begin with the most important. Much more details are provided to Hat Trick subscribers.

RAIDS OF INDIVIDUAL ACCOUNTS

This is so important a topic, that it deserves top billing!!! Hidden inside the AIG bailout funding package, surely hastily cobbled together, but carefully enough to include a totally corrupt clause, was a handy dandy clause that permits raids. The conglomerate financial firms are permitted at this point to use private individual brokerage account funds to relieve their own liquidity pressures. This represents unauthorized loans of your stock account assets. So next, if the conglomerate fails, your stock account is part of the bankruptcy process. Finally the corrupt USGovt and corrupt Wall Street houses are desperate enough to put into policy, stated by the US Federal Reserve, outlining the authorized raid of your money.

Beware. A good route would be to remove your money, start a subscription here, and open a GoldMoney account, then purchase physical gold or preferably silver with my offered discount. That cannot be taken from you, and will rise 5x for gold and 10x for silver in the next two to three years. The actual evidence for legalized stock account raids by the financial firms can be found in recent articles in Financial Times and Wall Street Journal . So this is not a wild claim. The September 14th article on the Wall Street Journal entitled “Wall Street Crisis Hits Stocks” was the first exposure.

The runs on US banks are in progress. See Washington Mutual, where private email messages have been shared by WaMu bank officers. WaMu alone could deplete the entire Federal Deposit Insurance Corp fund for bank deposit coverage. Eventually the FDIC will compete for USGovt federal money for bailouts and nationalizations. Eventually, bank deposits will not receive 100 cents per dollar, in a compromise. Next the bank runs will push banks into failure, at a time when stock accounts are under raids, without broad public knowledge.

GOLD TAKES LEAD IN CURRENCY WORLD

Did anyone notice that on Wednesday the 17th, gold was up big, like over $50, silver was up big, like over 70 cents, but the USDollar was essentially flat, even up a smidgeon? By afternoon, the gold rise intensified, and the USDollar fell hard. THE MESSAGE IS CLEAR: GOLD IS LEADING MOVEMENTS IN CURRENCY PRICES. The world did flock to the USTreasurys, surely led by mangled confused central bankers who have lost control. However, gold is finally being seen as a safe haven. It will become highly amusing to observe a clueless cast of corrupted minds attempt to explain why gold vaults past the 1000 mark, and why silver vaults past the 20 mark. They will offer up reasons, and if lucky, they will touch on at most three or four of the twenty relevant reasons. Their confusion includes observation of the decline in the crude oil price. Their eye is off the monetary panic.

Moral hazard is just an obstacle to be side-stepped in such times. Today, Bill McCullum of PIMCO actually said “We should not give one thought to inflationary consequences.” He was referring to gargantuan rescue packages and now global lending lines to central bankers. And people wonder why gold shot up $80 yesterday, and why silver silver shot up over $1 yesterday. PREPARE IN THE VERY NEAR FUTURE FOR GOLD TO RISE OVER $100 ON SUCCESSIVE DAYS, AND FOR SILVER TO RISE OVER $2 ON SUCCESSIVE DAYS. Inflation is soon to be seen as the remedy to prevent monetary collapse. Gold just hit 900, and silver has reached 12.70 today. The euro has risen 500 basis points just since Friday morning. Gold is not rising sharply due to inflation concerns alone, although plenty of monetary inflation is set to continue flying through the money pipelines. THE REAL REASON WHY GOLD IS RISING IS FOR THREAT OF SYSTEMIC FINANCIAL FAILURE CENTERING IN THE UNTIED STATES.

What factors are key to gold rising? Perhaps because the US financial system is imploding. Perhaps because the USGovt nationalization demands are accelerating. Perhaps because the threat of default for USTreasurys is seen as inevitable, even imminent. Perhaps because nitwits who have highjacked the White House and USMilitary are planning something truly reckless on the military front in Iran. Perhaps because the US Federal Reserve is depleted and secretly insolvent, even as they put word out of an INFINITE BALANCE SHEET. Perhaps because enormous demand has come in physical gold & silver, despite the low price set by corrupt US PaperHangers. Perhaps because fear has entered the room globally.

CONSOLIDATION AMONG THE DEAD

The financial firms are not just dead, they are corrupt to the core. Perhaps one or two Wall Street firms will be left standing in a year or more. Has anyone figured out why foreign pursuit of Wall Street firms is blocked? Partly because foreigners cannot assess the value of such complicated opaque assets, intertwined within nests of acid pits. The other reason is that US banking authorities wish to keep the protected corrupt evidence within the Manhattan fold. The South Koreans wanted a piece of Lehman Brothers, the best pieces. But they would have had access to evidence needed eventually in criminal prosecutions. See the KfW case of € 300 million theft, possibly soon to emerge against Lehman crooks. The German insurance titans wanted a piece of AIG, the dead insurance giant. But they would have been handed access to evidence of extreme vulnerability or criminality. Why were officers at Lehman permitted to remove box after box from their building, when it should be treated as a crime scene with yellow cordon tape? The answer has to do with the Fascist Business Model, the merger of state with business, where the syndicate facilitates fraud in deep collusion.

Why did Morgan Stanley stock go down hard after they announced early their quarterly earnings? Possibly because nobody believes they are honest. Morgan Stanley might be kept afloat longer, so as to enable theft of brokerage account funds. Lehman does not have private stock accounts, mostly bonds of the acidic type. So Lehman is free to enter the trash heap of liquidation and the de-bone process for assets. Meat is to be separated from bone. John Mack of Morgan Stanley had better be careful, as he appeals for a Chinese role in a merger. That could give the Chinese an important toe-hold in US mortgage bond ownership. They are looking to convert mammoth USTBond garbage paper into hard assets, as a foundation to a possible migration of one hundred thousand to one million elite Chinese, to California, Arizona, Las Vegas, and Florida. It is called colonization.

The moral of the consolidation story is that the dead are marrying the dead. The Bank of America merger with Merrill Lynch struck me as hilarious. Each is dead from insolvency. Each has big counter-party risk from coverage of failed bonds. So they will now serve as each other's guarantor of counter-party risk? Not in this world! Imagine two fat men absent of musculature tossed overboard a ship. They tell each other, “Stand on my shoulders and you will be fine for breathing in this vast sea.” They both sink. The end game for such ludicrous indefensible consolidation is that the Wall Street fraudulent corporations go down all together. A friend called last night from the analyst community. He wondered aloud that nobody could expect the speed of the breakdown.

My response was to point out a strong message mentioned here repeatedly. Since the Bear Stearns bailout killjob merger by JPMorgan, all Wall Street investment banks are aligned in similar fashion, with common bond risk and common counter-party risk. So when one Wall Street firm goes down, several will immediately go down, and AIG is the umbilical cord to the Main Street economy. This point was borne out as wickedly true when the Lehman funding bailout failed. The parties trying to bail them out, offering funds, all found themselves as subject to writedowns immediately. The funds they offered were not available, since the loop of price reality reduced the level of the offered funds!!! That means they are all in the same boat, and if one fails, they all fail. So the system will desperately attempt to avoid any failing. Thus, the entire system fails.

As simple citizens, people should be concerned that the US Federal Reserve and US Dept of Treasury have begun to take actions far outside their own legal powers. The bailout of AIG was made illegally. The USFed cannot act to aid non-bank entities. Senator Jim Bunning has drafted Congressional legislation to limit the USFed action outside the banking realm. The system is losing control, especially with the law.

The parade of doomed deals continues. Talks have begun for JPMorgan taking over Washington Mutual. Could the JPMorgan ‘Garbage Can' be inadequate soon? Bank of America has entered talks to take over Merrill Lynch, apparently striking a deal. Could BOA serve as the alternative ‘Garbage Can' next, whose service would be as squire to JPMorgan? Now Morgan Stanley is in talks to take over Wachovia. The disaster du jour today seems to be State Street, which was down over 50%. The dominos are falling. THE MESSAGE IS CLEAR: THE DEAD ARE MARRYING THE DEAD. It is unclear what music to play at such events. My suggestion is something from “Phantom of the Opera” would be apt.

A SHORT ‘TOLD YOU SO' HERE

The US financial sector became unglued this week. In last week's article, the point was made that the financial system had just that one week to lift the USDollar, to raid private accounts with games like yanked credit and a raft of paper naked short gold & silver future contracts. Then next week the brown excrement hits the fan. Over the weekend, deals were attempted to be forged into the night. Nobody seemed to ask the question why they were all acting like in an emergency. What emergency? A condition ordered by whom? My maintained point is that the Bank For Intl Settlements ordered the US bankers to fix it or flush it!

Big news was expected from my analysis, and my Hat Trick Letter newsletter. We got it! By the way, AIG was not on the radar for numerous analysts. It was on my radar, a secondary radar. The big banks are primary for my observation and monitor. WE ARE WITNESSING A CONCENTRATION OF RISK, OF RUINED CORPORATIONS, AND OF THEIR ACIDIC BALANCE SHEETS THAT IS SO GREAT THAT THE RISK OF US FINANCIAL IMPLOSION GROWS BY THE DAY !!!

Blame for speculators continues, as nitwit players within the fraud centers accuse others of speculation, and threaten prosecution by their watchdogs on leash. Recent research failed to disclose any collusion or illegal activity in the crude oil market. That does not stop continued claims, with hue & cry. These criminals are pathetic, if not consistent. Just when failed regulation is at the core of the financial crisis, Wall Street conmen and clueless Congressional legislators argue for more regulation and control, when the regulators and controllers deserve prison terms. Instead, prosecute the regulators and controllers, and begin with Alan Greenspan, and his knights of the Stupid Table at the Federal Reserve.

The financial crisis continues each day. Last Friday the currency markets smelled what was cited in broad terms as the end of the OPEN WINDOW for the US banks. The euro currency rose over 220 basis points that Friday, and the pound sterling rose over 330 basis points. Gold and silver firmed in price. Something tipped them off, like huge flows of private money out of the Untied States. This week, AIG and Merrill Lynch and Morgan Stanley dominate the news. On two different days this week, the NYSE Dow Jones Industrial index fell over 400 points. Today, when the Dow Jones Index was up 170 points, in a phone call to a trusted friend, we both agreed that the index would turn negative before the afternoon, and close down. So far, that call looks correct, as it was minus 100 points before now being up 50 to 60 points.

By the way, important option put stock positions are in place against Goldman Sachs. They point to a strong likelihood of the GSax stock falling to 80 or 85 imminently. The knock on GSax is that they have lied about their subprime mortgage exposure, and soon will be forced to come clean. The ‘GS' stock shares plummeted from 160 in early September, now to under 100. Justice is served. My guess is their executives will profit privately from shorting their own stock. Even their 6-month corporate paper must pay out 20% in bond yield in order to attract funds.

UNIVERSAL MONETARY INFLATION

OK, so finally the US Federal Reserve has opened the monetary spigots to England, to Europe, to Switzerland, to Japan, and later to Canada. Not only is the monetary spigot overflowing inside the Untied States, it is overflowing from the US to the world. At least to the world affected (infected) by US control. The total central bank infusions of liquidity (translated: phony money) is $180 billion in the last several hours alone!! This huge amount is not enough to quiet the LIBOR or the 2-year USTreasury swaps. Gold is rising versus the pound sterling, the euro, the yen, and Canadian Dollar, aka the loonie. This trend is new and powerful. Central bankers are growing desperate. Their measures to open numerous lending facilities have not stopped lending constraints. Even commercial paper has fallen by $52 billion last week.

Clownish anchors and analysts cannot seem to comprehend what is going on with the central bankers, liquidity injections, market tanking, USDollar decline, and gold & silver zoom. They wonder why the USDollar would continue to fall after central bankers reacted responsibly. BECAUSE THE USTREASURY IS DOOMED FROM INSOLVENT BANKS, EXTREME DEMANDS FROM NATIONALIZATION, AND RECESSION, AGAINST A BACKDROP OF ENDLESS WAR FOR PRIVATE SYNDICATE BENEFIT. It is obvious! Gold smells a systemic failure.

FOREIGN CREDITORS UNITE

A hidden initiative has been in progress for the last two weeks. Foreigners are forced to supply credit for the Untied States. Nations led by Russia, China, Arabs, and Japanese are meeting to form a formal committee. They have a common purpose, to maintain and manage massive US$-based debt securities in danger. Their continued credit support is hampered by three magnificent factors, each a show stopper.

1) The US banks are insolvent,

2) The Wall Street bankers export fraudulent bonds, and

3) The USMilitary has acted with chronic aggression in violation of established contracts, international treaties, and disrespect for sovereign boundaries.

So they are working to organize a committee of giant USTreasury Bond creditors. They wish to confront the US debtor with a single voice. Regard this important step as a prelude to possible default of the USTreasurys . It is one thing to be in trouble from insolvency. Add corruption from export of fraud, and you have a bigger problem. Throw in military aggression, complete with misreporting by a controlled press, and you have a crisis in need of almost immediate remedy. My argument has been made for four years, that foreign held US debt creates a threat to national sovereignty. Since when are the Chinese our friends and allies? They are business partners turned rivals, now adversaries. Since when are Russians our friends and allies? They are energy and metals suppliers, betrayed by treaty violations, now adversaries, even on the military front. Since when are Arabs our friends and allies? For three decades an uneasy partnership has been in existence, one that has turned into a blatant protection racket. The endless concocted war on terrorism is seen by Arabs as a war on Islam.

USTREASURYS AT RISK

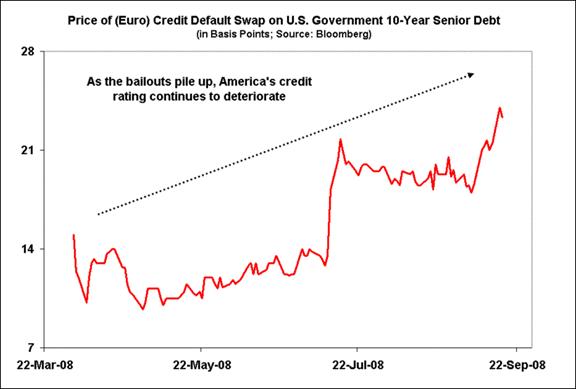

Don't be fooled by the drop in USTBond yields. That is a symptom of collapse in my view. Yesterday, it was with great disillusion yet satisfaction that my eyes and ears witnessed an interview by a Standard & Poor analyst. He said there was no imminent danger of a USTreasury debt security downgrade, but he did say that if pushed, the S&P would put them on NEGATIVE WATCH. Interpret that to mean the USTreasurys will soon be downgraded. Never is a denial of such importance made without coming to fact and fruition later. Why else is the topic even discussed? This line of thinking is basic when ripping the BS from US financial propaganda. Notice the Credit Default Swap price for USTreasury Notes. The price is around 0.24% for the AAA-rated USGovt debt. Without colossal continued corrupt pressure against the ratings agencies by the US thugs in financial orifices, the USGovt debt would have been downgraded immediately with the launch of the Iraq and Afghan Wars, or years earlier. The Shock & Awe should have been reflected in USTBond risk.

CHECK OUT THE 1-MONTH USTBILL YIELD

The US bankers have lost control badly. Even ill-equipped USFed Chairman Bernanke admitted recently as having lost control. He spoke to economist David Hale at a Florida financial conference last week. Bernanke said, “We have lost control. We cannot stabilize the dollar. We cannot control commodity prices.” The age of central bank control, ala Soviet Politburo, is coming to an end. GOLD RECOGNIZES IT. Check out the 1-month USTreasury Bill yield. Incredibly, it closed under 0.1% yesterday. This ultra short-term bond yield testifies to lost control and the advent of extreme conditions, the prelude to an historical storm. Just what should the USTreasury maturity yield curve look like before a default? Let me check, and get back to you. Ooops, no precedent! The TED Spread (difference between USTreasury and EuroDollar yield) has jumped up, another signal of banking turmoil.

In recent days, the tight grip control of certain commodities has been lost by the Evil Ones. Even Morgan Stanley has been forced to close down its trading desks at the Platts Window, where they trade crude oil. The USCongress is equally lost. Today, a quote came from Senate Majority Leader Harry Reid. They are unlikely to pass new legislation to overhaul financial regulations this year. He said, “No one knows what to do. We are in new territory, this is a different game. [Neither Federal Reserve Chairman Ben Bernanke nor Treasury Secretary Henry Paulson] know what to do, but they are trying to come up with ideas.” Gee! Maybe the chief architects of this grand failure have a solution? They should be ignored then imprisoned. Perhaps they are seeking final opportunities to steal, raid, and pilfer from the public till during the final months of this Administration.

The 2-year USTBill yield has also plummeted, but not as drastically. It is now far below the official USFed Fed Funds 2.0% rate. Some thought the USFed might cut rates in an act of desperation this week, me included. My guess is for two reasons, why they did not. 1) They did not want to project an impression of lost control, not after the Fannie Mae & Freddie Mac bailout, not after the failed Lehman Brothers deal, not after the shotgun wedding for Bank of America & Merrill Lynch, not after the secret eloped marriage in the works for JPMorgan & Washington Mutual, not after the merger of cadavers planned between Morgan Stanley & Wachovia. And 2) the Bank For Intl Settlements in Switzerland might have forbidden a USFed rate cut. My maintained position is firm, that the BIS ordered the US to fix it or flush it! Let's watch to see if the 2-year TBill yield continues lower, a signal of even more lost control.

THE USELESS INFLATION VS DEFLATION DEBATE

My greatest impatience is shown for those who attempt to argue whether inflation or deflation is winning, and where we stand. Such pursuits of chasing one's tail serves to illuminate nothing and to waste time. We have both, will continue to have both, as both intensify. The key is for monetary inflation to enter the mainstream, which is underway finally. One can benefit little from putting the unique crisis into convenient cans for purposes of organization. This is not simple, and people should not attempt to simplify the ongoing collapse of the Great American Experiment in Counterfeit Monetary Systems. To be sure, we have gone past a tipping point. The move to flood the monetary pools of phony money beyond Wall Street is the big event. To be sure, the bankruptcies and deep insolvent events are accelerating. To be sure, the desperation for attempted mergers is palpable. To be sure, central bank activity with lending, swapping, and even accepting stock equity as collateral is a sign of total absence of any safeguard toward respect of moral hazard.

Looking for inflation vs deflation labels when the failure and default of USTBonds and receivership occur TOTALLY MISSES WHAT IS GOING ON. This is a death event for the US finances, US banking system, USEconomy structure, and USTreasurys, all rolled together like a gigantic vortex hurricane. Looking for (in) vs (de)flation in this environment is like observing color schemes on walking dead as they attempt to merge at a ceremony. They are of DEAD PARTIES ATTEMPTING TO SHARE COUNTER-PARTY RISK. Looking for (in) vs (de)flation when dead partners are marrying is like DECIDING WHETHER A HONEYMOON SHOULD TAKE PLACE IN THE CARIBBEAN OR FRENCH COAST. They both go to the recycling cemetery instead. The place to be now is in gold and silver, preferably silver since central banks own none and because silver has strong industrial demand. Besides, a silver default of sorts has been in effect for several months.

It is with pleasure to attend again the upcoming Cambridge House conference in Toronto on October 4 and 5. Thankfully, my Frequent Flyer miles were used to cover the airfare from Costa Rica, where the rainy season is coming close to an end. POR FIN! Is that inflationary or deflationary? With absolute certainty, one can say WHO CARES?

Buy gold, buy silver, do NOT use borrowed money or leverage, and rest comfortably at night, since it cannot be taken from you. Then patiently wait for gravity to work, for night to follow day, for evil to be unmasked, for foreign creditors to arrive with hatchets. dvz

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“Your analysis is of outstanding quality, the best I have read. In particular, as a person on the spot, I can confirm the accuracy of your bleak assessment of our prospects in the UK .” (JanB in England )

“I just subscribed to your services and must say that your insights are so eye-opening that it is like having a window to the future. I never thought that they would in so much detail encompassing the entire world. With all that is going on, I still wonder how you are so in touch with it all.” (ChrisB in Australia )

“The latest Hat Trick letter is great work. I am still reading and absorbing, but this is just great analytical work. Truly inspired. I would say you produce a very sophisticated, detailed product that is the best of the bunch. Truly. You help keep me very focused on current events and help me keep my eyes on the distant horizon.” (RichardB in Texas )

“Your unmatched ability to find and unmask a string of significant nuggets, and to wrap them into a meaningful mosaic of the treachery-*****-stupidity which comprise our current financial system, make yours the most informative and valuable of investment letters. You have refined the ‘bits-and-pieces' approach into an awesome intellectual tool.” - (RobertN in Texas )

“Your reports scare the hell out of me every month, probably more so over time, since so many of your predictions have turned out to be very accurate. I am afraid you might be right that by the end of 2008, we are in a pretty severe situation, with civil unrest and severe financial stress on Main Street .” - (GeorgeC in Minnesota )

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.