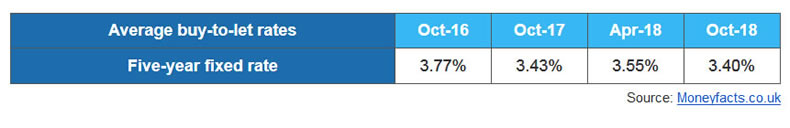

Average five-year Fixed BTL Mortgage Rate Lowest on Record

Housing-Market / Buy to Let Oct 18, 2018 - 12:09 PM GMTBy: MoneyFacts

With significant change in the buy-to-let (BTL) market over the past few years, many landlords feel uncertain as to what the future holds for them and their investment. However, this nervousness has not deterred lenders, with the average five-year fixed rate falling to its lowest level on Moneyfacts.co.uk records this month.

Charlotte Nelson, Finance Expert at Moneyfacts.co.uk, said:

“The BTL market has been on a rollercoaster ride in recent years, with not only two base rate rises to contend with, but multiple regulation and tax changes thrown into the mix. With all these elements, many would have assumed that rates would rise as a result. However, the opposite appears to be the case, particularly for the long-term fixed rates, with the average five-year fixed mortgage rate falling by 0.05% in just one month to reach the lowest on record.

“There has been a lot of upheaval for landlords and many are taking a step back, with the number of BTL property purchases down 11.1%* year-on-year in July 2018 (the latest month for which data is available). In response, providers are doing their best to re-engage borrowers by making their deals more attractive, absorbing some of the cost themselves in order to keep rates low..

“As a result, competition in the BTL market remains high. In the aftermath of August’s base rate rise, many BTL borrowers will be looking to remortgage from their standard variable rates (SVRs), with several of these landlords potentially considering longer-term options to act as a buffer against any future rises. It is this extra business providers are wanting to attract.

“Not only would a five-year fixed mortgage protect landlords from future rate rises, but savvy borrowers are aware that the strict stress test applied to two-year deals is not applied to five-year fixed rates. This could be yet another reason why competition is now homed in on the five-year fixed rate mortgage market.

“While it is great news for landlords that the long-term deals are cheaper, borrowers know all too well that with the potential for further base rate rises in the future, these low rates are unlikely to last. Therefore, any borrower sitting on their SVR or coming to the end of their term would be wise to consider a new deal now before it’s too late.”

*UK Finance - Mortgage Trends Update – September 2018

moneyfacts.co.uk is a financial product price comparison site, launched in 2000, which helps consumers compare thousands of financial products, including credit cards, savings, mortgages and many more. Unlike other comparison sites, there is no commercial influence on the way moneyfacts.co.uk ranks products, showing consumers a true picture of the best products based on the criteria they select. The site also provides informative guides and covers the latest consumer finance news, as well as offering a weekly newsletter.

MoneyFacts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.