Gold Soars to $893: Finally, the Wait is Over!

Commodities / Gold & Silver Sep 18, 2008 - 03:36 PM GMTBy: John_Lee

The financial crisis is fast unfolding as Fannie Mae, Freddie Mac, AIG, Lehman, Merrill Lynch, Washington Mutual and Wachovia are joining Countrywide, Bear Stearns and company in their disappearing acts.

The financial crisis is fast unfolding as Fannie Mae, Freddie Mac, AIG, Lehman, Merrill Lynch, Washington Mutual and Wachovia are joining Countrywide, Bear Stearns and company in their disappearing acts.

There are rumors now that Morgan Stanley is in trouble, too. I am surprised that the administration did not do more than they did to stabilize the financial sector (not that I am for it). There's no question in my mind that conditions in the market are worse than 1929, except that this time the dollar is not anchored to the gold standard so governments are printing at will. Watch out for credit card collaterals deteriorating, which will hurt Citibank and Bank of America.

Before you put me in the economic doom and gloom camp, let me be specific. I am anticipating more trouble for the financial sector, not doom and gloom spanning the entire economy. The debt implosion in financials merely facilitates wealth transfer, not economic collapse. This is the time to go shopping for hard assets. International land, apartments, good stocks, metals. Those hard assets are not disappearing and with a poisonous dollar, and after the crunch we're having, those assets priced in dollars will act as a shelter for all dollar holders. I expect the dollar to freefall relative to metals and Asian currencies in the next 6 months.

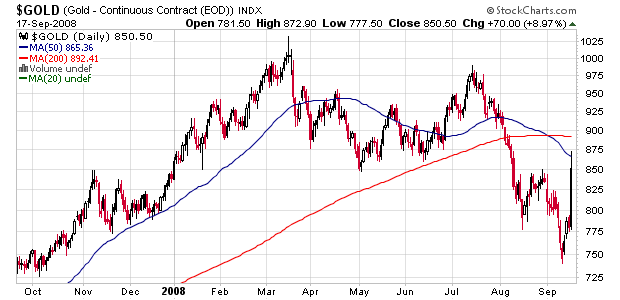

Oil is down slightly to $96 while gold is up $86 yesterday and $31 today to $893. AIG and Lehman both have big positions in the futures markets (long oil, short metals), and I highly suspect those positions are being unwound (ie. Sell oil, buy to cover metals). I have been VERY careful in not calling a bottom, however I am confident now that the bottom is in, and things can unravel quickly if short stops are taken out, creating a squeeze.

Below, I've linked to an interview of John Embry, the most famous gold fund manager in Canada. His fund is down 45% YTD, which makes our numbers look very good. Like Embry, we now have positions that are selling for as much as 20% below the cash they have in the bank. Finally, I expect a very healthy rebound in metals and metal stocks, while rest of the markets continue to yo-yo. Finally, the wait is over.

John Embry: "When the gold's all gone, the market will go nuts": http://www.marketoracle.co.uk/Article6248.html

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.