ECB Meeting Minutes and US Inflation Data in Focus

Economics / Inflation Oct 09, 2018 - 09:04 AM GMTBy: Submissions

We don’t have a central bank meeting scheduled for this week, but we get the minutes of the latest ECB one. Following the upbeat remarks of President Draghi at the conference following that meeting, it will be interesting to see whether other ECB officials are on the same page. In the US, we have the CPIs for September. We get inflation data from Norway and Sweden as well.

We don’t have a central bank meeting scheduled for this week, but we get the minutes of the latest ECB one. Following the upbeat remarks of President Draghi at the conference following that meeting, it will be interesting to see whether other ECB officials are on the same page. In the US, we have the CPIs for September. We get inflation data from Norway and Sweden as well.

Monday appears to be a quiet day in terms of economic releases. The only noteworthy data point we have on the calendar is German industrial production for August, which is expected to have rebounded 0.4% mom after sliding 1.1% in July.

On Tuesday, during the Asian morning, we get Australia’s NAB business survey for September. Although this is usually not a market mover, given the RBA’s emphasis on wage growth, we will take a close look at the Labour Costs sub-index. At its last two meetings, the Bank reiterated that wage growth remains low, but removed the part saying that this is likely to continue. Instead, officials noted that it has picked up a little and that further lift is expected. The NAB Labour Costs index accelerated to +1.3% qoq in the three months to August, from 0.9% in the three months to July and it would be interesting to see whether this improvement will continue as the RBA has suggested.

As for the rest of the day, the only releases worth mentioning are Germany’s trade balance for August and Canada’s housing starts for September. Germany’s trade surplus is expected to have increased slightly, while Canada’s housing starts are expected to have increased to 205.0k from 201.0k in August.

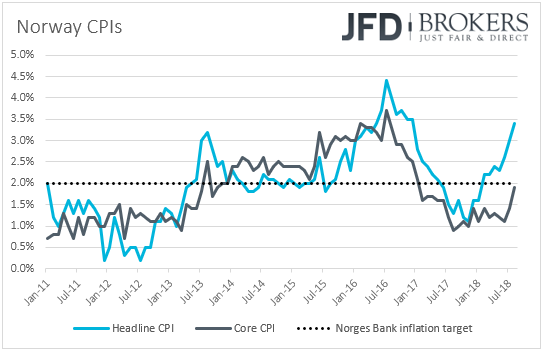

On Wednesday, during the European morning, we get Norway’s CPI data for September. Expectations are for both the headline and core rates to have declined, to +3.2% yoy and +1.7% yoy from 3.4% and 1.9% respectively. At its latest policy meeting, the Norges Bank decided to raise rates to +0.75% as was widely expected, but lowered its projected rate path, disappointing those expecting a more hawkish approach. The Bank also noted that the next rate increase will most likely come in Q1 2019.

The Bank’s upcoming gathering is scheduled for the 25th of October, but this will be one of the “smaller” meetings that are not accompanied by updated economic projections, neither a press conference by Governor Olsen. Thus, even if inflation slows somewhat, we don’t expect to get any major changes in the statement. We believe that officials may prefer to wait for more inflation data before they reassess the timing of when they expect the next rate increase to occur. We believe that a more severe slowdown in inflation is needed for officials to push back their hike expectations when they meet next.

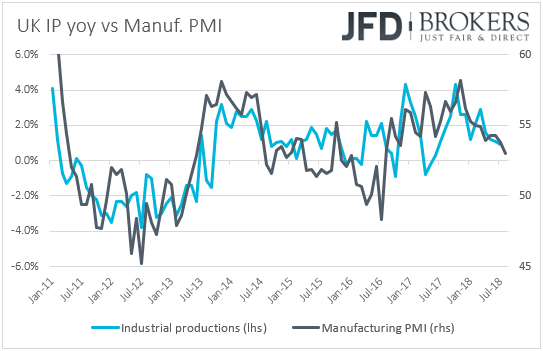

From the UK, we have industrial and manufacturing production data for August. Industrial production is anticipated to have accelerated to +0.2% mom from +0.1% in July, something that could bring the yoy rate up to +1.1% from +0.9%. Manufacturing production is expected to have rebounded 0.2% mom after falling by the same pace the previous month. This is likely to drive the manufacturing yearly rate up to +1.5% from +1.1%. Having said all these though, bearing in mind that the manufacturing PMI for the month declined to 53.0 from 53.8, we view the risks surrounding the forecasts as tilted to the downside. The nation’s trade balance for August is also coming out and expectations are for the UK trade deficit to have widened to GBP -11.8bn from -10.0bn. We get the monthly GDP data for August as well. Expectations are for a slowdown back to +0.1% mom from +0.3% mom in July, which could drive the qoq rate down to +0.5% from +0.6%.

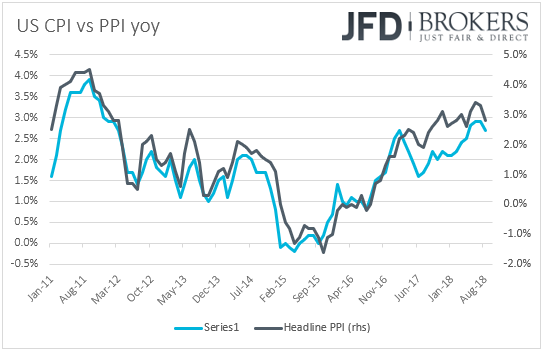

In the US, the PPIs for September a scheduled to be released. Expectations are for the headline rate to have remained unchanged at +2.8% yoy, while the core rate is anticipated to have risen to +2.5% yoy from +2.3% in August. Accelerating core producer prices could result in accelerating core consumer prices and thus, these prints may raise some speculations that the CPIs, due out on Thursday, could move in a similar fashion.

From Canada, we get building permits for August and expectations are for a 1.3% mom rebound after a 0.1% slide in July.

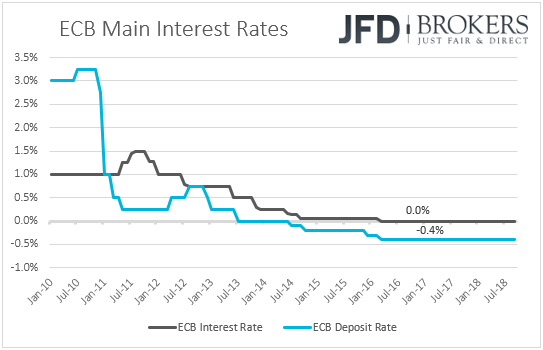

On Thursday, we get the minutes from the latest ECB policy meeting. At that meeting, the Bank repeated that asset purchases are likely to end in December and maintained the guidance that interest rates are likely to stay at current levels “at least through the summer of 2019”. At the press conference following the decision, despite the downgrade in the Bank’s growth projections, Draghi appeared fairly optimistic, noting that the balance of risks surrounding growth has not changed. What’s more, speaking at the Economic and Monetary Affairs of the European Parliament hearing a couple of weeks ago, Draghi said that he sees a “relatively vigorous” pickup in underlying inflation as the tightening labor market is resulting accelerating wage growth. Thus, although we don’t expect to get any surprises from the minutes on the guidance front, it will be interesting to see whether other officials, besides Draghi, are upbeat on the Euro-area economic and inflation outlooks.

As for Thursday’s economic data, during the European morning, we have Sweden’s CPIs for September. The forecasts suggest the CPI rate rebounded to +2.2% yoy from +2.0% in August, while the CPIF print is expected to have risen to +2.4% yoy from +2.2%. That said, once again, we will pay more attention to the core CPIF inflation metric, which excludes energy.

At its latest policy meeting, the Riksbank kept interest rates on hold and noted that rates will be held unchanged at the October gathering, and then raised either in December or February. However, after that meeting, inflation data showed that the core CPIF rate fell to +1.2% yoy, its lowest since January 2017. Thus, another slowdown in this inflation metric, or even an unchanged rate, could raise concerns that at is upcoming gathering, scheduled for the 23rd of October, the world’s oldest central bank may dismiss the December option and note that rates could be raised at the beginning of next year. We believe that a notable rebound in the core CPIF rate is needed for the Bank to keep the door open for a December hike.

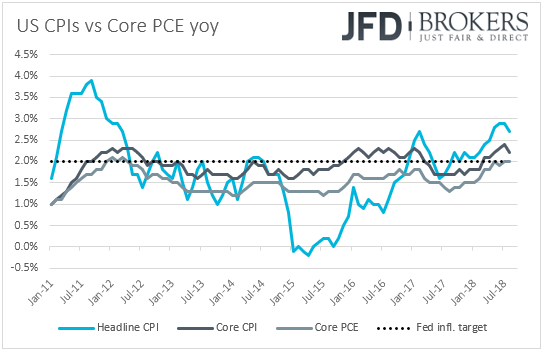

Later in the day, we get inflation data for September from the US as well. The headline CPI rate is expected to have declined to +2.4% yoy from +2.7% in August, but the core rate is anticipated to have risen to +2.3% yoy from 2.2%. Thad said, bearing in mind that the PPIs are expected to show a steady headline rate and a decent acceleration in core terms, we view the risks surrounding the CPI forecasts as tilted somewhat to the upside. Even though the Fed drives the monetary policy wheel based on the PCE inflation metrics, an upside surprise in the core CPI rate may increase bets that the core PCE index, the Fed’s preferred inflation gauge, may follow suit.

The key takeaway we got from the latest FOMC meeting, as well as by Chair Powell’s latest remarks is that Fed officials are willing to continue raising rates guided mainly by economic data, instead of how close to their neutral level interest rates are. Powell also said that interest rates could increase beyond their neutral level. On Friday, the employment data showed that NFPs rose only 134k in September, missing their forecast of 185k, while the yoy earnings rate ticked down to +2.8% from +2.9%. However, the unemployment rate slid to 3.7%, the lowest since 1969, while August NFP number was revised up. In our view, the report was decent enough to keep the Fed on track for more rate increases and accelerating underlying inflation could further support the case.

Finally, on Friday, during the Asian morning, we get trade data for September from China. Expectations are for the nation’s trade surplus to have declined to USD 21.0bn from USD 27.9bn in August. Both exports and imports are expected to have slowed to +9.1% yoy and +15.0% yoy from +9.8% and 19.9% respectively.

During the European day, we get Germany’s final CPI for September and it is anticipated to confirm its preliminary estimate of +2.3% yoy. Eurozone’s industrial production is forecast to have risen 0.4% mom in August, after sliding 0.8% in July. However, this is likely to drive the yoy rate down to -0.3% from -0.1%.

In the US, we have the preliminary UoM consumer sentiment index for October, which is expected to increase to 100.5 from 100.1. The 1-year and 5-year preliminary UoM inflation expectations are also due to be released.

by Charalambos Pissouros

JFD Brokers is an internationally licensed global provider of multi-asset trading and investment services applying a pure agency model with 100% DMA/STP execution of all client orders - direct, anonymous and MiFID compliant post-trade transparent access to 20+ LPs (Tier1 Banks, Non-Bank LPs and MTFs) for a choice of 1000+ instruments.

Author Bio: Charalambos joined JFD Brokers in 2017 as a Senior Market Analyst for the JFD Research team. He has more than 4 years of experience in analyzing financial markets, with his primary focus on the currency markets. After reviewing economic and political agendas, he evaluates how market data and events can affect the financial world, which technical levels come into play, and how bigger trends relate to corresponding economic developments. His approach is a blend of both fundamental and technical analyses. Charalambos became a Certified Financial Technician (CFTe) of the International Federation of Technical Analysts, after being rated top-of-the class during his studies and excelling in the STA diploma exams with distinction. He is now a member of the Society of Technical Analysts (STA) and the CySEC public register, and is also a holder of a BSc degree in Mathematics and an MSc degree in Actuarial and Financial Mathematics from the Aegean University in Greece.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.