Barrick Randgold Deal Breathes New Life into Gold

Commodities / Gold and Silver Stocks 2018 Oct 08, 2018 - 05:27 PM GMTBy: Richard_Mills

Despite having a rough summer, with a number of factors pushing gold below $1,200 an ounce (the high dollar, US economic growth, interest rate hikes, booming stock markets), the precious metal appears to be back in favor, with December gold futures closing Tuesday’s trading at $1,207 an ounce - a two-week high. In 10 minutes, Bloomberg reported, December gold contracts equal to 1.57 million ounces changed hands on the Comex in New York - almost 12 times the 100-day average volume at that time of day. The catalyst was fresh safe-haven demand owing to political uncertainty in Italy. A government official reportedly said Italy would be better off with its own currency, adding to doubts about the country’s fiscal situation. The EU has to pass Italy’s budget and many think it won’t cut the mustard.

Despite having a rough summer, with a number of factors pushing gold below $1,200 an ounce (the high dollar, US economic growth, interest rate hikes, booming stock markets), the precious metal appears to be back in favor, with December gold futures closing Tuesday’s trading at $1,207 an ounce - a two-week high. In 10 minutes, Bloomberg reported, December gold contracts equal to 1.57 million ounces changed hands on the Comex in New York - almost 12 times the 100-day average volume at that time of day. The catalyst was fresh safe-haven demand owing to political uncertainty in Italy. A government official reportedly said Italy would be better off with its own currency, adding to doubts about the country’s fiscal situation. The EU has to pass Italy’s budget and many think it won’t cut the mustard.

“An IMF Financial Statistics Report reveals that Egypt recently bought gold for the first time since 1978, and that India, Indonesia, Thailand and the Philippines have re-entered the gold market after years-long absences. And Bloomberg reported that the Bank of Mongolia has purchased 12.2 tonnes of gold so far this year.

The World Gold Council believes that many emerging market central banks are turning their attention to gold as after years of exposure to the U.S. dollar, and as a natural currency hedge against other reserve currencies.

The report maintains that gold is a strategic asset that can help central banks meet tactical objectives, as the international monetary system gradually shifts away from a U.S. dollar-dominated system towards a multipolar one.” Central bank demand for gold reaches 3-year high, mining.com

‘Central bank buying activity’ World Gold Council

While gold slipped under $1,200 on Wednesday, last trading at $1,198.64 at time of writing, it’s a lot better than the major down-leg gold suffered at the end of September, when it dropped to $1,182.30 on September 28. That day gold was at its lowest in six weeks due to US dollar strength, stock market gains and the US Commerce Department reporting that GDP increased at an annual 4.2%. Good economic news and a rising dollar are generally bad news for gold, which serves as a flight to safety in times of economic uncertainty.

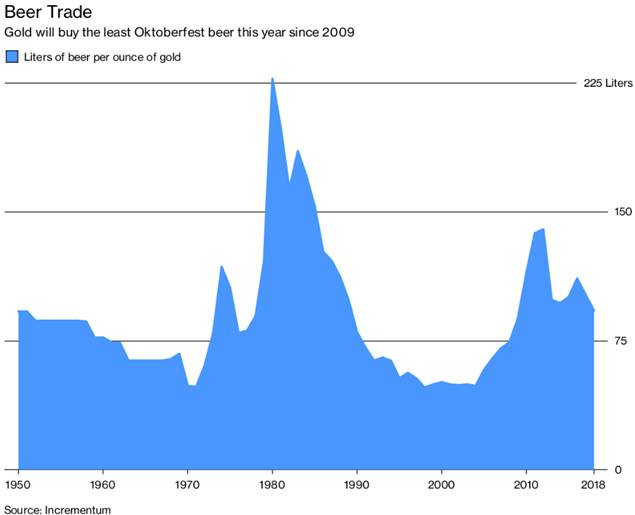

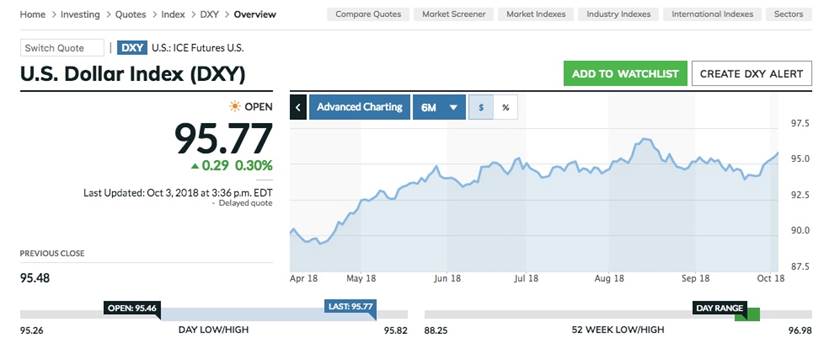

The chart below is probably the number one reason for gold’s poor performance; the US dollar has climbed steadily since April, mostly due to continued buying of US Treasuries - not because other countries are especially confident of the US economy right now (in fact the opposite is true, with the Trump Administration engaged in a protracted trade war with China) - but because there are no other alternatives. The gold price chart above is practically a mirror image of the dollar.

Read our Gold and the great stage of fools to learn why the dollar is so strong, at the expense of gold, and The beginning of the end of the dollar, about why the dollar no longer enjoys “exorbitant privilege”.

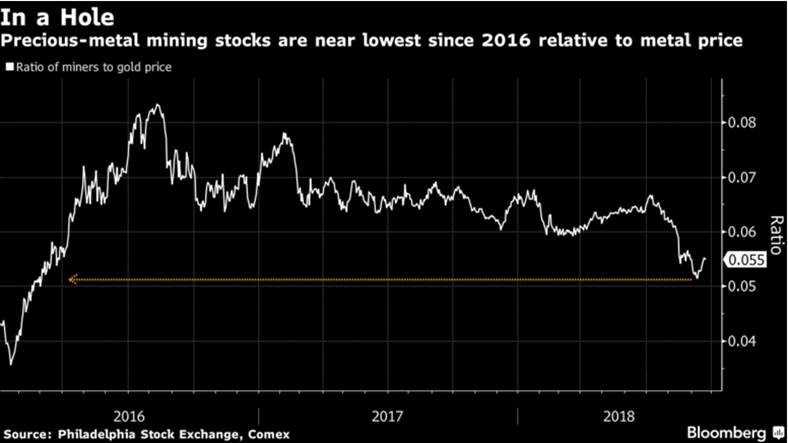

On September 24, however, gold and gold miners got an unexpected shot in the arm, in the form of a mega-merger of two gold majors, Canada’s Barrick Gold and Africa-focused Randgold Resources.

Toronto-based Barrick announced it would purchase Randgold for a spectacular $6 billion - putting Barrick on top of the gold producer heap just as it was about to be shoved off by US-based Newmont Mining. The all-share deal means Barrick shareholders own two-thirds of the company and Randgold the rest.

The merger gives Barrick strength in Africa, a region where Barrick has struggled of late, particularly a tax dispute between its subsidiary, Acacia Mining, and the Tanzanian government which has dragged on for years.

Randgold on the other hand is considered one of the most successful gold producers, delivering a shareholder return of 96% over the past decade, led by colorful CEO Mark Bristow. Mining blog Inca Kola News, which apparently broke the merger story according to the Financial Post, posted photos of Bristow dressed in hunting gear with a rifle posing next to dead big game animals.

But maintaining its African projects won’t exactly be like shooting fish in a barrel. As the FP notes, resource nationalism is beginning to rear its ugly head, giving the example of Randgold embroiled in a tax dispute with Mali over its 700,000-ounce Loulo-Gounkoto complex; the Ivory Coast, where a labor dispute threatens production at it 300,000-ounce Tongon mine; and DRC mining code revisions expected to cost the company an extra $20 million per year.

Between them, Barrick and Randgold will produce north of 6 million ounces annually, if they hold to their 2017 outputs. The merged company will own five of the 10 lowest-cost gold mines in the world.

The merger follows earlier M&A in the gold space this year, including the acquisition of Nevada-based producer Rye Patch Gold for $128 million, US silver miner Hecla Mining acquiring Klondex Mines, which has three underground gold mines in Nevada, and the swallowing up of Victoria Gold and its Eagle gold project in the Yukon by Osisko Royalties - which has a 5% royalty on the largest gold mine in Canada, Canadian Malarctic.

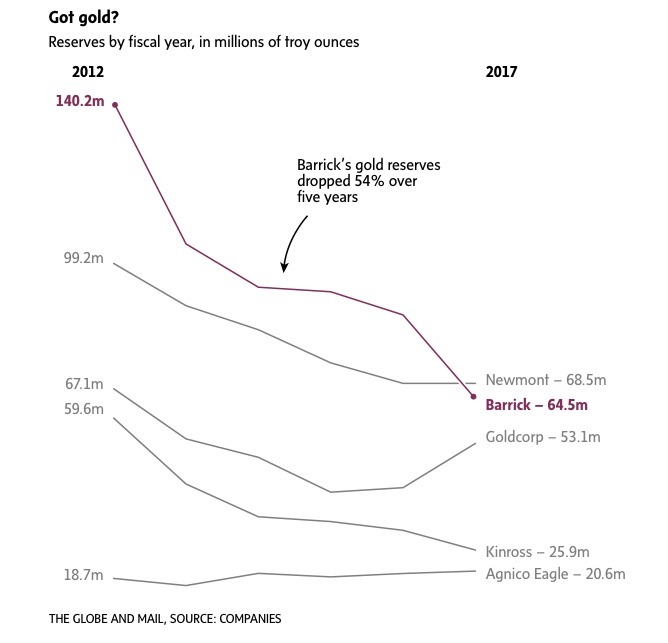

So why the M&A now? The short answer is, the majors are running out of gold. In an effort to reduce debt, Barrick has been selling non-core assets like a hoarding renter faced with an eviction notice. The company sold off $720 million worth of Nevada properties, including its Ruby Hill Mine and its half of the Round Mountain Mine. Barrick’s reserves have fallen by 54% over the last five years, to 64.5 million ounces, states the Globe and Mail.

The reasons behind flat-lining/declining gold production are numerous:

- Production declines in mature mining areas

- Slower than expected ramp-ups of output

- Development time up

- The entire resource extraction industry suffers from a lack of skilled people

- Extreme weather

- Labor strikes

- Protests

- Increasingly more remote and lacking in infrastructure projects

- Higher capex costs

- Increased resource nationalism

- Increased environmental regulation

- More complex metallurgy

- Lower cutoff grades

Peak gold?

Gold companies are just now starting to replenish their deposits through acquisitions. A Thomson Reuters report said 2016 was the first year since 2008 that gold mine output actually fell - by 22 tonnes or 3%.

South African gold production has plummeted below 250 tonnes compared to 1,000 tonnes in the 1970s, and China, the leading gold producer, is the only country to increase production in recent years.

As for new gold mines, the bear market of 2012 to 2016 meant most large gold companies slashed exploration budgets and small explorers had an extremely tough time raising cash. All of the low-hanging fruit - easy-to-mine gold deposits - have been picked, and what is left is usually remote, deep underground, and expensive to extract.

The experts agree the industry is seeing a significant slowdown in the number of large deposits being discovered. Franco-Nevada co-founder Pierre Lassonde said he doesn’t know how we’ll replace the massive deposits found over the last 130 years.

The big gold miners made some dumb moves at the top of the mining cycle, spending like drunken sailors on over-priced mines, putting themselves into debt and causing mine writedowns, then failing to buy cheap assets when the gold price tumbled in 2013 because they were tapped out. The most infamous of these was Barrick’s absurd purchase in 2011 of Equinox Minerals. Hoping to diversify into copper, Barrick paid $7.3 billion for Equinox and its Lumwana copper mine in Zambia, only to write down $4.2 billion two years later. But it wasn’t only Barrick creating shareholder value destruction – the sector incurred $85 billion of write-offs from 2010 to early 2017.

The result has been a lack of gold mining deals despite higher prices. In 2017 the value of gold mining M&A was at its lowest level in 12 years.

So we’ve been due for another round of M&A, and the Barrick-Randgold merger is evidence of the pickle gold mining companies find themselves in having sold so many of their assets or depleted existing ones. But it also adds a brush of excitement to a sector that has seen little signs of life recently.

For more on this subject, read our Unloved gold juniors ripe for the picking

That of course is good news for junior gold explorers with solid projects in safe jurisdictions (not subject to resource nationalism), that could be of interest to a mid-tier or major looking to bump up their gold inventory.

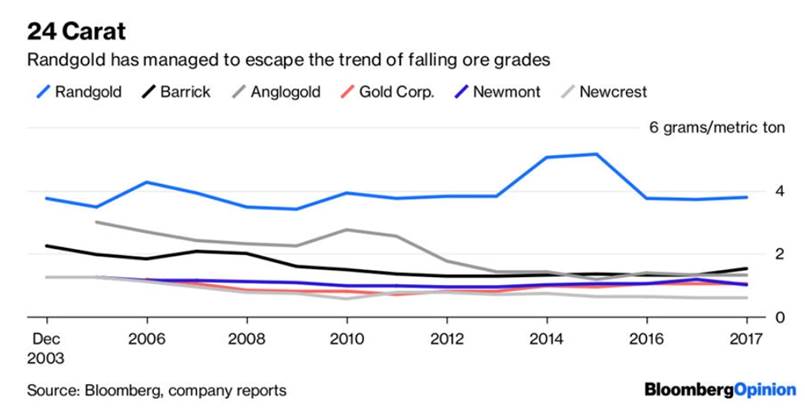

Ore grades are declining. That’s another problem, but also a catalyst for M&A. Bloomberg points out that the world’s gold reserves have fallen from an average 10 grams a tonne in the late 1960s to just one gram per tonne now. The average reserve grade of the top five gold miners is now 1.12 g/t.

However Randgold has largely been spared the curse of falling grades, mining at over 4 g/t compared to the other four top majors - Barrick, Anglogold, Newcrest and Newmont - who are at 2 grams a tonne and below. This shows that Barrick needs Randgold more than the other way round.

Looking forward, experts at the recent Denver Gold Forum seemed to agree that the bottom for gold has been reached and that it’s time for a rebalancing.

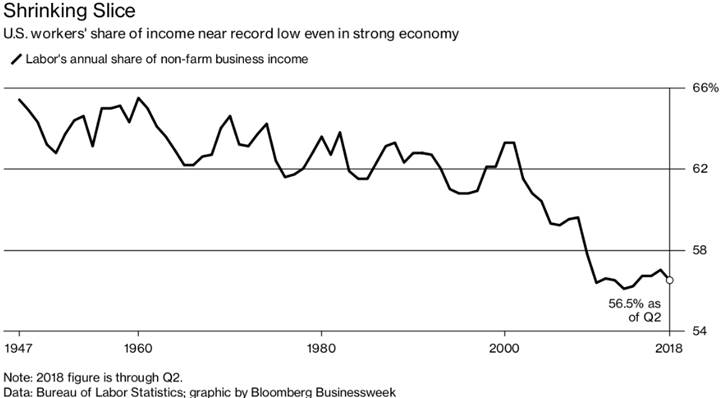

Ken Hoffman, senior expert at McKinsey Basic Material Practice, told Kitco News that a rising US deficit, coupled with more money printing (another QE?) will heat up the gold price. That deficit, by the way, is heading toward $985 billion in fiscal 2019. In other words, the US government spent 4.407 trillion but only took in revenues of 3.422 trillion. It’s 18% more than last year.

Gold is also rallying because other commodities are rising, namely oil, which closed at $85.90 on Wednesday (Brent crude). This increases the threat of inflation, which is a catalyst for gold. Right now gold is the cheapest it’s been compared to oil, in four years.

It’s all positive for the gold market. Mergers and acquisitions are heating up as gold companies position themselves to take advantage of undervalued companies and assets. Of these there are dozens of juniors out there with excellent properties ripe for the picking.

The US dollar is still a headwind for gold, but the dollar can’t stay strong forever. As we’ve written, we are witnessing what is likely the beginning of the end of the dollar. The US is unlikely to win a trade war with China, and in fact, is only making China more independent of the US, and encouraging other countries in its orbit, including Russia, to trade in rubles and Chinese yuan. Interest rate hikes are probably baked into the price of gold. We no longer see big swings every time the Fed threatens to raise rates. The hot spots around the world aren’t cooling down any, opening the door to investors who want to own gold to calm their fears of plummeting currencies.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2018 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.