USD Lifted by Data and Fed Chair Powell’s Remarks

Currencies / US Dollar Oct 05, 2018 - 02:39 PM GMTBy: Submissions

The US dollar outperformed all its major peers yesterday following solid economic data and hawkish remarks by Fed Chair Jerome Powell. Italian assets were supported by the reports that Italy’s government is planning to scale back its deficit targets for 2020 and 2021, while in the UK, PM May’s speech did not result in any major market reaction.

Dollar and Tr. Yields Surge on Upbeat US Data and Powell’s Comments

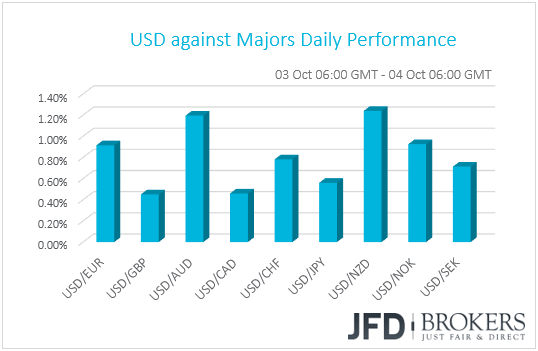

The dollar managed to outperform all the other G10 currencies on Wednesday. It gained the most against NZD, AUD and NOK, while the currencies against which it gained the least were GBP and CAD.

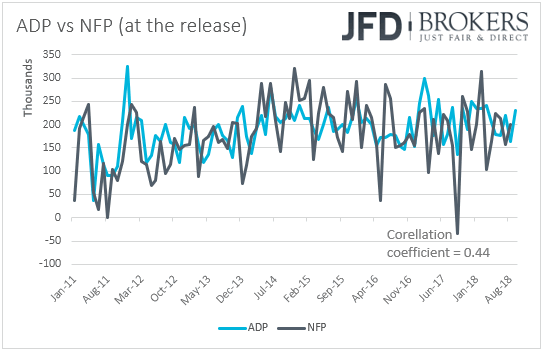

The dollar stood tall and US Treasury yields surged yesterday following solid US data as well as hawkish remarks by Fed Chair Jerome Powell. Getting the ball rolling with the data, the ADP employment report showed that the private sector gained 230k jobs in September, more than the expected 187k, and the highest since February. This may have raised bets that the NFP number, due out tomorrow, may also exceed its forecast, which stands at 185k. That said, as we noted several times in the past, the correlation between the two time-series at the time of the release (no revisions are taken into account) has been very low in recent years. Taking into account data from January 2011, the correlation stands at around 0.44. The greenback may have also been boosted by the ISM non-manufacturing index, which jumped to 61.6 in September from 58.5 in August. This marks the highest print of the index since August 1997.

The icing on the cake though was Fed Chair Powell’s speech. The Fed Chief said that he is very happy on the economy and that its expansion “can continue for quite some time”. He noted that interest rates are still distant from their neutral level and that the Fed could raise rates past that level. He also said that interest rates are still accommodative.

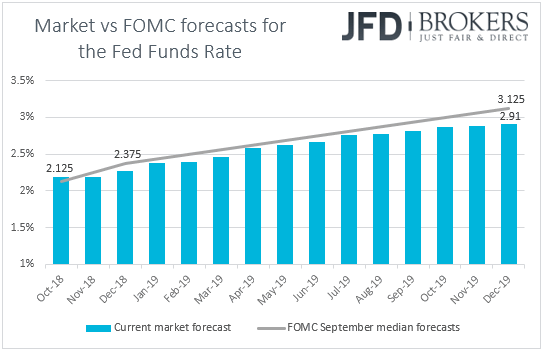

In our view, his remarks confirm more or less the message we got from the latest FOMC meeting. Although officials removed from the statement the part describing policy as accommodative, they remain willing to continue raising rates guided mainly by economic data, instead of estimates on how close to their neutral level interest rates are. However, the market may have still reacted to Powell's remarks, as this time, he clearly stated that interest rates could move beyond neutral. For us, this means that, even though the new dot plot continues to point to another hike this year and three more in 2019, if data support so, the Committee could well deliver four hikes next year as well. Currently, the market implies a near 80% chance for a December hike, while it is fully pricing in only two more for 2019. This suggests that there is room for the market to bring its forecasts closer to the Fed’s if data continue to come in on the strong side, something that could keep the greenback supported, especially against currencies the central banks of which have a long way to go before the consider raising rates, like the Aussie and the Kiwi.

With regards to the equity markets, most major EU and US indices closed in positive territory, with Dow Jones hitting a new record high for the second consecutive day. That said, the US indices came off their highs, perhaps on concerns of too aggressive hikes by the Fed. Higher interest rates mean higher borrowing costs for companies, which could hurt their profitability. Thus, more comments or data suggesting a faster-than-expected rate path by the Fed may prompt some investors to abandon the equity market and thereby, the US indices could correct a bit lower. This could be the case if the US employment data, due out tomorrow, reveal accelerating wage growth, which could be translated into higher inflation in the foreseeable future.

The EU indices may have been supported by the reports suggesting that the Italian government plans to reduce its budget deficit targets for 2020 and 2021. Italy’s FTSE MIB closed in the green for the first time after 5 red days, while the nation’s 10-year government bond yields slid 3.27%. The spread between Italian and German 10-year yields, a widely watched indicator of Eurozone political tension, narrowed to 282.7 bps from 303.3.

In the UK, PM Theresa May’s speech at the annual Conservative Party conference proved to be a non-event, at least in terms of market reactions. May tried to unite members of her party, noting that divisions risk ending up with no Brexit at all. Britain is not afraid to leave the EU without a deal, but no deal would be a bad outcome for both sides, she said.

USD/JPY – Technical Outlook

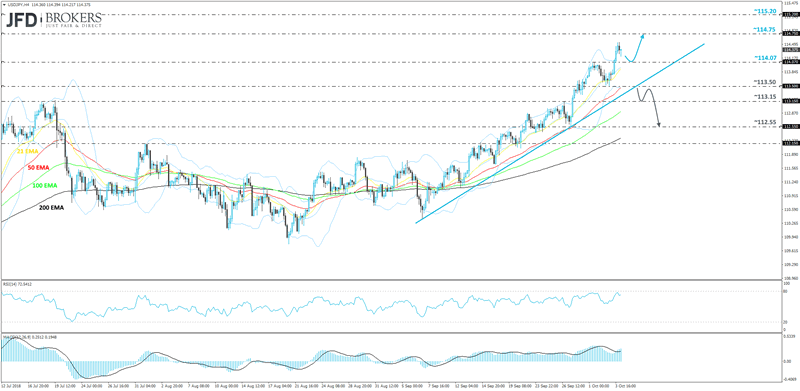

The US dollar continues to strengthen across the board and the Japanese yen is one of those currencies that is feeling the greenback’s pressure. USD/JPY has been trading steadily in the upwards direction, supported by a short-term upside line, taken from the low of the 7th of September. Even if the pair decides to retrace slightly back down, still, as long as the upside line remains intact, such a move could be seen as a temporary correction before the bulls take advantage of the lower rate and push USD/JPY up again.

The idea of a temporary corrective move lower could be confirmed by a break below the 114.07 level, which was Monday’s high. This way we could start looking at the aforementioned short-term upside line, which could be the next strong support area, where the buyers could try and step in again, in order to lift the pair higher again. Of course, we should keep in mind that if the previously mentioned 114.07 hurdle will continue to hold, the potential bounce could happen earlier, and USD/JPY could then aim towards the 114.75 barrier, marked by the highest point of November last year.

Alternatively, for us to get comfortable with slightly deeper declines, we would need to see a close, not only below the abovementioned short-term upside support line, but also a close below the 113.50 zone, which could open the path towards the support area around 113.15, which acted as the day’s resistance on the 26th of September. If the selling pressure remains, USD/JPY could easily slide to the 112.55 obstacle, marked by the low of the 27th of September.

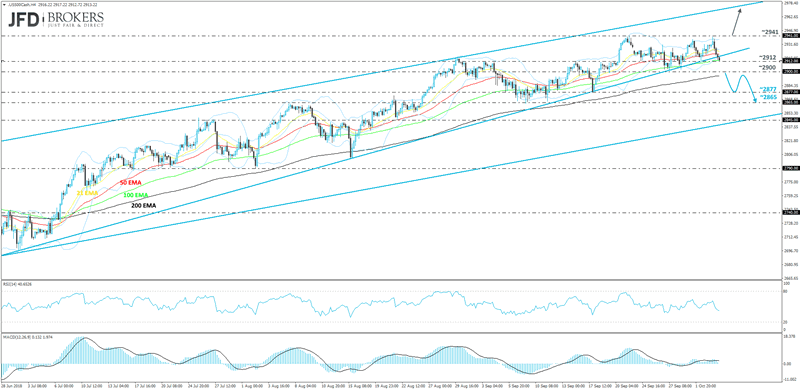

S&P 500 – Technical Outlook

After struggling to overcome the all-time high that was recently established near the 2941 level, the S&P 500 cash index has now turned south and has broken the short-term upside support line taken from the low the 28th of June. Even though this could be a sign of upcoming weakness in the short-run, overall, the index continues to trade within a rising channel formation that started in the end of March. For now, we will remain cautiously bearish from the short-term perspective and wait for a confirmation close below one of our key support areas.

Although the S&P 500 has already broken the short-term upside support line that was mentioned previously, for us to get comfortable with the downside scenario, we need the index to close below the 2900 barrier. This is where we could start aiming for the 2877 obstacle, or even the 2865 area, marked by the lowest point of September. If these two support zones are not able to withstand the bear-pressure, the lower bound of the aforementioned rising channel could get tested.

That said, for us to start considering the upside from the short-term perspective, we would need S&P 500 to get back, not only above the short-term upside support line, but also above the 2941 level, which was the all-time high. The index will start forming new all-time highs and the next stop for it could be the upper bound of the aforementioned rising channel.

As for Today’s Events

Thursday’s economic agenda appears to be relatively light. From the US, we get factory orders for August and initial jobless claims for the week ended on the 28th of September. Factory orders are expected to have rebounded 2.1% mom after sliding 0.8% in July, while initial jobless claims are anticipated to have declined somewhat, to 211k from 214k the week before. In Canada, we get the Ivey PMI for September, which is forecast to have risen to 62.3 from 61.9 in August.

As for tonight, during the Asian morning Friday, Australia’s retail sales are expected to have risen 0.3% mom in August after stagnating in July.

We also have two speakers scheduled for today: Fed Board Governor Randal Quarles and ECB Executive Board Member Benoit Coeure.

by Charalambos Pissouros

JFD Brokers is an internationally licensed global provider of multi-asset trading and investment services applying a pure agency model with 100% DMA/STP execution of all client orders - direct, anonymous and MiFID compliant post-trade transparent access to 20+ LPs (Tier1 Banks, Non-Bank LPs and MTFs) for a choice of 1000+ instruments.

Author Bio: Charalambos joined JFD Brokers in 2017 as a Senior Market Analyst for the JFD Research team. He has more than 4 years of experience in analyzing financial markets, with his primary focus on the currency markets. After reviewing economic and political agendas, he evaluates how market data and events can affect the financial world, which technical levels come into play, and how bigger trends relate to corresponding economic developments. His approach is a blend of both fundamental and technical analyses. Charalambos became a Certified Financial Technician (CFTe) of the International Federation of Technical Analysts, after being rated top-of-the class during his studies and excelling in the STA diploma exams with distinction. He is now a member of the Society of Technical Analysts (STA) and the CySEC public register, and is also a holder of a BSc degree in Mathematics and an MSc degree in Actuarial and Financial Mathematics from the Aegean University in Greece.

Disclaimer:

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Brokers, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Brokers analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyzes and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyzes and must therefore be viewed by the reader as marketing information. JFD Brokers prohibits the duplication or publication without explicit approval.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading CFDs with the Company. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.