Bitcoin Time for More Action?

Currencies / Bitcoin Oct 03, 2018 - 12:25 PM GMTBy: Mike_McAra

Bitcoin has been moving up for some time now. The path to higher values has been a rocky one and Bitcoin bulls might be getting some encouragement. Whether this translates to a bullish outlook is another question entirely.

Bitcoin has been moving up for some time now. The path to higher values has been a rocky one and Bitcoin bulls might be getting some encouragement. Whether this translates to a bullish outlook is another question entirely.

Not all governments are hostile to Bitcoin. Actually, a lot of governments are simply not sure what Bitcoin is and how to approach it. The government of Malta stands out as an example of how officials might actually try to understand the currency and regulate it. In an article on CoinDesk, we read:

Now, in an address to the United Nation's General Assembly, Malta Prime Minister Joseph Muscat has said he sees blockchain technology as the tool which will allow bitcoin and crypto to "inevitably" gain widespread, mass adoption and become the future of money.

Muscat has previously said he believes bitcoin and blockchain have the ability to eliminate third party service providers, giving users more freedom over information and money.

(…)

"By being the first jurisdiction worldwide to regulate this new technology that previously existed in a legal vacuum. Blockchain makes cryptocurrencies inevitable future of money. More transparent, it helps filter good business from bad business.”

This is a pretty interesting development. We are actually seeing one country talking about regulating Bitcoin and including it in the financial system. Is this a breakthrough? For starters, it is hard to overlook the fact that Malta is a rather small country. This means that whatever its government does, doesn’t necessarily have to have any impact on the developments in the broad Bitcoin market. But we can’t brush this event off either.

The willingness of one government to regulate Bitcoin provides us with a hint that it might not be completely unreasonable to expect governments to regulate Bitcoin in the years to come. So, Malta gives us something to look forward to. That is, we are on the lookout for systemically important countries changing their approach to Bitcoin. For instance, any similar comments from the U.S. government could be interpreted as bullish. We are not at this point yet, though.

Bitcoin Moving Higher?

On BitStamp, Bitcoin has been, on average, trading higher in the last three weeks. This might be encouraging for Bitcoin bulls. But is it a game-changer?

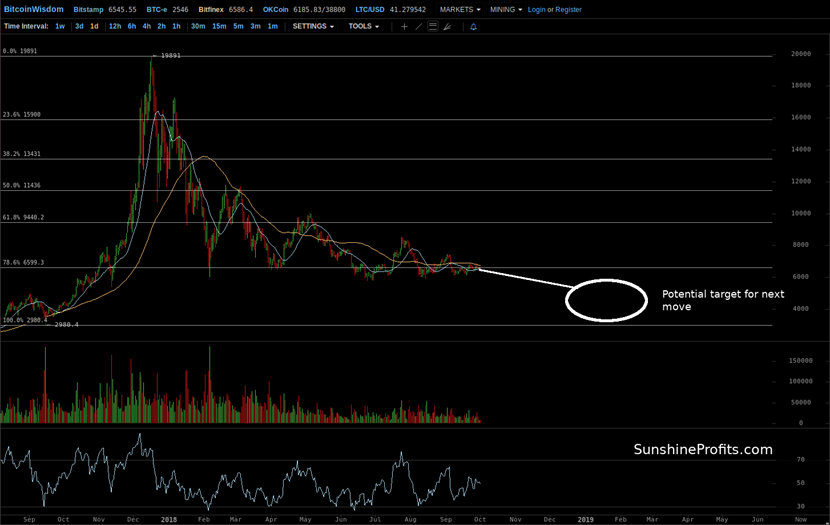

In our opinion, it is not. Even though the currency has been generally trending higher, there are still other factors to consider. One of them is the fact that the most prominent moves to the upside took Bitcoin above the 50% Fibonacci retracement level but were stopped by the 38.2% level. Second, the currency is now back below the 50% level and this suggests that the recent move up might have broken down. Third, the recent two local tops – the last two ones formed in the last month – follow a pattern of a lower top, which suggests that the move up might have dried up.

The mentioned factors point to possible lower values for Bitcoin. The action of the last three weeks looks like a correction within a more pronounced move down. The immediate level to which Bitcoin could drop is slightly above $6,000. It could turn out to be the trigger for more action to the downside.

$6,000-6,500 Area

On the long-term Bitfinex chart, we are seeing a move to the upside but it is pretty clear that this move pales in comparison with other moves from the not-so-distant future.

The long-term chart also provides us with an indication that Bitcoin seems to be dancing around the 78.6% Fibonacci retracement level based on the rally from around $3,000 to the all-time high around $20,000. This line seems to have coincided with the February bottom, the April one, and the currency has been moving around it since mid-June. If we see a sustained move below this line, then it might provide a trigger for the move down.

But there’s another level quite close, which could also turn out to be the beginning of more significant declines. Namely, $6,000 is the support level suggested by a different set of Fibonacci retracements (the ones based on the February rally) and by recent lows. It would seem that together, these two levels suggest that the $6,000-6,500 area is a place where powerful declines could start. And we’re right at the upper boarder of this area (at the moment of writing).

It is entirely possible that we could see a move up from the current levels, but the signals that we see in the market suggest a bearish outlook. Any move to the upside from here might be volatile and quickly reversed to the downside.

Summing up, in our opinion both short-term and long-term signals suggest a bearish outlook.

If you have enjoyed the above analysis and would like to receive free follow-ups, we encourage you to sign up for our daily newsletter – it’s free and if you don’t like it, you can unsubscribe with just 2 clicks. If you sign up today, you’ll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up now.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Mike McAra Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.