Omanization: a 20-year Process to Fight Volatile Oil Prices

Commodities / Crude Oil Sep 18, 2018 - 11:41 AM GMTBy: Ben_Jardine

The stark realisation that the oil industry, with its volatile fluctuations, is an unreliable source of income for the Sultanate of Oman, has encouraged its leaders in 1988 to introduce what is commonly referred to as the ‘Omanization’ of its economy. In short, this means that through its National Program for Enhancing Economic Diversification (Tanfeeth), the Omani government has decided to develop the following sectors: manufacturing, transport, logistics, and tourism. This they hope, will transform its economy from one that is less reliant on its oil reserves and expat workers, to one that is self-sufficient at its core.

Many members of The Gulf Cooperation Council (GCC) have already started this process over a decade ago, notably the UAE and Qatar and more recently KSA with many government reforms enabling it to concentrate on high tech and tourism. This represents a refreshing outlook on the GCC which is widely accused of being in control of the oil taps of OPEC, and thus, affecting oil prices across the world, something that has encouraged many countries to invest billions of dollars in non-oil industries such as electric cars and renewable energy.

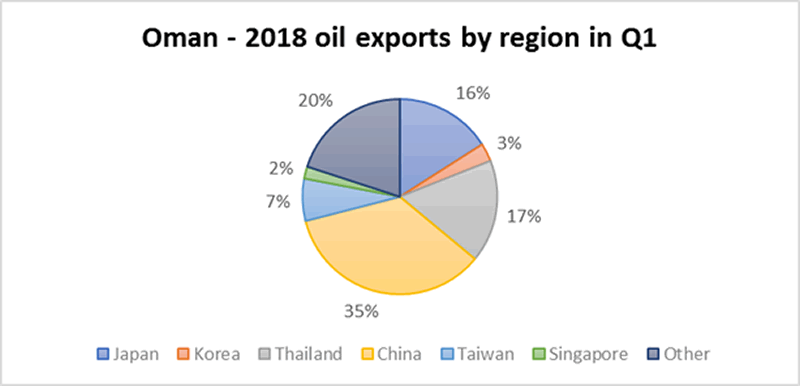

After a somewhat sluggish three years of oil prices affecting the sultanate economy, things are looking brighter so far this year. According to the National Center for Statistics and Information, Q1 has represented a 27.2% growth in total export revenue for Oman when compared to the same period last year. The total export revenue for the first quarter of 2018 hit OMR3.76 billion, compared with OMR2.96 billion in the first quarter of 2017. The value of oil and gas exports stood at OMR2.36 billion, equivalent to almost 63% of the total value of commodity exports in the first quarter of 2018, thanks to an increase in the price of Omani crude oil. Of the total exports from the oil and gas sector, OMR1.75 billion was from oil, while liquefied natural gas exports accounted for OMR394.3 million during the period, revealed the NCSI report.

On the down side, the rating agency forecasts Oman’s fiscal deficit to remain at 5% to 7% of GDP in the next five years. Their debt will exceed 50% of GDP by 2019 and rise above 60% by 2021. This follows $5 billion worth of bonds sold only a year ago by the Omani government. It is nearly two years ago since Oman has launched a USD$200m Oman Technology Fund (OTF) to invest in start-up technology companies around the GCC and the world. At the time of the launch, Dr Ali bin Masoud bin Ali al Sunaidy, the Minister of Commerce and Industry said that “the fund will invest for positive future returns, nationally and regionally. As part of the government’s diversification strategy, technology and a connected digital society have been identified as key development areas for Oman and a significant driver towards an increasingly diversified national economy.”

He also added that “The fund will put all their efforts towards positioning the sultanate as an attractive tech hub within the region, which will directly and indirectly benefit new and existing ITC businesses in Oman, while working to deliver sustainable future dividends that benefit the nation.” This move is happening in conjunction with the rise of popularity in online betting in Oman, as some are looking for another possible revenue stream. It is important to note that gambling remains illegal in Oman, as it is in all the Arabian Peninsula, this is due to the nations’ very conservative interpretation of the Quran, which does not allow gambling. Perhaps this is something that will change, as countries such as the UAE are more lenient when it comes to horse racing, so who knows maybe in a few years’ time Arabian betting will become the norm to help boost the Oman economy.

The Oman economy will continue to depend on its traditional oil industry to sustain its growth, however, glancing across to its neighbour the UAE and its ability to diversify its own economy to attract investment in other industries such as infrastructure, tech, and tourism will help to ensure that the Sultanate remains a strong player in the world economy. It remains to be seen how the shifting sands of the Oman economy will shape the future of Oman in the next decade.

By Be Jardine

© 2018 Copyright Ben Jardine - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.