Gold Stocks Forced Capitulation

Commodities / Gold and Silver Stocks 2018 Sep 15, 2018 - 07:45 PM GMTBy: Zeal_LLC

The gold miners’ stocks suffered a rare capitulation selloff over the past month or so. Selling cascaded to extremes as stop losses were sequentially triggered, battering this contrarian sector to exceedingly-low levels. While very challenging psychologically, capitulations are super-bullish. They rapidly exhaust all near-term selling potential, leaving gold stocks wildly oversold and undervalued which births major new uplegs.

The gold miners’ stocks suffered a rare capitulation selloff over the past month or so. Selling cascaded to extremes as stop losses were sequentially triggered, battering this contrarian sector to exceedingly-low levels. While very challenging psychologically, capitulations are super-bullish. They rapidly exhaust all near-term selling potential, leaving gold stocks wildly oversold and undervalued which births major new uplegs.

Capitulations are quite rare which makes them inherently unpredictable. The vast majority of selloffs end normally well before they snowball into capitulation-grade plummets. But very seldomly heavy selling just continues to intensify rather than abate like usual. The word capitulation means “the act of surrendering or giving up”. That’s exactly what happens in these extraordinary selling events, traders stampede for the exits.

Exceptionally-bearish sentiment definitely plays a major role in capitulations. As serious selling mounts, the resulting technical carnage leaves speculators and investors alike incredibly disheartened. The pain is so great that all but the most-hardened contrarians give up and sell low. But forced selling is equally if not more important in fueling capitulations. That likely played a bigger role than sentiment over this past month.

All prudent traders protect their capital deployed in stocks with stop-loss orders. They are essential in a sector as super-volatile as gold stocks, as significant-to-serious individual-company and sector-wide risks always lurk. Stop losses are typically set loose enough to weather any normal volatility. But when selling grows severe, stock prices are bashed low enough to trigger stops unleashing a vicious circle of selling.

The lower stock prices fall, the more stop-loss orders are tripped. That adds to the selling pressure and pushes prices lower still, hitting even more stops. So even the most-rational traders grounded so deeply in fundamentals that nothing scares them contributed to the capitulation plunge via mechanical stop-loss selling. We are in that camp, suffering quite a few stoppings in our trades despite no emotional distress.

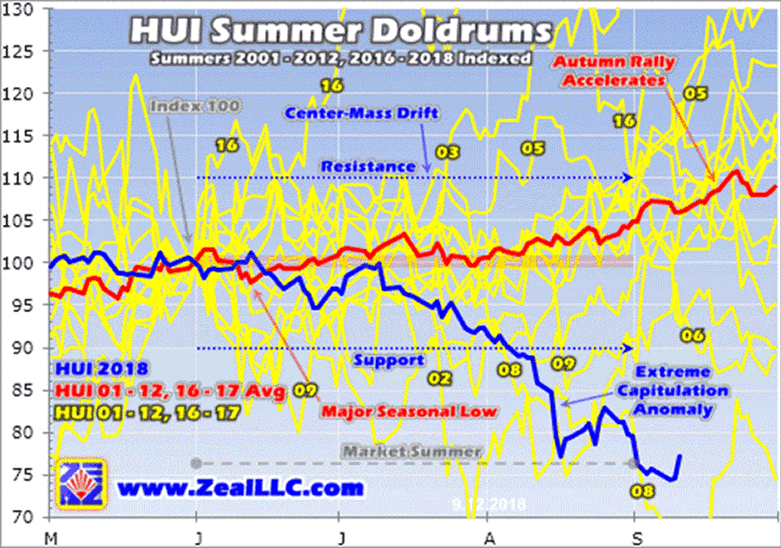

The resulting cascading technical carnage was extreme by any measure. This first chart is updated from my early-June essay on gold’s summer doldrums. It shows how gold stocks have behaved in summers of all modern bull-market years as rendered by their flagship HUI NYSE Arca Gold BUGS Index. Every year is individually indexed to 100 as of May’s final close, with all gold-stock action recast off that common base.

This approach leaves gold stocks’ summer trading perfectly comparable in percentage terms regardless of prevailing gold-stock price levels. The yellow lines show how the HUI performed in the summers from 2001 to 2012 and 2016 to 2017. They are all averaged together in the red line, which reveals this sector’s normal summer tendencies. Typically gold stocks are flat to weaker until late July, then start rallying again.

But the recent extreme capitulation anomaly made the summer of 2018 one of the worst on record for the gold stocks, as the blue line divulges. Gold stocks usually have a center-mass drift in market summers running 10% from May’s final close. But at worst in mid-August, the gold stocks had plummeted a nauseating 22.8% summer-to-date! That was way beyond even the weak seasonal norms of market summers.

So realize there was nothing normal or foreseeable about gold stocks’ recent brutal plunge, everything about it was exceptional. Again very few selloffs keep on cascading into full-blown-capitulation territory. When such events rarely and surprisingly arise, all speculators and investors can do is hunker down and ride them out. Understanding what odd confluence of events fueled them clarifies what is likely coming next.

This next chart shifts to the leading GDX VanEck Vectors Gold Miners ETF, the most-popular gold-stock investment vehicle. Gold miners’ stocks are ultimately leveraged plays on the gold price, which directly drives their profits. Gold itself actually remains in a bull market birthed in mid-December 2015, so the gold stocks are too still considered to be in bull-market mode despite this recent extreme capitulation anomaly.

After hitting a fundamentally-absurd all-time low in GDX terms in January 2016, gold stocks skyrocketed in a powerful new bull. GDX soared 151.2% higher in just 6.4 months, driven by a parallel 29.9% new gold bull! Then a normal and healthy bull-market correction from those resulting wildly-overbought levels was greatly exacerbated. After Trump won the presidency, stock markets surged dramatically which hit gold hard.

Gold is the ultimate contrarian investment, tending to rally when stock markets weaken. When stocks are powering to seemingly-endless new record highs, gold investment demand really wanes. Thus gold and the stocks of its miners were trapped in long consolidations as stock markets surged over the past couple years or so. GDX settled into a meandering consolidation basing trend between $21 support to $25 resistance.

That held rock-solid from late December 2016 to early August 2018, a long 19.3-month span. Before this recent extreme capitulation anomaly, GDX’s key $21 support was challenged no less than 5 times in that timeframe. It held every single time, soon bouncing gold stocks back up higher into their consolidation trend channel. These long-term pre-capitulation technicals offered little warning of an impending breakdown.

While gold stocks had carved lower highs in the first half of 2018, that had happened before in the first half of 2017. Yet out of their summer-doldrums lows that July, gold stocks surged dramatically in their usual autumn rally which drove GDX above its $25 resistance. Pretty much everyone was bearish on gold stocks leading into August 2018, but that’s normal when they’re low in their trend during market summers.

So there was nothing unusual technically or sentimentally leading into gold stocks’ latest capitulation plummeting. I’ve intensely studied and actively traded this sector for decades now, and still can’t find any way to divine when normal selling will suddenly snowball into capitulation-grade selling. I sure wish these exceedingly-rare events were predictable, but the sad truth is they’re not. Capitulations are incredibly anomalous.

But they can definitely be understood after the fact. The gold stocks were actually faring reasonably well for most of this past summer. GDX and the HUI entered June at $22.34 and 180.1, relatively-low levels reflecting the bearish sentiment plaguing gold stocks. In mid-June then early-July, they closed as high as $22.66 and 182.2 then $22.68 and 179.7. Gold stocks were flat in the middle of their consolidation basing trend.

Gold itself peaked at $1302 in mid-June, faring really well for the early summer doldrums. But then out of the blue selling ignited. Gold price action is dominated by gold-futures speculators, which use extreme leverage to wield outsized influence. On June 14th the European Central Bank announced it would finally wind down its massive quantitative-easing campaign at year-end. That oddly hammered the euro 1.8% lower.

While ending QE money printing was inarguably hawkish, the ECB tried to mitigate that blow by tapering a final time and promising no rate hikes before the summer of 2019. The latter was a surprise. As the euro accounts for over 4/7ths of the US Dollar Index’s weight, the dollar surged on that falling euro. Overnight gold-futures speculators sold aggressively on the strong dollar, hammering gold 1.7% lower the next day.

That unleashed the events that would ultimately snowball into the gold-stock capitulation over the next couple months or so. The rallying US dollar spawned extreme short selling in gold futures, which forced gold lower. The falling gold prices combined with strong stock markets motivated investors to flee as well. This pressured the world’s leading gold ETFs led by GLD to spew much physical gold bullion into the markets.

That bashed gold prices lower still, leading gold-futures speculators to press their advantage with even more short selling. The more they sold short, the more gold fell. The more gold fell, the more they sold short. This culminated in speculators’ gold-futures short positions soaring to record extremes far beyond anything ever witnessed before! My essay last week explained all this in depth, it’s critical to understand.

With spec gold-futures shorts skyrocketing and investors hemorrhaging gold in sympathy, the gold stocks remained surprisingly resilient. During the first 5 weeks of this epic gold selling leading into late July, gold plunged 6.1% from $1302 to $1223. Normally gold stocks leverage gold’s downside by 2x to 3x, but GDX and the HUI only slid 4.8% and 6.3% in that span! Such relative strength certainly didn’t herald a capitulation.

I suspect the main reason gold stocks weren’t down a normal 12% to 18% by then was most of the weak hands had long since exited this battered sector. Only the hardened contrarians remained, and they rightfully weren’t worried about $1225 gold. Why? GDX’s major gold miners were reporting their Q2’18 all-in sustaining costs, which would eventually average just $856 per ounce. $1225 remained very profitable.

But gold kept drifting lower still into late July as already-record-high spec gold-futures shorts ballooned even higher. On August’s opening trading day, gold fell 0.6% to $1216 which was a fresh year-to-date low. August is normally gold’s 4th-best month of the year seasonally, enjoying big average gains of 2.2% in modern bull-market years! That mounting disconnect drove GDX and the HUI lower to $21.11 and 164.5.

That was right at GDX’s major $21 support line that had held strong for over a year and a half, do-or-die time technically. Complicating matters, GDX and the HUI were down 5.5% and 8.7% summer-to-date at that point. The major gold miners’ stocks were nearing levels where tight stop losses were set. Since this sector is so darned volatile, I’d define tight to loose as 10% to 25% trailing. Tight stops were within range.

Sectors always look terrible technically and feel miserable sentimentally when they slide down near their major support zones. So even into the first week of August there was no indication of an impending rare extreme capitulation plummeting. GDX was stabilizing right around $21, despite gold drifting a bit lower. It closed between $1208 to $1213 in August’s initial few trading days, and gold stocks largely held steady.

Considering the epic record-extreme gold-futures short selling and heavy differential-GLD-share selling, gold was holding up impressively well. As of August’s first Friday, gold had fallen 6.8% since mid-June on roughly 111.0k contracts of spec gold-futures shorting and a 4.1% GLD draw. Those were the equivalent of 345.3 and 33.9 metric tons of selling respectively! GDX and the HUI had only lost 6.6% and 9.6% in that span.

Again that was relatively light compared to gold, with gold stocks leveraging its fairly-big summer-to-date losses by just 1.0x and 1.4x. With all the information available even at that point, there was no reason to expect an extreme capitulation anomaly. Technicals and sentiment were on a precarious edge, but that’s the way they always look at major support approaches. They finally started to give way Monday August 6th.

Gold fell another 0.5% to $1207 that day on speculators continuing to short sell gold futures. That must have been when tight stop losses started to trigger, as GDX and the HUI both fell 1.2% that day. Despite gold bouncing 0.3% the next, those gold-stock losses accelerated with 1.1% and 1.7% follow-on drops. That pushed GDX decisively under its strong $21 support for the first time, meaning more than 1% below.

But even after that sharp lurch lower, gold and the gold stocks again stabilized for the next several trading days. While the capitulation had started in hindsight, even as late as Friday the 10th it was impossible to discern in real-time. Unfortunately it would hit with full force overnight the following Sunday, the dam of stop losses breaking as heavy selling triggered them in rapid succession. The catalytic spark was quite odd.

The USDX had surged strongly in early August because of a mounting emerging-market-currency crisis led by Turkey. Month-to-date by Monday the 13th, the Turkish lira had cratered by nearly half! Turkey’s central bank was getting desperate, so at 1am EDT it released a statement promising it would “take all necessary measures” to defend the lira. Among other things, it said it was ready to release $3b worth of gold.

At $1209 that would represent 77.2t, a big slug of gold to hit markets fast. It wasn’t clear whether that central bank actually sold any gold or not, but within minutes heavy futures selling slammed gold. It plunged 1.5% to $1193 that Monday, breaking below $1200 for the first time since mid-March 2017. That is important technical and psychological support for gold, so seeing it falter unleashed serious gold-stock selling.

That day GDX and the HUI plunged 2.8% and 3.4% on stop losses being triggered. That continued the next despite a slight gold bounce, with additional 1.1% and 1.3% losses. Then on Wednesday the 15th at peak vulnerability, another 1.5% gold selloff on speculators’ extreme gold-futures shorting hammered it down to a 19.3-month low of $1176. GDX and the HUI plummeted another 5.9% and 6.1% that brutal day!

That extreme largely-mechanical forced selling persisted another day as well with further 2.4% and 3.0% losses. In just 4 trading days, GDX and the HUI had collapsed 11.7% and 13.1%! That was a full-blown capitulation by any definition. The gold stocks hadn’t been lower since early February 2016. And down a catastrophic 18.7% and 22.8% summer-to-date, the great majority of stops had been triggered and executed.

Capitulation climaxes mark major, major bottoms because those extreme anomalous selloffs suck in and exhaust all available near-term selling. And that looked like the end of it since gold and its miners’ stocks all enjoyed solid bounces over the next 4 trading days. The radically-oversold gold stocks soared 5.0% in both GDX and HUI terms in that span! Contrarian traders were increasingly redeploying stopped capital.

That really should’ve capped the capitulation, but unbelievably in late August and early September something of an echo capitulation erupted. Gold once again slid under $1200 on specs adding even more shorts to their already-crazy-extreme pile. So over 7 trading days straddling the start of this month, GDX and the HUI plummeted another 7.3% and 8.4% to insane deep new capitulation lows of $17.61 and 134.0!

Some of this was newly-deployed gold-stock trades in the heart of mid-August’s original capitulation getting stopped out again. That would mostly be the tight stops too restrictive for this super-volatile sector. With bearishness off the charts after that first capitulation plummet, there were virtually no buyers in this echo one. So any selling in individual gold miners on bad news mushroomed unchecked, it was a bloodbath.

This extreme capitulation anomaly left gold stocks radically oversold and wildly undervalued, poised for a massive mean-reversion rally higher. Symmetrical V-bounces are common after capitulations, making them among the best-possible times to back up the truck and buy low. Trading at miserable 2.6-year lows, these fire-sale gold-stock prices weren’t fundamentally-righteous. Their operations remained very profitable.

At the major GDX gold miners’ average all-in sustaining costs of $856 per ounce in Q2, they were still collectively earning strong profits of $339 per ounce at $1195 gold! These are hefty 28% margins that most industries would kill for. Yet gold stocks were priced as if they were spiraling into bankruptcy, it was crazy. The major gold miners’ Q2’18 fundamentals were quite strong, so super-low stock prices aren’t righteous.

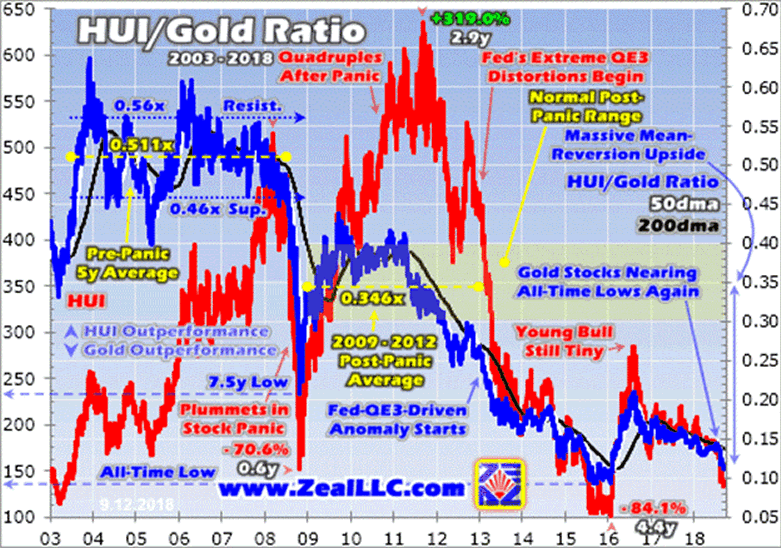

A great fundamental proxy for gold-stock price levels relative to prevailing gold prices is the HUI/Gold Ratio. It distills down the core relationship between gold prices, gold-mining profitability, and gold-stock prices. Thanks to the stunning capitulation selloffs over this past month, the gold stocks are now almost as undervalued relative to gold as they’ve ever been. This week the HGR plunged down to just 0.112x!

That’s way below the 0.207x seen at worst in late 2008’s first-in-a-century stock panic, the most-extreme fear event of our lifetimes. After that extreme sentiment anomaly that wasn’t justified fundamentally, the gold stocks more than quadrupled. Over the next 2.9 years GDX and the HUI skyrocketed 307.0% and 319.0% higher! Extreme lows in gold-stock prices relative to gold simply aren’t sustainable fundamentally.

The all-time-low in the HGR of 0.093x was last seen in mid-January 2016. That’s actually not much lower than today’s crazy levels. Gold stocks again soared out of that extreme anomaly, with GDX and the HUI enjoying huge gains of 151.2% and 182.2% in just over a half-year! Once again today we are faced with an extreme situation that can’t last forever. Gold stocks must and will mean revert dramatically higher.

And their potential upside from extreme capitulation lows is huge. From 2009 to 2012 after that stock panic, the HGR averaged 0.346x in those last normal years before the Fed’s QE3 levitated the US stock markets. Assuming gold stays around $1200, that implies gold stocks ought to mean revert far higher to around 415 in HUI terms. That’s a triple from here, and conservatively assumes no overshoot or gold rally.

Mean reversions out of extreme lows seldom stop at the averages, but surge on towards the opposite extreme. That implies a much-higher HGR the next time gold stocks are really back in favor. And gold is heading way higher too on the proportional extreme gold-futures short covering inevitable after the epic record shorts that fueled the recent gold plunge. Higher gold prices make for much-greater gold-stock upside.

There’s no sector in the world more hated and thus more undervalued than gold stocks today. Yet they just like all stocks must ultimately trade at reasonable multiples of their underlying earnings. When gold starts powering higher consistently again, likely on long-overdue stock-market weakness, the gold stocks will start returning to favor. Their prices will rapidly regain ground relative to gold as investment floods back in.

While it’s hard to buy low after a capitulation when bearishness is suffocating, that’s when fortunes are won. The gold stocks are a coiled spring ready to explode higher again after years of neglect, probably the best contrarian investment in all the markets. While inherently-unpredictable capitulations are very hard to weather psychologically, their aftermaths are exceedingly bullish since stock prices get dragged so low.

While investors and speculators alike can certainly play gold stocks’ coming mean reversion with the major ETFs like GDX, the best gains by far will be won in individual gold stocks with superior fundamentals. Their upside will far exceed the ETFs, which are burdened by over-diversification and underperforming stocks. A carefully-handpicked portfolio of elite gold and silver miners will generate much-greater wealth creation.

At Zeal we’ve literally spent tens of thousands of hours researching individual gold stocks and markets, so we can better decide what to trade and when. As of the end of Q2, this has resulted in 1012 stock trades recommended in real-time to our newsletter subscribers since 2001. Fighting the crowd to buy low and sell high is very profitable, as all these trades averaged stellar annualized realized gains of +19.3%!

The key to this success is staying informed and being contrarian. That means buying low when others are scared, before undervalued gold stocks soar much higher. An easy way to keep abreast is through our acclaimed weekly and monthly newsletters. They draw on my vast experience, knowledge, wisdom, and ongoing research to explain what’s going on in the markets, why, and how to trade them with specific stocks. Subscribe today, for just $12 an issue you can learn to think, trade, and thrive like contrarians!

The bottom line is gold stocks just suffered a brutal capitulation selloff. These extreme anomalies are very rare and inherently unpredictable. Epic record gold-futures short selling pushed gold low enough to unleash cascading forced stop-loss selling in the gold stocks, pummeling them to deep lows. But these resulting gold-stock prices are radically-oversold and wildly-undervalued, certainly not justified fundamentally.

While very challenging psychologically, the aftermath of capitulations is exceedingly bullish. They suck in all available near-term selling, leaving nothing but buyers to propel sharp mean-reversion rebounds. The technicals and sentiment spawned by capitulations are so extreme they usually birth massive uplegs and entire bull markets. Contrarians willing to deploy capital when few others will can earn fortunes out of such lows.

Adam Hamilton, CPA

So how can you profit from this information? We publish an acclaimed monthly newsletter, Zeal Intelligence , that details exactly what we are doing in terms of actual stock and options trading based on all the lessons we have learned in our market research. Please consider joining us each month for tactical trading details and more in our premium Zeal Intelligence service at … www.zealllc.com/subscribe.htm

Questions for Adam? I would be more than happy to address them through my private consulting business. Please visit www.zealllc.com/adam.htm for more information.

Thoughts, comments, or flames? Fire away at zelotes@zealllc.com . Due to my staggering and perpetually increasing e-mail load, I regret that I am not able to respond to comments personally. I will read all messages though and really appreciate your feedback!

Copyright 2000 - 2018 Zeal Research ( www.ZealLLC.com )

Zeal_LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.