Bitcoin Price Is About To Bottom

Currencies / Bitcoin Sep 14, 2018 - 07:12 AM GMTBy: Avi_Gilburt

The painful nine month bear market that began when Bitcoin topped in the mid $19,000’s is now the second longest bear market in crypto history; second in rank to one that began after the Mt. Gox sent Bitcoin down nearly 90% in 18 long months.

As is typical in a bear market, the investing public passes blame. Those trapped in the ensuing downtrend look for reasons they are losing money, as if the market owes them something. For cryptos, the opening of CME Bitcoin futures trading, which began trading shortly before the top, is the chief target. I’ve heard that it said that paper futures always ruin markets. Other targets of blame include regulation in the states and abroad, and the plethora of ‘crap’ coins on the market. The general and age old cry that the markets are manipulated also abound.

The fact is that euphoric sentiment brought this market to its knees. In fact, it was this same euphoria that led to the opening of the CME Bitcoin futures trading.

As Bitcoin launched like a moon rocket far too many believed they could get rich trading cryptos. From millennials planning to buy lamborghinis, to many retiring to trade cryptos without having traded any other asset class, these are just a couple signs of the ‘bubble’ boiling over.

Ryan Wilday, who wrote this article with me, has joked in prior articles that he no longer is asked out to lunch like he was at the top, when everyone wanted to take him out to talk about cryptos. Fortunately, Ryan was telling those folks to stop buying, and consider taking money off the table.

When we had finally confirmed the top was in, Ryan marked the $4700 region as the ideal resting spot for Bitcoin, with the possibility we see $3000. We had two strong rally attempts that put those levels in question- one in February and one in April. And, while Ryan watched them for the possibility that they reach escape velocity, they ultimately came back down through the supports he marked.

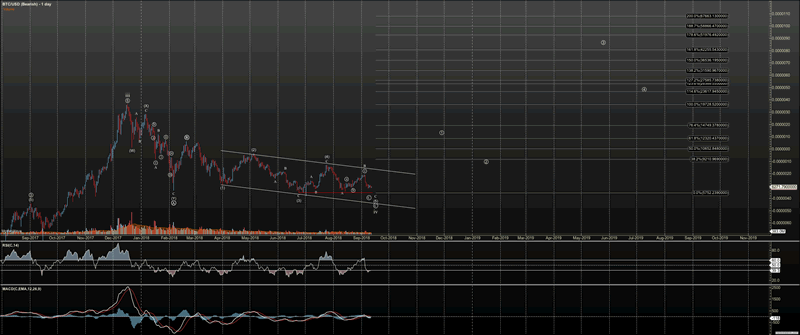

So we are now within spitting distance of this region and with a bearish setup that can take us closer to this key region. Further, we approaching completion an ABC correction, punctuated by an ending diagonal, a pattern that often brings a strong reversal.

In the chart attached, we outline an ending diagonal which started with the February high and completed as 5 waves to the spot we now find ourselves. But this final leg is not completed, and we are setting up for the final wave into the $5600-5800 region. Because Bitcoin is an asset with a tendency to extend in 5ths we may see that ideal $4700 region.

While we’d like to promise that this is the final bottom in this bear market, there are ways this market can grow more evil and complex. Mainly, this completed pattern we discuss above may only be followed by a corrective rally, a b-wave. This would suggest another larger degree decline can ensue months from now. So, as the market rallies off the low is strikes in the near term, we will track so that we can appropriately raise stops so we are not caught in a c-wave downdraft, searching for a lower low.

The euphoric sentiment mentioned above has been completely reversed and now resides in the basement. Apathetic may even be a better way to describe the sentiment amongst crypto investors and the general public, than outright bearish. While analysts that have always been skeptics of cryptos are congratulating themselves for ‘calling’ the bubble pop, those that tried their hand at investing in crypto seem to be quiet, bruised, with no plans of going back. Only small groups of die hard enthusiasts remain.

On the other hand, based on second hand information, it seems institutions have used this correction to accumulate. Word abounds of multi-million, even billion dollar purchases by banks and hedge funds. These big hands trade on the OTC market where the transactions are more stealth and not affecting price. The launch of institutional custodial services by Coinbase, the high speed crypto exchange called the San Juan Merc, and the growth of the CME and CBOE futures interest are all strong evidence that institutions are moving into the market. Will they power this market forward while the public remains apathetic and tired? We’re hitting key levels soon that will likely answer these questions.

Avi Gilburt is a widely followed Elliott Wave technical analyst and author of ElliottWaveTrader.net (www.elliottwavetrader.net), a live Trading Room featuring his intraday market analysis (including emini S&P 500, metals, oil, USD & VXX), interactive member-analyst forum, and detailed library of Elliott Wave education.

© 2018 Copyright Avi Gilburt - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.