Trading Cryptocurrencies: To Win, You Must Know Where You're Wrong

Currencies / BlockChain Sep 13, 2018 - 09:34 AM GMTBy: EWI

See how Elliott wave analysis helped traders reduce risk in Litecoin's recent price action

See how Elliott wave analysis helped traders reduce risk in Litecoin's recent price action

Dear readers, if a story about the get-rich-quick promises of cryptocurrency trading is what you seek, keep on moving.

Rest assured, that story exists. It's all over the interwebs, in one form or another: jazzy headlines about average Joe So-and-So turning $1k into $1 million overnight in the crypto markets.

We're not saying it couldn't happen. People do get lucky now and again. It's just that, we're not in the business of luck. We're in the business of using objective analysis to identify high-confidence trade setups in the world's leading financial markets, inscrutable as they may be.

Sure, it doesn't have the same ring to it. But it's honest. And that's invaluable in a hyper-speculative market filled with unscrupulous coin-makers looking to take advantage of unsuspecting traders.

For more, we turn open the pages of our newly minted report Crypto Trading Guide: 5 simple Strategies to Catch the Next Opportunity, where our Cryptocurrency Pro Service analyst, Jim Martens, extols the singular benefit of Elliott wave analysis -- its ability to limit your trading risk:

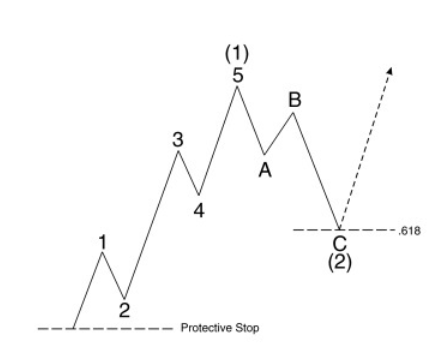

"When considering a trade, you always want to answer this question first: 'Where will I be wrong?'

"I want to know that risk. For example, a market has been falling and you're expecting a low. All of a sudden, we see what looks like a five-wave advance on a 60-minute chart. At this point, should you take action?

"No, you should wait for a three-wave decline, which would be the correction of that advance."

"Based on one rule of the Wave Principle, I know where this count becomes wrong. [Remember from Chapter 1:] Wave (2) cannot retrace more than 100% of wave (1).

"So, I draw a line at the start of wave 1. If the decline surpasses that level, I know that my count is incorrect.

"Elliott wave analysis is one of few methodologies that give us an absolute number for our protective stop."

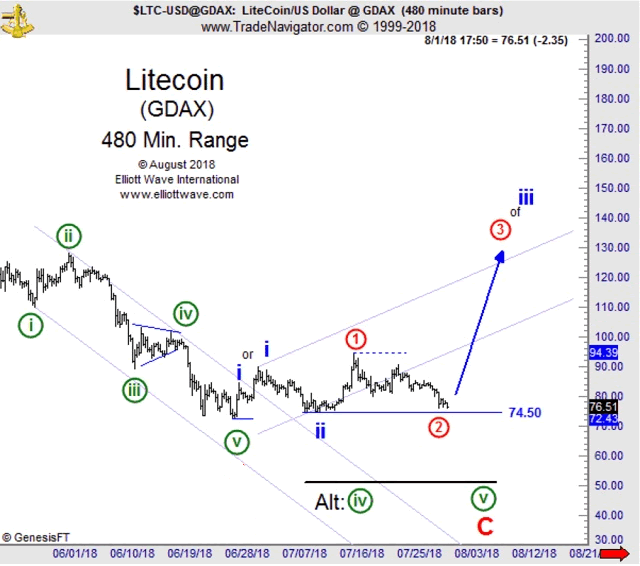

In other words, Elliott waves allow you to identify specific points of ruin for every trade before you even start. To see how this plays out in a real-world market, we turn our attention to the August 1 Cryptocurrency Pro Service coverage of Litecoin.

There, our analysis outlined a bullish, 3rd-wave rally -- noting, however, that any upside move was contingent on wave 2 not retracing more than 100% of wave 1, just as Jim explained in the excerpt above.

From the August 1 Cryptocurrency Pro Service intraday forecasts:

"74.50 should therefore be considered the line in the sand for the bullish count. If breached, we'll have to adopt a bearish Alternate as we did for Ethereum to allow for lower before wave C of (Y) finds its bottom."

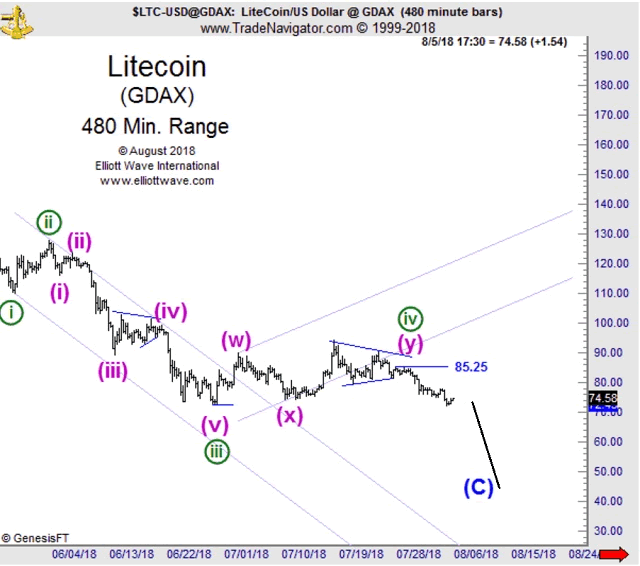

A few days later, Litecoin prices did, in fact, fall below the 74.50 handle, signaling a resumption of the downtrend. On August 5, our Cryptocurrency Pro Service made the necessary, bearish adjustment:

"74.50 hung in there tenaciously for a while, but was ultimately violated in the weekend's trading. As discussed Friday, that has called up the incomplete wave C Alternate count. "

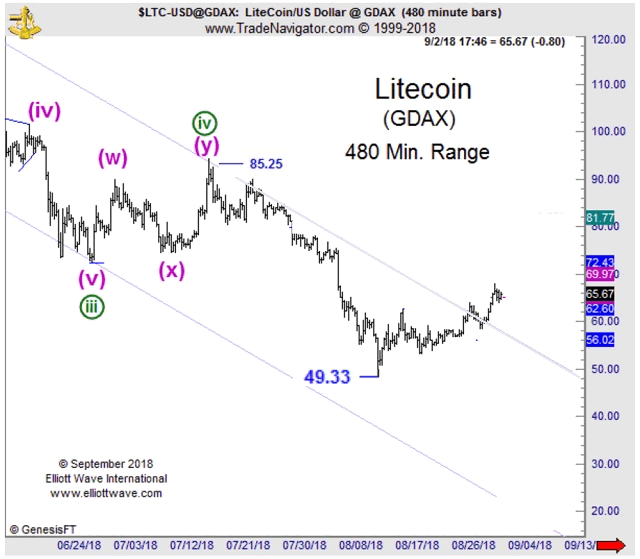

The next chart captures the rapid descent that followed, bringing Litecoin to an eight-month low in early August before stopping.

We understand the pressure to leap headlong into the blockchain breach is intense. If you subtract the numbers "inflated through fake and deceptive activities," the average daily trading volume of crypto exchange markets is around $6 billion (Aug. 28 CNN).

But we believe there's a way to be smart and discerning about where to leap. With 1600 cryptocurrencies and counting, that starts with choosing only the most reputable markets with proven track records and transparency. Chances are, it won't be named after a comic book character or piece of fruit. Our Cryptocurrency Pro Service tracks the top three cryptos: Bitcoin, Ethereum and Litecoin.

The second requirement of a high-confidence cryptocurrency trade is knowing when your trade is wrong. This is where Elliott wave analysis is in a league unto its own.

Our free report "Crypto Trading Guide: 5 Simple Strategies to Catch the Next Opportunity" explains more. Each chapter shows you the power of the Elliott Wave Principle to explain some of the biggest recent moves in Bitcoin, Litecoin and Ethereum -- and how you can apply this method in your own trading, going forward. Get instant access.

This article was syndicated by Elliott Wave International and was originally published under the headline Trading Cryptocurrencies: To Win, You Must Know Where You're Wrong. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.