Gold Miners Setting Up for Big Rally

Commodities / Gold and Silver Stocks 2018 Sep 07, 2018 - 08:50 AM GMTBy: Jordan_Roy_Byrne

The recent rally attempt of the gold stocks fizzled out as the December 2016 lows failed to hold. Now the miners are making new lows. As they pine for the next support they figure to be even more oversold as more bulls throw in the towel. These are the conditions needed to engender a significant counter-trend rebound. While we aren’t predicting it yet, look for a bullish reversal to begin sometime in the next few weeks.

The recent rally attempt of the gold stocks fizzled out as the December 2016 lows failed to hold. Now the miners are making new lows. As they pine for the next support they figure to be even more oversold as more bulls throw in the towel. These are the conditions needed to engender a significant counter-trend rebound. While we aren’t predicting it yet, look for a bullish reversal to begin sometime in the next few weeks.

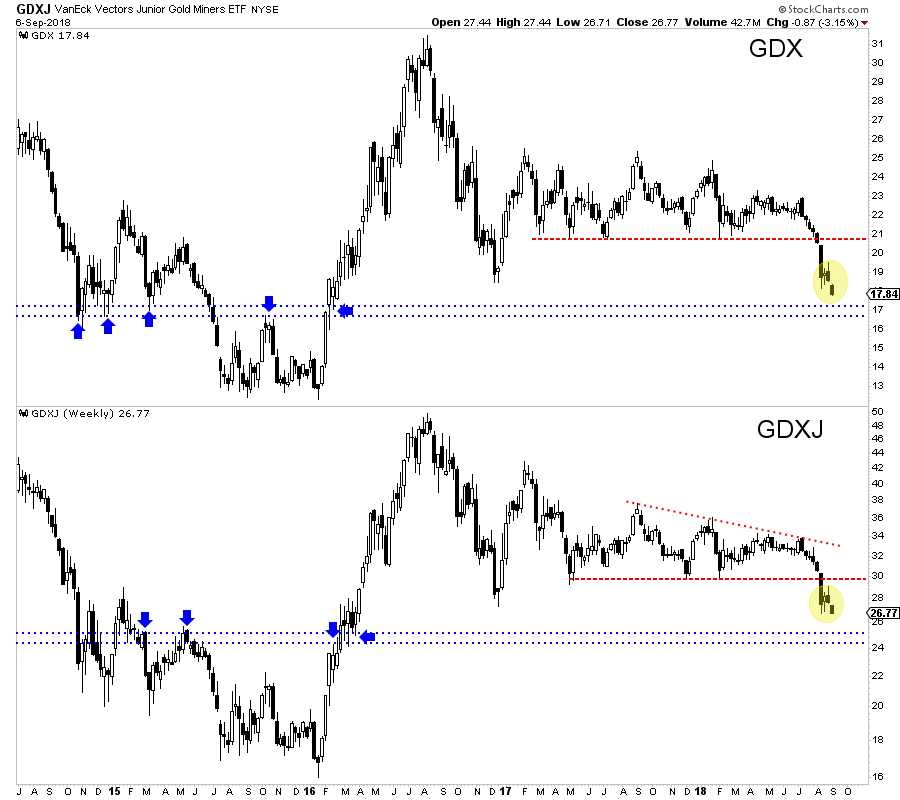

The gold stocks have lost their December 2016 support but strong support is not too far away. The breakdown in GDX below $21 projects to a measured downside target of roughly $16.50. That aligns with the next strong support level on the chart. The breakdown in GDXJ projects down to the $23-$24 area. That is very close to the next strong support level around $24-$25.

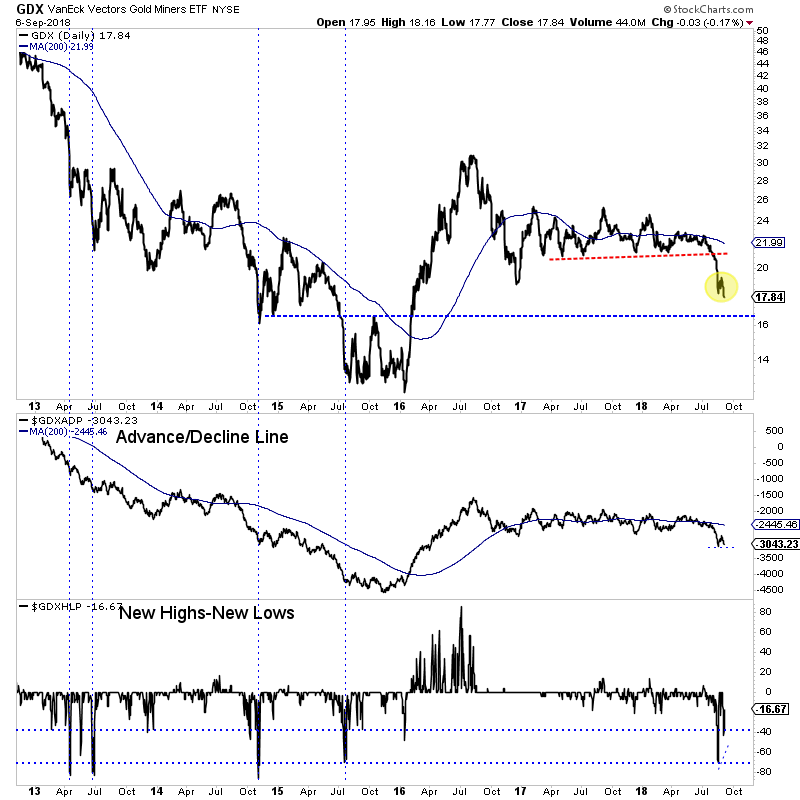

Assuming GDX will reach $16.50, then we want to keep an eye out for potential divergences in the breadth indicators. GDX has broken below its August low but note that its advance decline line has yet to test its August low. Also note that the new highs less new lows indicator remains far from the -70% level it hit at the August low. If the current divergences hold as GDX tests $16.50 then it would be a signal that selling pressure has waned.

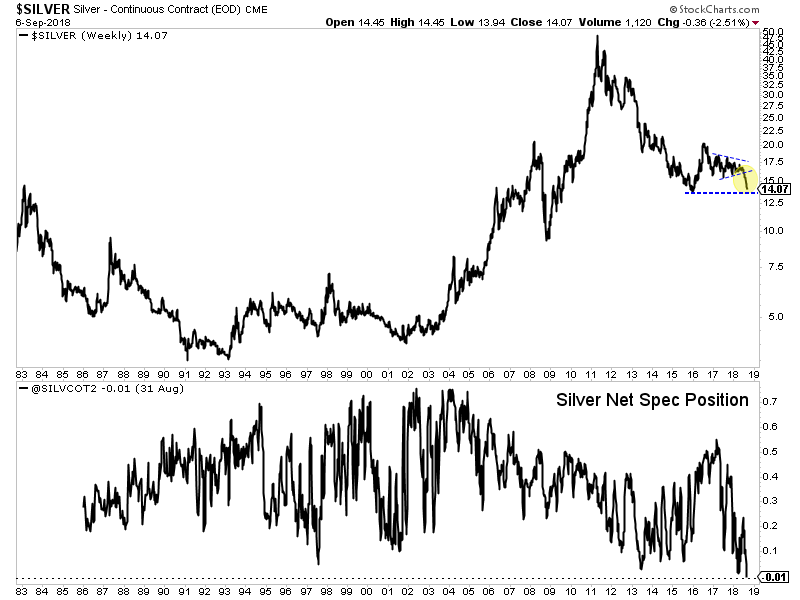

Sentiment is obviously quite negative and with the gold stocks and Silver breaking their August lows, it should only get worse. In recent weeks the net speculative position for Gold reached its second lowest level in 17 years. In fact, the commercial traders are very close to being long.

Circling back to Silver, the most recent net speculative position hit an all-time low of -1%. For the first time ever, the speculators were net short. Silver is also approaching its 2015 low where it should find good support. A rebound would obviously align with a rebound in the gold stocks.

To navigate the volatility ahead and prepare for an epic buying opportunity in 2019, consider learning more about our premium service.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.