China Economy Sneezed… Will the World Catch Cold?

Stock-Markets / Stock Markets 2018 Sep 06, 2018 - 01:24 PM GMTBy: Graham_Summers

The markets are getting downright ugly. If things don’t turn up soon we could be at the point at which the Everything Bubble begins to burst.

The markets are getting downright ugly. If things don’t turn up soon we could be at the point at which the Everything Bubble begins to burst.

While US stocks have performed relatively well recently, globally things are looking worse and worse.

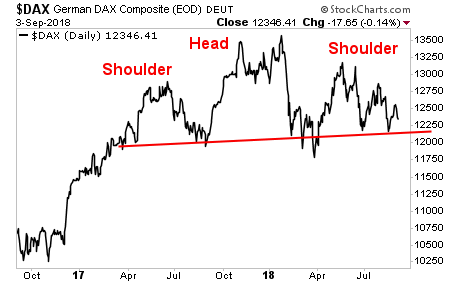

Germany’s DAX never reclaimed its former high established back in January. Instead it’s been carving out a massive Head and Shoulders pattern. Germany is the fourth largest economy in the world and heavily reliant on exports for growth. This chart pattern doesn’t bode well for global trade or growth.

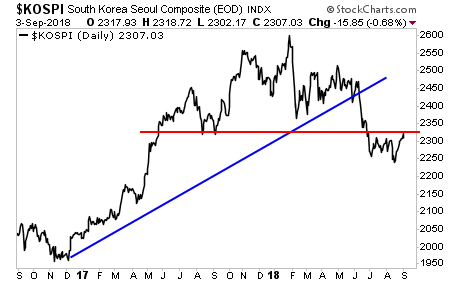

South Korea is another export-focused economy that serves as a bell weather for global growth. This is particularly true given its connection to Asia (China accounts for 25% of SK’s exports, while ASEAN countries account for another 14%).

South Korea’s stock market, the KOSPI, has lost its bull market trendline (blue line). It is now struggling to reclaim former support (red line). This again suggests global growth and trade have slowed dramatically.

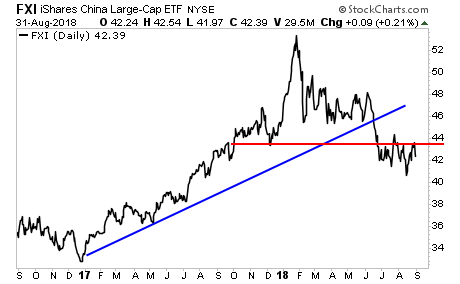

And finally there’s China: the second largest economy in the world, and the primary driver for economic growth in the post-2008 business cycle. Here again, we’ve lost the bull market trendline (blue line). And China has since been rejected at former support (red line) multiple times.

Just one of these charts would be a warning to investors… but all three together suggest that global growth has completely crashed. All around the world, the peak was in January 2018… and since that time most markets have been in MAJOR downtrends if not outright bear markets.

On that note, we are putting together an Executive Summary outlining all of these issues as well as what’s coming down the pike when the Everything Bubble bursts.

It will be available exclusively to our clients. If you’d like to have a copy delivered to your inbox when it’s completed, you can join the wait-list here.

Do NOT delay… there are fewer than 67 slots remaining.

https://phoenixcapitalmarketing.com/TEB.html

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and unde74rvalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2018 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.