GBP/USD Remains Bearish

Currencies / British Pound Sep 04, 2018 - 03:03 PM GMTBy: FXOpen

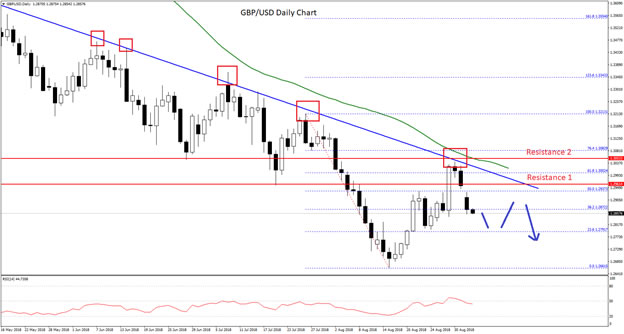

The daily chart of GBP/USD suggests that the pair is in a major downtrend below 1.3000 and it could decline further.

Key Points

- The British Pound failed recently to break a crucial resistance near 1.3000/40 against the US Dollar.

- The GBP/USD pair is following a major bearish trend line with resistance at 1.2970 on the daily chart.

GBP/USD Technical Analysis

The British Pound recently found support near the 1.2700 area and recovered against the US Dollar. The GBP/USD pair traded above the 1.2900 resistance, but it faced a major resistance near the 1.3000/40 zone.

After trading as low as 1.2660, the pair traded higher and moved above the 1.2880 and 1.2900 resistance levels. Moreover, there was a break above the 50% Fib retracement level of the last major slide from the 1.3210 swing high to 1.2660 swing low.

However, the upside move was capped by a significant resistance near 1.3000/40, which was a support earlier. More importantly, there pair is following a major bearish trend line with resistance at 1.2970 on the daily chart.

Above the trend line, the 50-day simple moving average is positioned near the 1.3030 level. The pair was clearly rejected from the trend line and it is currently trading below the 1.2900 support.

It seems like the pair may continue to move down towards the 1.2780 support zone, below which the pair could test the last swing low of 1.2660.

Conversely, if the pair moves higher, buyers are likely to face a strong resistance near the 1.3000 zone.

Only a successful close above 1.3030 and the 50-day SMA may perhaps push the GBP/USD pair back in a positive zone. If not, there is a risk of more losses towards 1.2660 and 1.2600.

The market outlook is provided by FXOpen broker.

FXOpen - true ECN/STP Forex and cryptocurrency broker.

© 2018 Copyright FXOpen - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.