S&P Makes 4 Consecutive All-time Highs in August. Like 1987?

Stock-Markets / Stock Markets 2018 Sep 01, 2018 - 10:06 AM GMTBy: Troy_Bombardia

New-all time highs in August for the U.S. stock market are rare because the stock market’s seasonality in August isn’t particularly bullish. But you know what’s even rarer? 4 consecutive all-time highs in August.

As of yesterday, the S&P made 4 consecutive all-time highs (CLOSE $) in August.

The last time this happened was in August 1987, just before the S&P made a “big correction”.

But of course “the last time X happened, the stock market did Y” doesn’t mean anything. You need to look at all the historical cases to derive a conclusion.

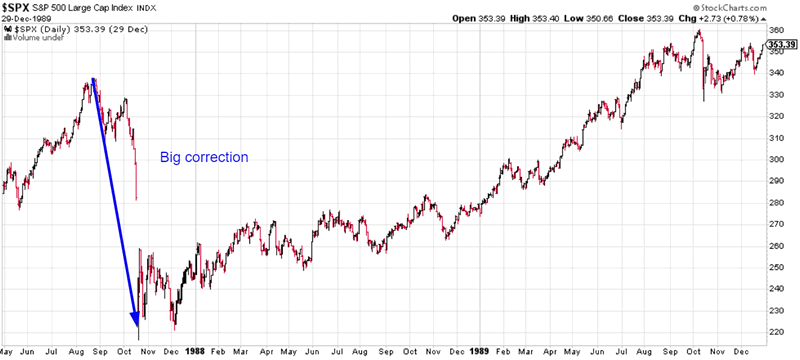

There are only 3 historical cases in which the S&P made 4 consecutive all-time highs in August:

- August 11, 1987

- August 11, 1972

- August 7, 1951

Here’s what the S&P did next.

Click here to download the data in Excel

1972 is the only historical case in which the S&P made 5 consecutive all-time highs in August. Let’s look at these historical cases in detail.

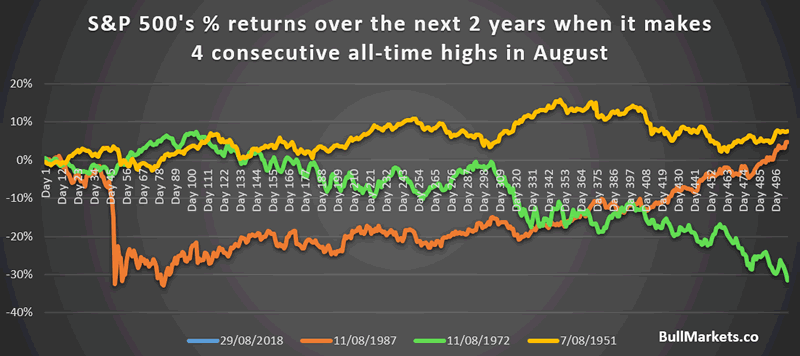

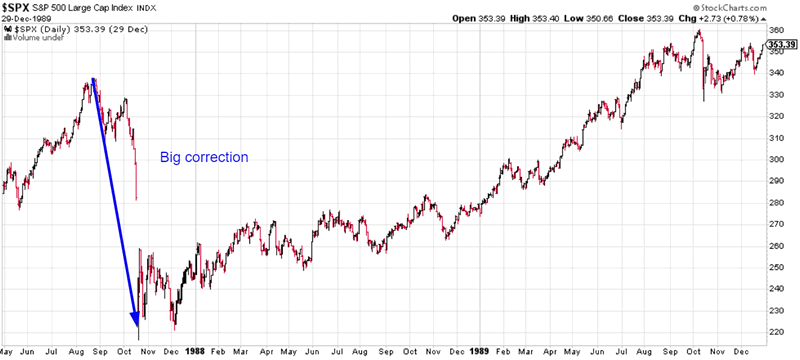

August 11, 1987

The stock market immediately fell into a “big correction”

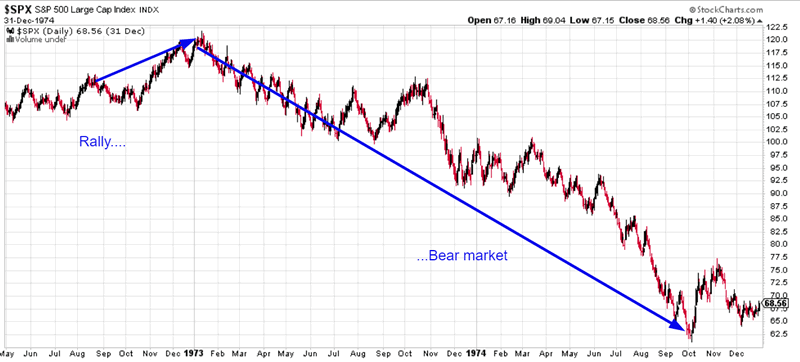

August 11, 1972

The stock market rallied another 4 months before it began a bear market.

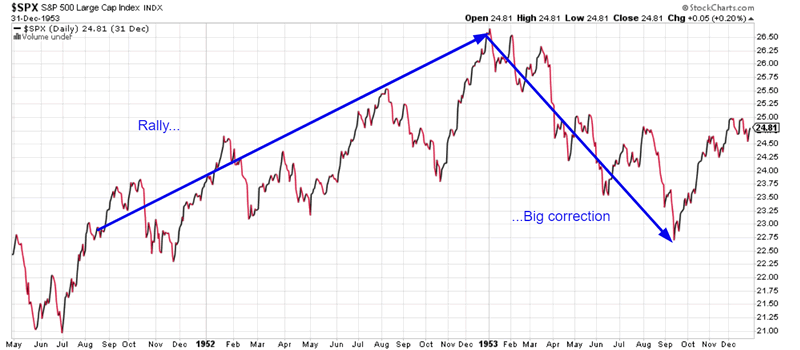

August 7, 1951

The stock market rallied more than 1 year before starting a “big correction”

Conclusion

As you can see, this is not a particularly bullish study for the U.S. stock market. It suggests that the U.S. stock market will begin a “big correction” or bear market sometime within the next 1.5 years.

Based on where the Medium-Long Term Model is right now:

- A big correction or bear market will not start in 2018. The stock market’s medium-long term is bullish (i.e. still a “big rally”, still a “bull market”)

- 2019 will be a very different story. Bull market top somewhere in 2019.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.