SPX Making New Highs, But Nearing a Reversal

Stock-Markets / Stock Markets 2018 Aug 27, 2018 - 04:43 PM GMT SPX is making even newer all-time highs, so it’s time to get out the calculator to find what new targets there may be. The next Pivot date is Wednesday, which is day 266 in the Master Cycle, 8 days beyond the mean. It is also a Primary Cycle pivot, which is often associated with Cyclical strength leading up to it. The two red Fibonacci calculations appear to be the most likely, given the short time available to make that high. However, we cannot rule out the top calculation at 2948.70, should there be a panic buying period.

SPX is making even newer all-time highs, so it’s time to get out the calculator to find what new targets there may be. The next Pivot date is Wednesday, which is day 266 in the Master Cycle, 8 days beyond the mean. It is also a Primary Cycle pivot, which is often associated with Cyclical strength leading up to it. The two red Fibonacci calculations appear to be the most likely, given the short time available to make that high. However, we cannot rule out the top calculation at 2948.70, should there be a panic buying period.

The weekly chart gives us another calculation that agrees with one of the calculations above. The Weekly Cycle Top is nearby, so I wouldn’t discount this one. There are other, lesser calculations which project a possible target in the 2890’s. SPX futures have already reached a high of 2888.25, so we will opt for the higher calculations. I will revisit them if appropriate.

ZeroHedge observes, “It has been a quiet overnight session as UK markets are closed for holiday, with last Friday's post-Jackson Hole surge that sent the S&P to a new all time high carrying over in the new week, and sending world stock markets to their highest level in more than two weeks on Monday as reassuring comments from Fed chief Powell, an easing in trade war jitters and a bid by China’s central bank to stabilize the yuan lifted risk appetite.”

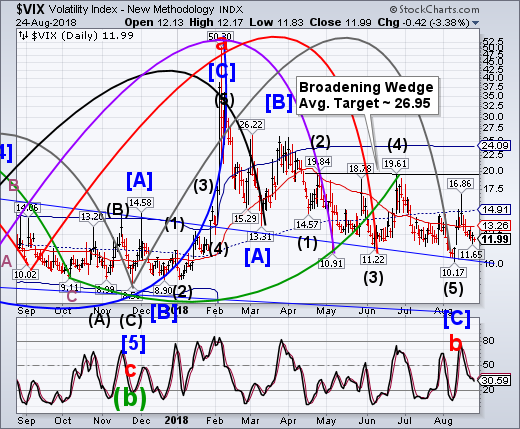

VIX futures are higher and appear that they may open above the 50-day Moving Average at 13.26. It is possible for the VIX to rise as the SPX is still making new highs. It acts as an early warning of what may come. As a result, we will be keeping a close watch on the NYSE Hi-Lo Index , as well.

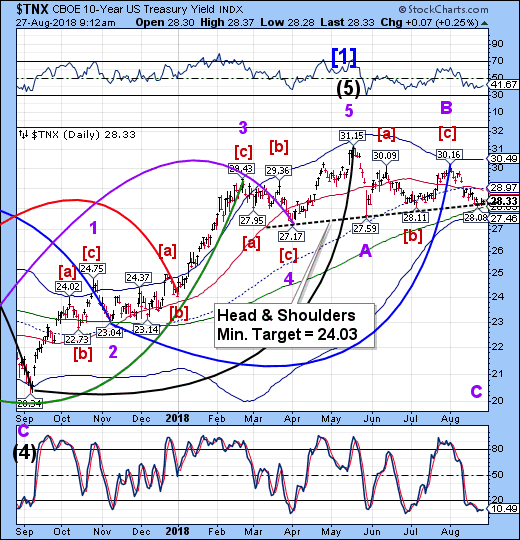

TNX is consolidating above the neckline. Of course, a move beneath the neckline gives us a sell signal on the 10-year yield.

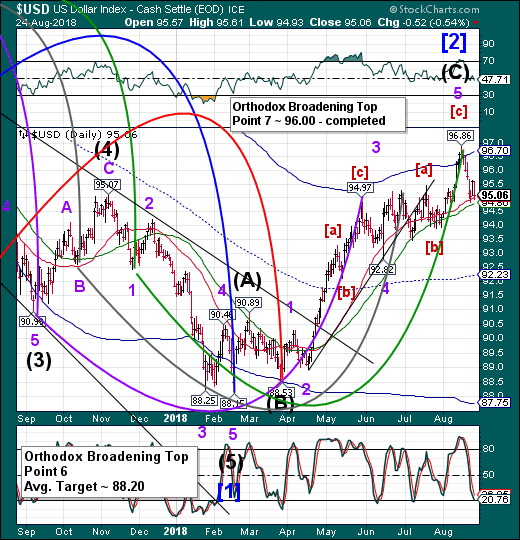

USD futures are edging lower, but not yet beneath Wednesday’s low of 94.83. Often the threat of a new low may bring on a reversal from the SPX, so we are on high alert.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.