What the Copper and Gold Crash Means for Commodities and Stocks

Commodities / Commodities Trading Aug 20, 2018 - 10:04 AM GMTBy: Troy_Bombardia

As you probably know, commodity prices have been falling significantly over the past few months on Trump’s trade war, which has caused the U.S. Dollar to rise.

As you probably know, commodity prices have been falling significantly over the past few months on Trump’s trade war, which has caused the U.S. Dollar to rise.

This has some bearish investors afraid of a few things:

- “Contagion” from commodities and emerging markets to the U.S. stock market

- An economic slowdown, because commodity prices are “supposed to” reflect economic data. Conventional thinking states that falling commodity prices = falling demand, which signals a slowdown in the economy.

These 2 fears are unsubstantiated. Commodity prices are driven by their own supply and demand. These days, commodity demand has more to do with China than the U.S. Hence, falling commodity prices is more symbolic of problems in China (and emerging markets) than the U.S.

Here’s the data to prove it.

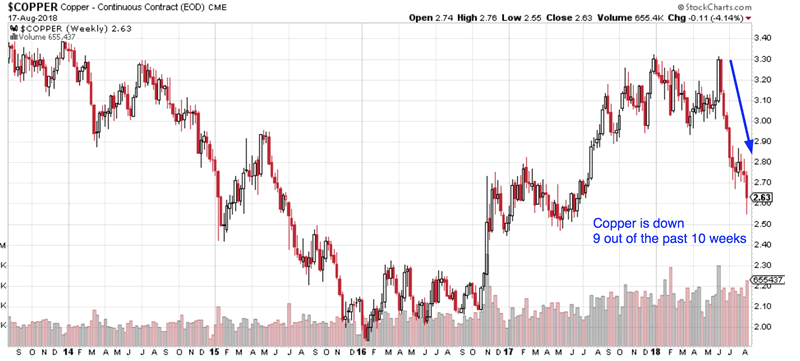

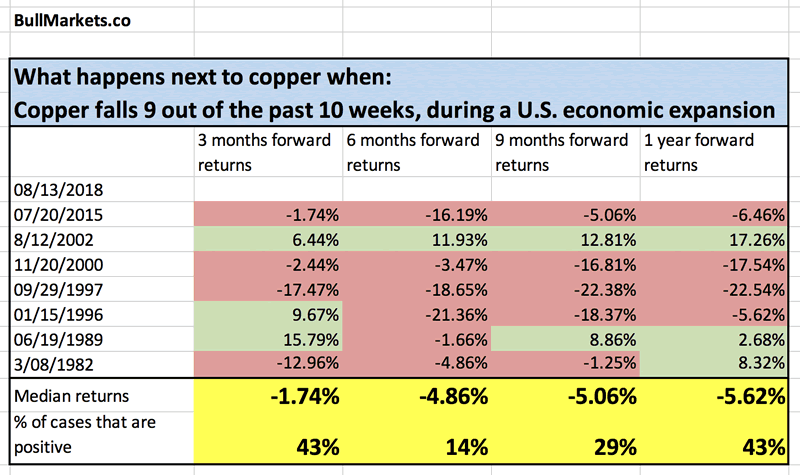

Copper has now fallen 9 out of the past 10 weeks. This is what happens next to copper (historically)

Click here to download the data in Excel

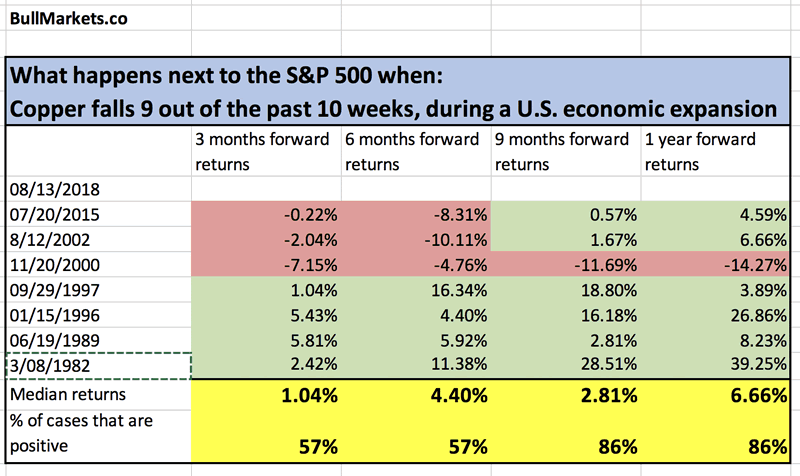

This is what happens next to the S&P 500 when copper falls 9 out of the past 10 weeks.

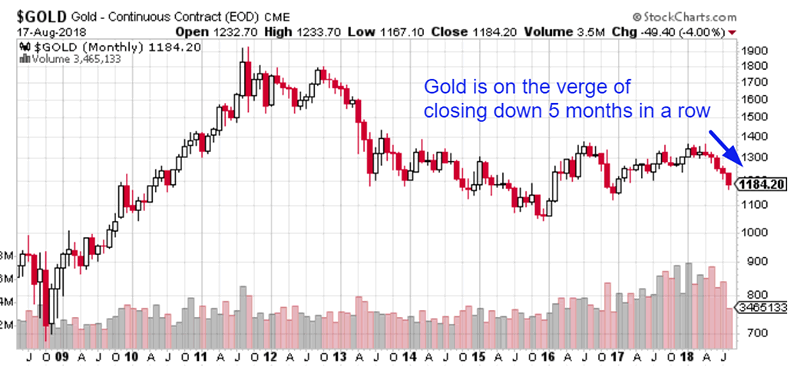

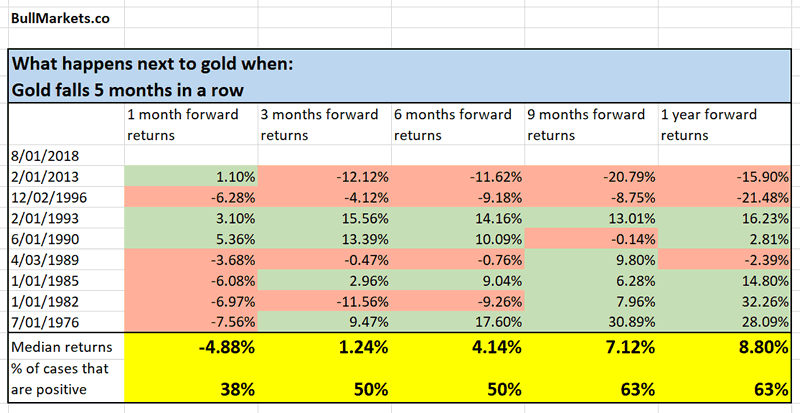

Gold is on the verge of closing down 5 months in a row. This is a rare sign of extreme weakness in the precious metals markets.

Here’s what happens next to gold when it goes down 5 months in a row

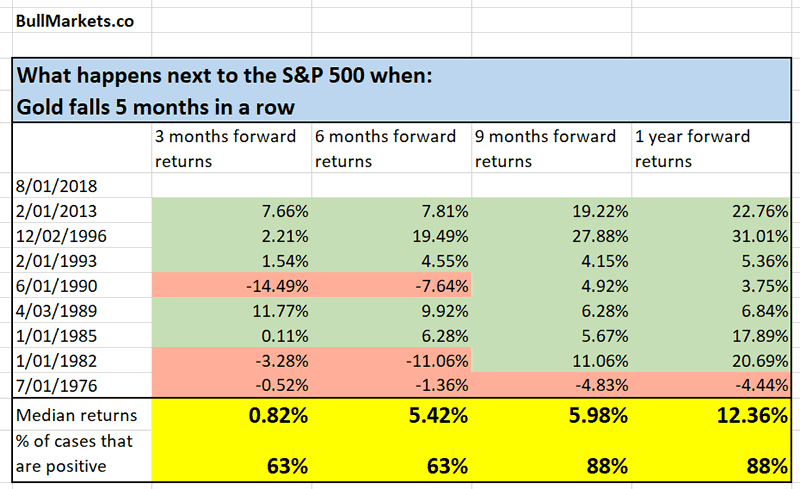

Here’s what happens next to the S&P 500 when gold goes down 5 months in a row.

Click here to download the data in Excel.

Conclusion

Don’t get too bullish on commodities just because they have crashed. “Oversold” can become even more oversold.

But more importantly, U.S. stock market investors should ignore the weakness in commodity prices. Copper is NOT a useful indicator for the U.S. stock market.

Click here for more market studies.

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.