SPX Losing Gains

Stock-Markets / Financial Markets 2018 Aug 17, 2018 - 03:36 PM GMT SPX futures are losing yesterday’s gains as selling in the world markets returns. The index appears to be challenging Short-term support at 2835.51 at this time. This morning the SPX E-mini futures and options expire at the open. It is unusual to see the selling begin before expiration. As a result, this may cause more selling for the regular options that expire later today.

SPX futures are losing yesterday’s gains as selling in the world markets returns. The index appears to be challenging Short-term support at 2835.51 at this time. This morning the SPX E-mini futures and options expire at the open. It is unusual to see the selling begin before expiration. As a result, this may cause more selling for the regular options that expire later today.

ZeroHedge reports, “A sense of "risk off" has returned to the the market, with 10Y yields sliding, the dollar rebounding from session lows and the Turkish Lira resuming its plunge, renewing concerns about emerging market contagion, leading to a "red return" across global market monitors, following yesterday's torrid surge in the S&P500.”

NDX futures are also down, but haven’t yet broken through mid-Cycle support at 7339.04.

Bloomberg reports, “Semiconductor stocks may be poised to extend their longest skid in months after disappointing guidance from Nvidia Corp. and Applied Materials Inc. sent shares of both companies sliding in extended trading.

The Philadelphia Semiconductor Index is poised to fall for a fourth day on Friday with Nvidia sinking 3.8 percent in pre-market trading in New York, while Applied Materials fell 5.7 percent on little early volume. Peer Micron Technology Inc. also fell 1.2 percent after it was named in a class-action antitrust case Thursday alongside South Korean peers Samsung Electronics Co. and SK Hynix Inc.”

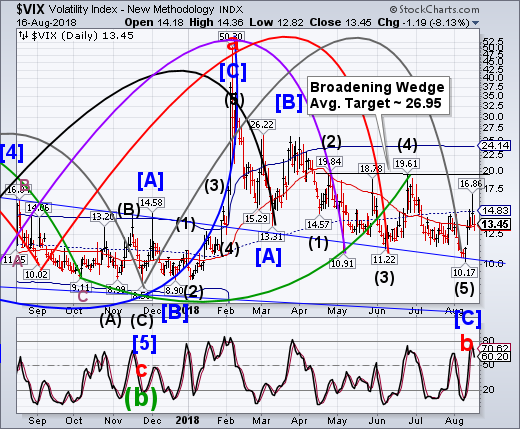

VIX futures are rallying after closing above the 50-day Moving Average at 13.23. Today has the potential of being a barn burner for the VIX. Despite yesterday’s pullback, the trading pattern shows “eagerness” to go considerably higher. This appears to be the start of the largest rally since February.

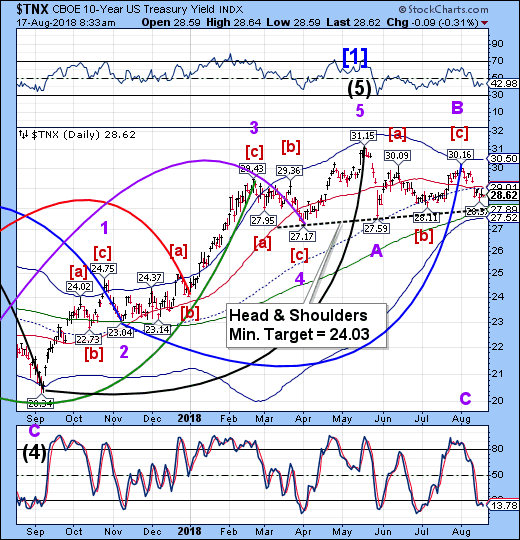

TNX appears to be resuming its decline after testing mid-Cycle resistance at 29.01

A provocative article in ZeroHedge, “People associate leverage with volatility and trouble. The history of finance is littered with examples: the savings and loan crisis of the late 1980s, Orange County in 1994, Long Term Capital Management in 1998 and MF Global in 2011. But personal leverage is common; anyone with a mortgage is leveraging their home. The typical 20%-down mortgage gives the buyer five times leverage to their equity.

Leverage is a productive tool, used within limits.

Enter U.S. Treasury bonds.

Leverage may not immediately seem to belong with a Treasury, but for three important reasons, leveraged U.S. Treasury bonds make sense as an ordinary investment.”

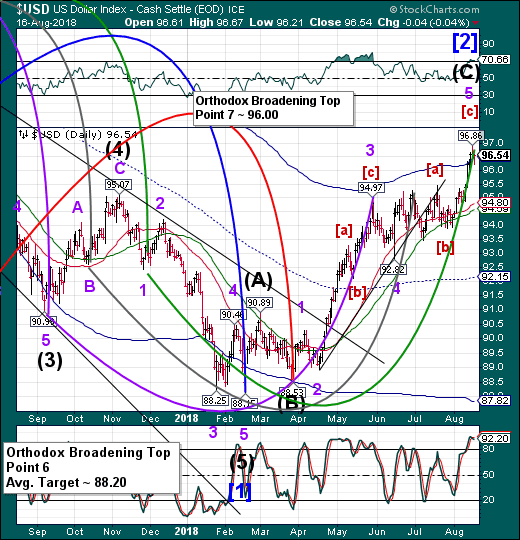

USD futures have declined beneath Cycle Top support at 96.49. A recognizable reversal pattern is not evident, but a decline beneath the Cycle Top is the first evidence of a change in trend in a pattern such as this.

The SouthChinaMorningPost quips, “Forget the trade war – it’s the strong US dollar that should really make us worry

Richard Harris says the strength of the US currency is bad news for economies with large trade deficits, budget problems or – like Turkey – enormous foreign borrowings. If the strong dollar continues, a global slowdown can’t be ruled out.

The biggest financial issue of the moment is not the collapse of the Turkish lira, or Britain’s impending ignominious exit from the European Union. Nor even Donald Trump’s tariff temper tantrums, or China’s worryingly slowing growth. It is the mighty dollar.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at http://mrpracticalinvestor.com/ to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinve4stor.com .

Anthony M. Cherniawski, President and CIOhttp://mrpracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.