Talk Cold Turkey Economic Crisis

Economics / Turkey Aug 13, 2018 - 07:28 AM GMTBy: Raul_I_Meijer

Recep Tayyip Erdogan became Prime Minister of Turkey in 2003. His AKP party had won a major election victory in 2002, but Erdogan was banned from political office until his predecessor Gül annulled the ban. Which he had gotten in 1997 for reciting an old poem to which he had added the lines “The mosques are our barracks, the domes our helmets, the minarets our bayonets and the faithful our soldiers….”

Recep Tayyip Erdogan became Prime Minister of Turkey in 2003. His AKP party had won a major election victory in 2002, but Erdogan was banned from political office until his predecessor Gül annulled the ban. Which he had gotten in 1997 for reciting an old poem to which he had added the lines “The mosques are our barracks, the domes our helmets, the minarets our bayonets and the faithful our soldiers….”

The Turkish courts of the time saw this as “an incitement to violence and religious or racial hatred..” and sentenced him to ten months in prison (of which he served four in 1999). The courts saw Erdogan as a threat to the secular Turkish state as defined by Kemal Ataturk, the founder of modern Turkey in the 1920’s. Erdogan is trying to both turn the nation towards Islam and at the same time not appearing to insult Ataturk.

The reality is that many Turks today lean towards a religion-based society, and no longer understand why Ataturk insisted on a secular(ist) state. Which he did after many years of wars and conflicts as a result of religious -and other- struggles. Seeing how Turkey lies in the middle between Christian Europe and the Muslim world, it is not difficult to fathom why the ‘father’ of the country saw secularism as the best if not only option. But that was 90 years ago.

And it doesn’t serve Erdogan’s purposes. If he can appeal to the ‘silent’ religious crowd and gather their support, he has the power. To wit. In 2003, one of his first acts as prime minister was to have Turkey enter George W.’s coalition of the willing to invade Saddam Hussein’s Iraq. As a reward for that, negotiations for Turkey to join the EU started. These are officially still happening, but unofficially they’re dead.

In 2014 Erdogan finally got his dream job: president. Ironically, in order to get the job, Erdogan depended heavily on the movement of scholar and imam Fethullah Gülen, who, despite moving to Pennsylvania in 1999, still had (has?) considerable influence in Turkish society. Two years after becoming president, Erdogan accused Gülen of being the mastermind behind a ‘failed coup’ in 2016, after which tens of thousands of alleged Gülenists were arrested, fired, etc.

Fast forward to the past week. Donald Trump imposed tariffs on Turkey, ostensibly because Erdogan refuses to free an American pastor. The result was a god-almighty drop in the Turkish lira. Analysts at Goldman Sachs said if it reached 7:1 vs the USD, it would be game over for Turkish banks. It got to 6.8:1 before falling back to 6.4:1. And without support from China or the IMF, it would indeed appear the game’s up.

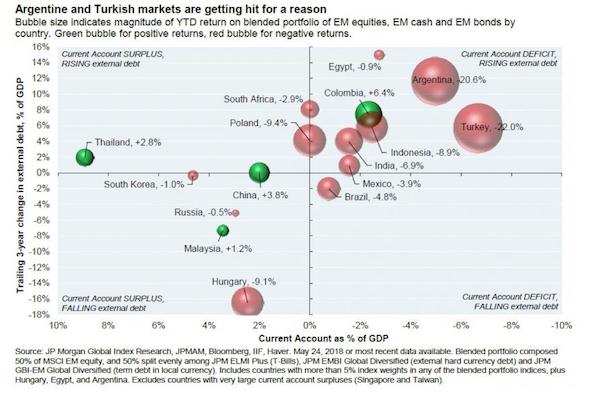

With a stronger dollar, investors’ urge to have their money in emerging markets fades away. And with Turkey being the ugliest horse in the EM factory (perhaps after Argentina, but that’s a whole different story), it’s only logical it would be the first emerging market to see foreign investment disappear. It’s the easiest thing in the world, and It looks something like this:

Here, Turkey’s the main outlier. Tyler Durden’s comment: “as JPMorgan showed 2 months ago, Turkey faces a secondary threat in addition to its gaping current account deficit: a massive and growing debt load. If foreign buyers of Turkish debt go on strike, or if Turkey is unable to rollover near-term maturities, watch how quickly the currency crisis transforms into a broad economic collapse.”

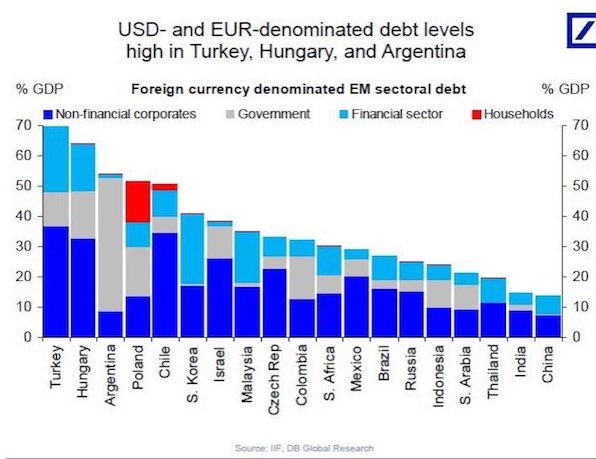

This next graph from the IIF shows how much debt Turkey has, and in which sectors. Not much household debt, which is positive, but a monster non-financial corporate debt, which is definitely not. NOTE: Hungary is no. 2 on this one, but look at the graph above, and you see that while Turkey has a current account DEFICIT and RISING external debt, Hungary has a current account SURPLUS and FALLING external debt. Don’t do the apples and oranges thing! Also note that Argentina’s debt is almost all government (bonds)

Along that same line, I saw Tom Luongo today compare Turkey anno now to Russia in 2014/15, but Moscow’s USD and EUR debt is about 25%, while Turkey’s is at 70%. it’s a very bad comparison. Russia has had sanctions for ages, and it’s and plenty time to adapt its economy to them. They have to hold some USD and Treasury’s, but they’re largely fine. Turkey is not.

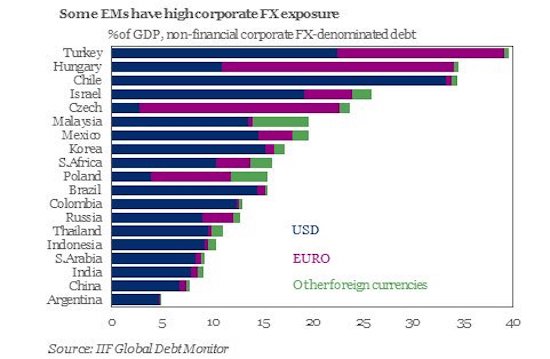

The third graph is useful because it depicts what currencies countries’ non-financial sectors have borrowed in. Again, Turkey is an outlier, this time in its USD exposure.

And unsurprisingly, we have EU banks exposed to Turkey. What’s wrong with BBVA? What’s wrong with Draghi?

But this is easy stuff. We know all this, or we could have. Turkey has been splurging on debt at least ever since Erdogan became PM 15 years ago. He bought his popularity to a large extent with large scale infrastructure projects, without letting on the country -and its corporate sector- were financing the projects with money borrowed from abroad (he built a $100 million, 1000-room palace for himself as well).

Where I think it gets really interesting, and I’ve been keeping away a bit from what others have written the past few days, is in what Erdogan knows about this, and how long he’s known how dire the situation is, and what he’s planning to do next. Because if he knows how bad things are, and he has it for a while, he may well have orchestrated the recent fall-out with Trump et al, to use it as a political tool.

What Erdogan needs is someone to blame for his collapsing economy. And also, if he can get it, a bail-out from somewhere anywhere. Problem with the bail-out thing is, no matter what option might be available, and it’s only might be, he will be forced to relinquish a lot of the central control he’s carefully built up through constitution amendments etc.

His -maybe- options are the IMF, Russia and China. The IMF equals America, and even if they feel a loan to Istanbul is better than an outright collapse, they will take his control over the central bank away, and probably much more – austerity on steroids.

Russia might want to assist, if only to get Turkey away from NATO, which Putin sees as a growing threat now it keeps approaching his borders ever more. Greece is presently in an angry spat with Moscow because the latter is trying to frustrate the Macedonia name deal that the US has been encouraging, which would lead to Macedonia NATO membership, and even more NATO troops right on Russian borders.

But Putin hasn’t forgotten Erdogan shooting down a Russian jet fighter in 2015, and you can bet he will avenge that ‘incident’. He’s at best ambivalent about supporting Erdogan, but he recognizes the potential advantages. Then again, he also recognizes the pluses of letting Turkey slide into a position where Erdogan will be forced out and the secular state reinstated. Russia doesn’t want more Muslim states on its borders anymore than it wants more NATO. Suffice it to say Putin’s watching closely. And he’s got his moves ready.

China sees things differently; it can of course appreciate the potential of Turkey as a strategic gem, if only for its Belt and Road Initiative, but Beijing can also see the potential problems. It’s easier -and much cheaper- to buy up Greek assets for that same purpose -and for pennies on the dollar- now that the EU and US have forced the country’s economy to slide into third world territory. Still if Erdogan gets desperate enough, XI may yet jump in. But Erdogan will not be an independent actor anymore, in his own country. Xi does not dole out Christmas gifts.

On Saturday, Erdogan -again- summoned Turks to bring home their foreign funds and to change all dollars and euros and bonds for lira. That may seem strange -and it probably is- because the first reaction is for people to do the exact opposite as long as the lira is plunging. But it appeals to that same religious sentiment that he has founded his entire political power on. Without it, he’s done anyway.

His approach now is to blame someone else for Turkey’s economic problems. Which is nonsense for anyone who has the valid details, but remember, his gutting of the press after the alleged ‘coup’ two years ago has left precious little information available to the Turkish people.

Erdogan has said he will look for other friends than the US. As detailed above, that will not be easy unless he’s prepared to give up substantial amounts of his power. He’s not prepared for that. It’s much easier for him, let alone advantageous, to claim there’s an economic war against Turkey being leveled. And he wouldn’t even be 100% wrong.

Thing is, to prevent the latest escalation, all he would have had to do was to release an American pastor. The fact that he didn’t is perhaps more telling than anything in all this. He’s looking for someone, come country, some organization perhaps, to present as an enemy to the Turkish people.

Since I’ve spent a lot of time in Athens in the past few years, I wouldn’t be surprised if Turkey, whose jetfighters’ violations of Greek air space have become so routine not even the Greek press tries to keep track, would invade, and claim ownership of, some Greek islands in the Aegean Sea, even if they’re just some uninhabited rocks, to whip up nationalist sentiment back home.

Recep Tayyip has long seen this coming. His economy is collapsing, his currency is collapsing, so he’ll focus on what’s left: Turkey’s strategic position on the map, its NATO membership, the negotiations for EU membership, and most of all the support of the Muslim contingent in Turkey that solidifies his power.

I don’t really want to make any historical comparisons, they appear obvious enough. Suffice it to say this ain’t over by a long shot, and it could lead to big trouble.

And don’t let’s forget that Turkey presently hosts millions of Syrian refugees. Erdogan can just buy a bunch of dinghies (he can still afford that) and cause absolute chaos in Greece and the EU.

Who’s going to be buying lira’s on Monday?

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2018 Copyright Raul I Meijer - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.