USD is Rising. What this Means for Currencies and Stocks

Stock-Markets / Financial Markets 2018 Aug 12, 2018 - 04:44 PM GMTBy: Troy_Bombardia

The U.S. stock market has had a quiet week. However, the story is very different overseas, with emerging market currencies and stocks cratering.

Here’s MSCI’s emerging markets currency index.

Here’s EEM, the emerging markets (equities) ETF.

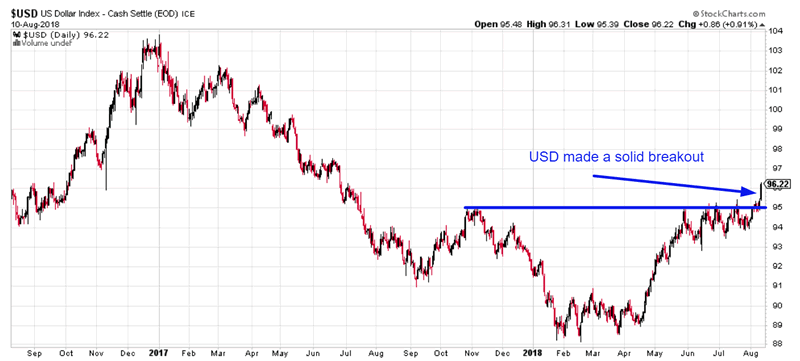

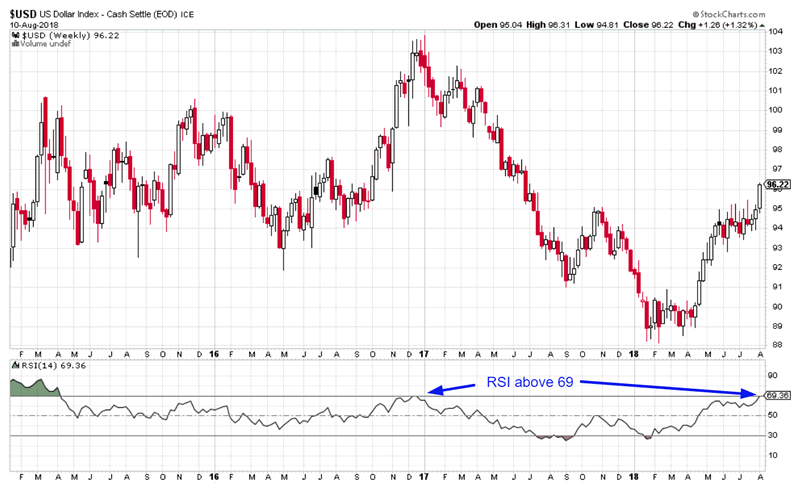

The U.S. Dollar Index has broken out from its resistance due to the weakness in foreign currencies and foreign stocks. The U.S. Dollar’s weekly RSI is now at 69, which means that it’s overbought in the medium term.

Here’s the USD’s 14 weekly RSI. It is now above 69 for the first time since December 2016.

Here’s what happens next to the U.S. Dollar Index when its 14 weekly RSI exceeds 69 for the first time in 1 year.

Click here to download the data in Excel.

As you can see, when the USD becomes medium term overbought for the first time in a long time:

- It tends to make a short term pullback.

- The medium and long term outlook is a 50-50 bet. The USD might go up and it also might go down.

However, a rising U.S. Dollar is not consistently bearish for the U.S. stock market. Contrary to what financial media would have you believe, “contagion” from emerging markets to the U.S. stock market is unlikely. The financial media always seems to be afraid of “contagion”. For every 10 of these fears, contagion actually occurs 1 in 10 times (i.e. a 10% accuracy rate). Don’t bet on low probability events.

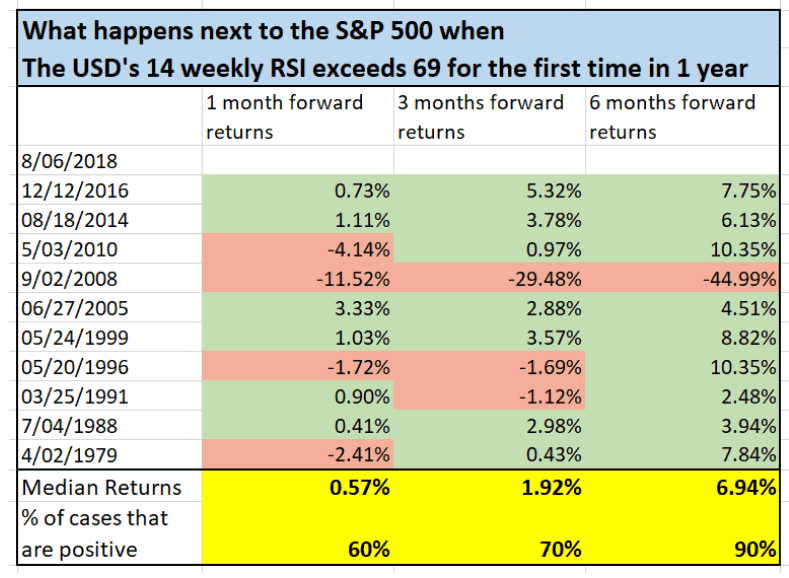

Here’s what happens next to the S&P 500 when the USD Index’s 14 weekly RSI exceeds 69 for the first time in 1 year.

Conclusion

As you can see, when the USD rises (foreign currencies are falling), the U.S. stock market actually tends to go UP in the next 6 months. “Contagion” from ex-U.S. to the U.S. is unlikely.

There is only 1 bearish case: September 2008. That case does not apply to today. The U.S. economy was in the midst of a massive recession and the stock market had already fallen -27%. The U.S. economy is growing today and the stock market is near all-time highs.

Click here for more market studies

By Troy Bombardia

I’m Troy Bombardia, the author behind BullMarkets.co. I used to run a hedge fund, but closed it due to a major health scare. I am now enjoying life and simply investing/trading my own account. I focus on long term performance and ignore short term performance.

Copyright 2018 © Troy Bombardia - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.