Dreaming of a "Comfortable Retirement" on a Public Pension?

Stock-Markets / Pensions & Retirement Aug 10, 2018 - 12:44 PM GMTBy: EWI

A 9-year bull market fails to close the pension gap

Did you realize that many U.S. pension funds are in trouble even though stocks have been rising since 2009?

Even so, many retirees expect a comfortable retirement.

Jump on once-in-a-lifetime opportunities and avoid dangerous pitfalls that no one else sees coming. We can help you prepare for opportunities and side step risks that will surprise most investors. You can get deeper insights in Elliott Wave International's new free report: 5 "Tells" that the Markets Are About to Reverse. The insights that you'll gain are especially applicable to the price patterns of key financial markets, including the stock market, now. Read the free report now.

Our March 2018 Elliott Wave Financial Forecast showed this chart and said:

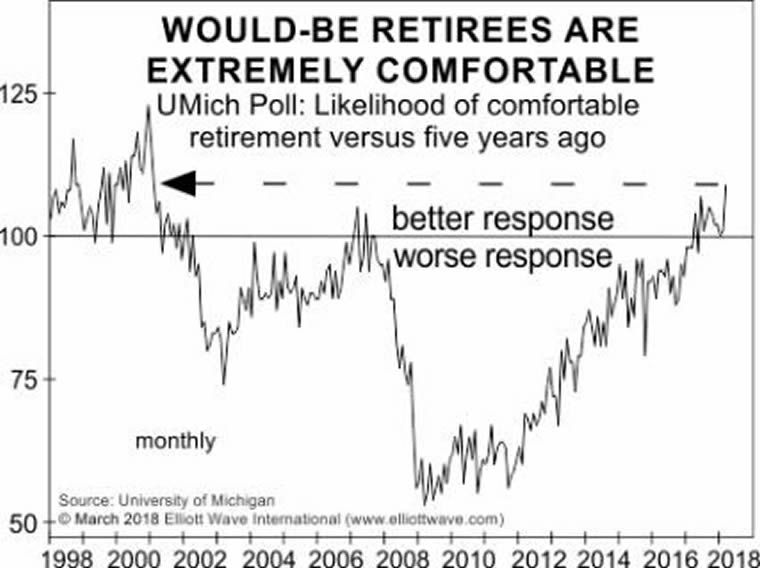

Over the last 20 years, [a University of Michigan] poll asked the following question every month: "Compared to five years ago, do you think the chances that you will have a comfortable retirement have gone up, gone down or remained about the same?" Considering that the line between a better and worse retirement is a reading of 100, consumers have been mostly glum about their retirement prospects since the record optimistic extreme of 123 in November 2000.... After stocks had been rising for five years... the survey's results pushed to a high of 105 in February 2007.... The chart shows retirees' negative responses as stocks crashed in 2008 and early 2009....

In March of 2017, retirees finally capitulated once again to the uptrend in share prices by registering a response of 104.... Last month, the survey even pushed to a 17-year extreme of 109.

A big reason why the hopes of retirees may be sorely misplaced is that the shortfall in local and state pensions is a staggering $4 trillion, according to Moody's Investors Service.

On July 30, the Wall Street Journal put that figure into perspective:

The Pension Hole for U.S. Cities and States Is the Size of Germany's Economy

Many retirement funds could face insolvency...

As the article notes, a fund covering Chicago municipal employees had less than 30% of what it needed in fiscal year 2017. New Jersey's pension system for state workers is so underfunded that it could go broke in 12 years, according to a Pew Charitable Trusts study.

But, in EWI's view, many public pension systems may become insolvent long before then.

In fact, this is already happening with retirement-age individuals.

On Aug. 5, The New York Times reported:

The rate of people 65 and older filing for bankruptcy is three times what it was in 1991.

With pension funds heavily invested in risk-assets like stocks, imagine the scenario during the next financial downturn.

Our analysts' comments about the stock market's technical picture should be of high interest to every market participant, including those expecting a comfortable retirement.

Regarding the details of EWI's technical analysis at the time, we encourage you to see them for yourself in a new free report that remains relevant now (see below).

Read the free report now -- just look for the quick-access details below.

Learn how to spot once-in-a-lifetime opportunities and avoid dangerous pitfalls that no one else sees coming.

We can help you learn how to spot opportunities and side step risks that will surprise most investors.

You can get deeper insights in Elliott Wave International's new free report: 5 "Tells" that the Markets Are About to Reverse.

The insights that you'll gain are especially applicable to the price patterns of key financial markets, including the stock market, now.

This article was syndicated by Elliott Wave International and was originally published under the headline Dreaming of a "Comfortable Retirement" on a Public Pension?. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.